【What is ETF】Hong Kong Investors Must See ETF Investment Guide

Recent global tariff policy changes and geopolitical tensions have increased market volatility, making exchange-traded funds (ETFs) a popular choice for Hong Kong investors to diversify risk. You may also have heard of leveraged and reverse ETFs, both of which track major market indices, but what is the difference between them? What is an ETF? How can I invest in an ETF in Hong Kong? Learn ETF basics and investment tips to capture market-finding opportunities today!

ETF Getting Started: What is an ETF?

ETF is an abbreviation for Exchange Traded Funds (ETFs). The way an ETF works is simple, it's like an “investment basket” that allows you to keep track of a specific index, industry, or portfolio of investments at a time, while freely trading on an exchange like stocks. This design combines the advantages of diversified risk and the flexibility of stock trading to make it easier for investors to deploy across markets without having to spend time picking stocks one by one and watching for long periods of time.

What's the difference between stocks vs investment ETFs?

In fact, ETFs have many advantages compared to investing in single stocks:

1. Dispersion risk

DIVERSIFIED RISK IS DIVERSIFIED INVESTING, WHICH MEANS NOT PUTTING ALL YOUR FUNDS “STAKED” IN THE SAME STOCK OR IN THE SAME BLOCK TO REDUCE THE RISK OF SIGNIFICANT LOSSES ON THE INVESTMENT. The essence of an ETF is a fund, buying and holding an ETF, which is equivalent to indirectly holding a basket of ETF-related assets. For investors, easy trading, greatly reducing the effort and time required to choose stocks, is a good strategy for lazy and diversified investments.

2. Low entry threshold

How much money will be needed if each well-known stock is bought? Hong Kong stocks, for example, are worth HKD 36,630 at the market price of HSBC Holdings (0005.HK). 400 shares are expected at the market price on June 2, 2025. US stocks, for example, like Microsoft (MSFT), require USD 642.87 to enter only one share.

Relatively speaking, ETFs are a way to invest in helping you hold a basket of well-known stocks at low cost.

3. Wide assortment

The asset classes that ETFs track are very rich. In addition to stocks, you can also find ETFs on the market that track bonds, commodities, forex, digital currencies, market volatility.

For example, if you think it's a good time to invest in gold recently, you don't have to buy gold futures or real gold, just have a securities account to grasp the potential opportunities for gold price rises with the flexibility of gold ETFs.

Of course, there are also some relative disadvantages of investing in ETFs that need to be paid special attention to before investing. It is mainly the following two points:

1. Tracking errors

In practice, it is not difficult for us to find that ETF movements are not the same as tracking an asset index 100%. Why does this happen? Because there is a tracking error in any ETF. The larger the tracking error indicates the further the ETF and the performance of that asset index or asset are deviating.

There are many reasons for tracking errors, including trading rules, ETF management fees, and securities financing. In most cases, the higher the ETF tracking error rate may also be higher.

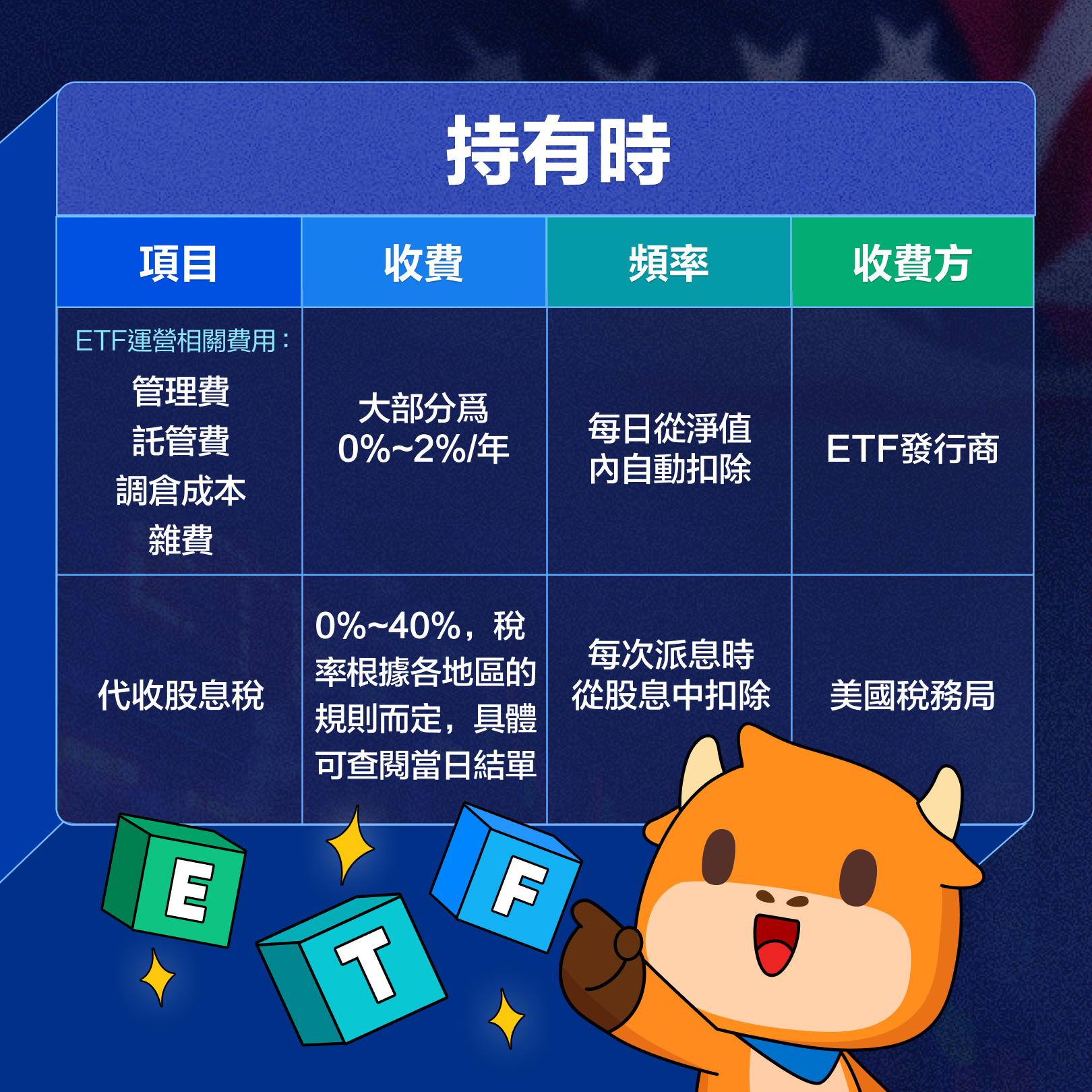

2. Pay the management fee

Trading fees for ETFs are basically the same as stocks, but they charge more than one management fee. For example, let's say you hold a $10,000 ETF with an ETF management fee of 0.1%, and you'll need to pay a $10 management fee per year. This fee is not deducted at the end of the year, but is deducted from the fund's net assets for every day you hold the ETF.

The longer the investment period, the more you need to keep an eye on the rate, as this fee gets bigger over time, and a little bit of a gap can lead to a far difference in the final return.

What are the different types of ETFs?

There are many ways in which ETFs are classified now. Common classifications are:

According to the asset class, it can be divided into: stocks, bonds, commodities, foreign exchange, etc.

According to the investment style, it can be divided into: active type, passive type;

ACCORDING TO LEVERAGE MULTIPLIER, IT CAN BE DIVIDED INTO: LEVERAGED ETF, REVERSE ETF, ORDINARY ETF

How to choose an ETF?

How do I determine which type of ETF I am suitable for investing in? You need to be clear about two questions:

What is the purpose of investing in ETFs?

What are your risk preferences?

Depending on your investment goals and risk preferences, roughly determine which type of ETF you can choose. Here are some common types of investors for your reference:

Lower risk preference, hold ETFs for a long time for steady returns

Stock Indices ETFs

Stock Indices ETFsDesigned to track the performance of specific indices such as the S&P 500, Nasdaq 100, Hang Seng Index, etc., to achieve returns close to the index by holding index constituents. BUFFETT, THE CORPORATE GIANT, HAS REPEATEDLY RECOMMENDED FOLLOW-UP TO THE PUBLICS&P500ETFSince investing in such ETFs is equivalent to investing indirectly in the US stock market, there is essentially no “run big market” situation.

U.S. Treasury ETF

U.S. Treasury ETFDepending on the issuer, the default risk is divided into different risk levels. Of all bonds, U.S. Treasury bonds are rated the highest and are considered as one of the least risky investments. As a result, many experienced investors also put US Treasury bonds or related ETFs in their portfolios, thereby risking a fall in hedge stocks.

High Yield ETF

There are many styles of more conservative investors who prefer to invest in high-yield stocks for stable returns. In all stock ETFs,High Yield ETFIt is a high-yield investment that distributes dividends to investors at a quarterly or monthly frequency. But for investmentUS Stock Market High Dividend ETFHong Kong Investors Need Focus“Dividend withholding tax”。 We'll go into more detail in the fees section later.

Gold ETF

Gold ETFIt provides hedging tools for conservative investors. Gold ETFs track gold price movements directly, so investors do not need to buy physical gold and participate in the gold market in a simpler way. Gold generally performs well in times of economic uncertainty or inflation, as a tool to hedge market risks, making it suitable as a balancing tool in a portfolio. Depending on their risk preferences, investors can consider whether they need to allocate some of their funds to suchAvoidance AssetsTop. In addition to commodities such as gold, energy and precious metals, can play a unique role in diversifying investments, soCommodity ETFIt is also popular with many investors

Higher Risk Preference, Prefer Short Line Block Trading

Bitcoin ETF

Bitcoin is the largest and most actively traded digital currency on the market today. However, its price fluctuation is high, and the threshold for buying Bitcoin directly and the risk is higher, causing some investors to take a step back.Bitcoin ETFis an investment tool listed directly on stock exchanges that tracks the market price of Bitcoin and is actually held by issuers as a reserve asset, allowing investors to invest in Bitcoin indirectly but without buying Bitcoin directly. In contrast, entry thresholds and risks are lower.

There are 3 Bitcoin Spot ETFs and 2 Bitcoin Futures ETFs in Hong Kong. As of May 23, 2025, the Hong Kong Bitcoin ETF entry fee is as low as HK$861.5! And the US Securities Exchange (SEC) has now approved 11 Bitcoin spot ETFs to be listed for professional investors to trade.

Emerging Markets ETF

Emerging markets are those markets that are lagging behind mature markets but are growing rapidly. In contrast, these markets are immature and risk high, but there is also more room for development. Ordinary investors may not have a full understanding of emerging markets, find it harder to get timely market information, or find the right channel to invest in emerging market stocks. whileEmerging Markets ETFThis provides a very convenient investment channel to help investors grasp investment opportunities in the market in a timely manner.

Japan Stock Market ETF

Not to mention the depreciation of the yen, the Japanese stock market came out on a very spectacular bull market, and not only that, we have very adequate tools for trading,Japanese Stock ETFAs a convenient investment tool, it provides investors with a simple and efficient way to participate in the performance of the Japanese stock market. Of course investors can also consider direct investmentJapan ETF, generated directly from trading on the Japanese stock market.

Leveraged or Reverse Single Stock ETF

In the US equity market, in addition to the traditional ETF that tracks a basket of assets, there is a specialRove/Reverse Single Stock ETFAllows investors to take a direct look at or discount a particular stock without margin. Such ETFs typically offer 2 to 3 times leverage or reverse operations. But be aware that such products track only a single stock, do not disperse risk, plus leverage, price volatility is high, potential returns are high, but the risk of loss is also magnified, suitable for ultra-short line operations rather than long-term holding.

Extended Reading:“Capturing Short Term Fluctuations with a Single Stock Leveraged ETF”

How to invest in an industry or blockchain opportunity through an ETF

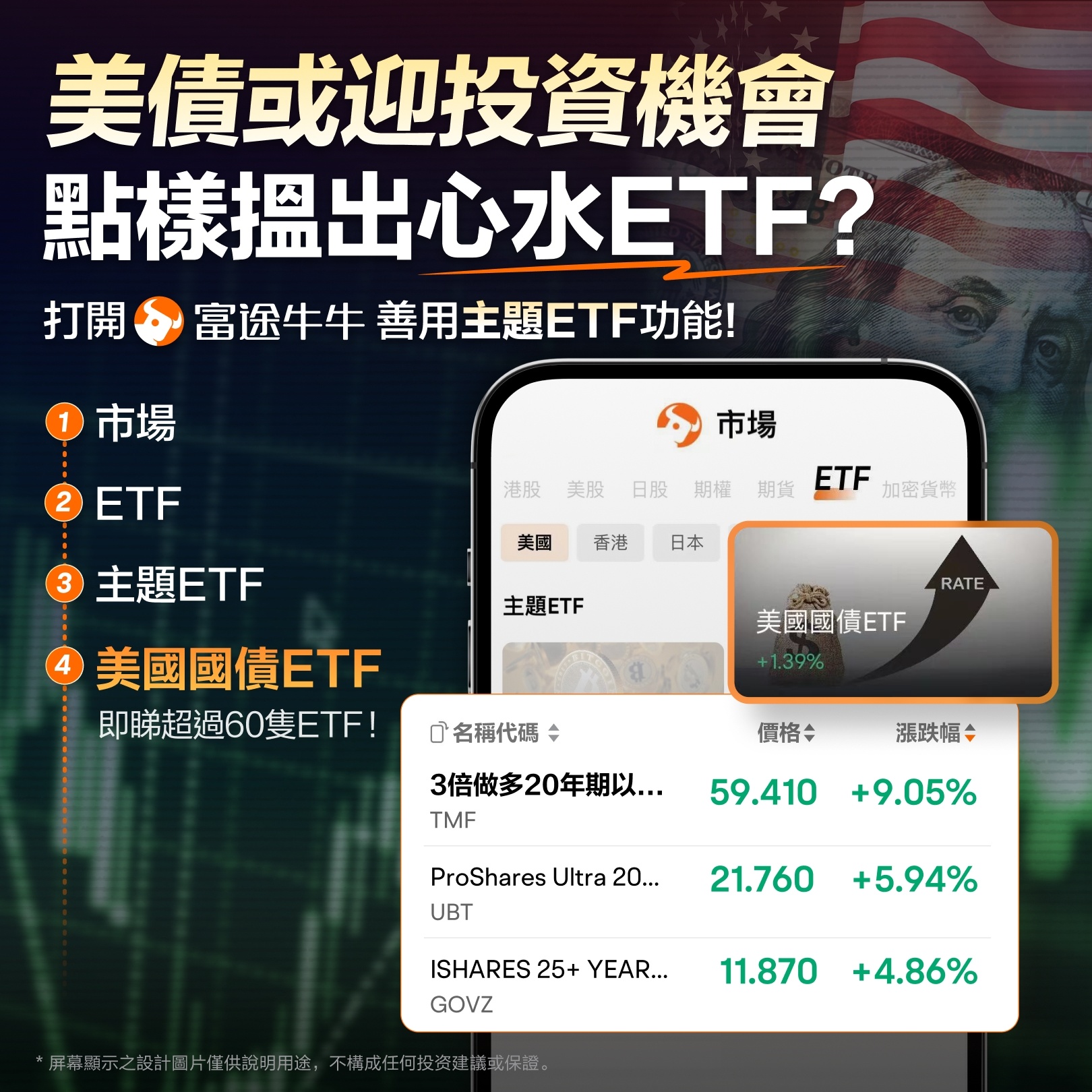

HOWEVER, YOU CAN CHOOSE A DIFFERENT ETF THEME BASED ON RECENT INVESTMENT OPPORTUNITIES. You can open Futubull, select the market cap in the navigation bar below, click on “ETF” to help you find more ETF investment opportunities on this page. FIND THE TOPIC ETF COLUMN TO SEE A LIST OF ETFS RELATED TO THE TOP TOPICS.

For example, suppose you want to see a list of semiconductor-related ETFs, you can do this:

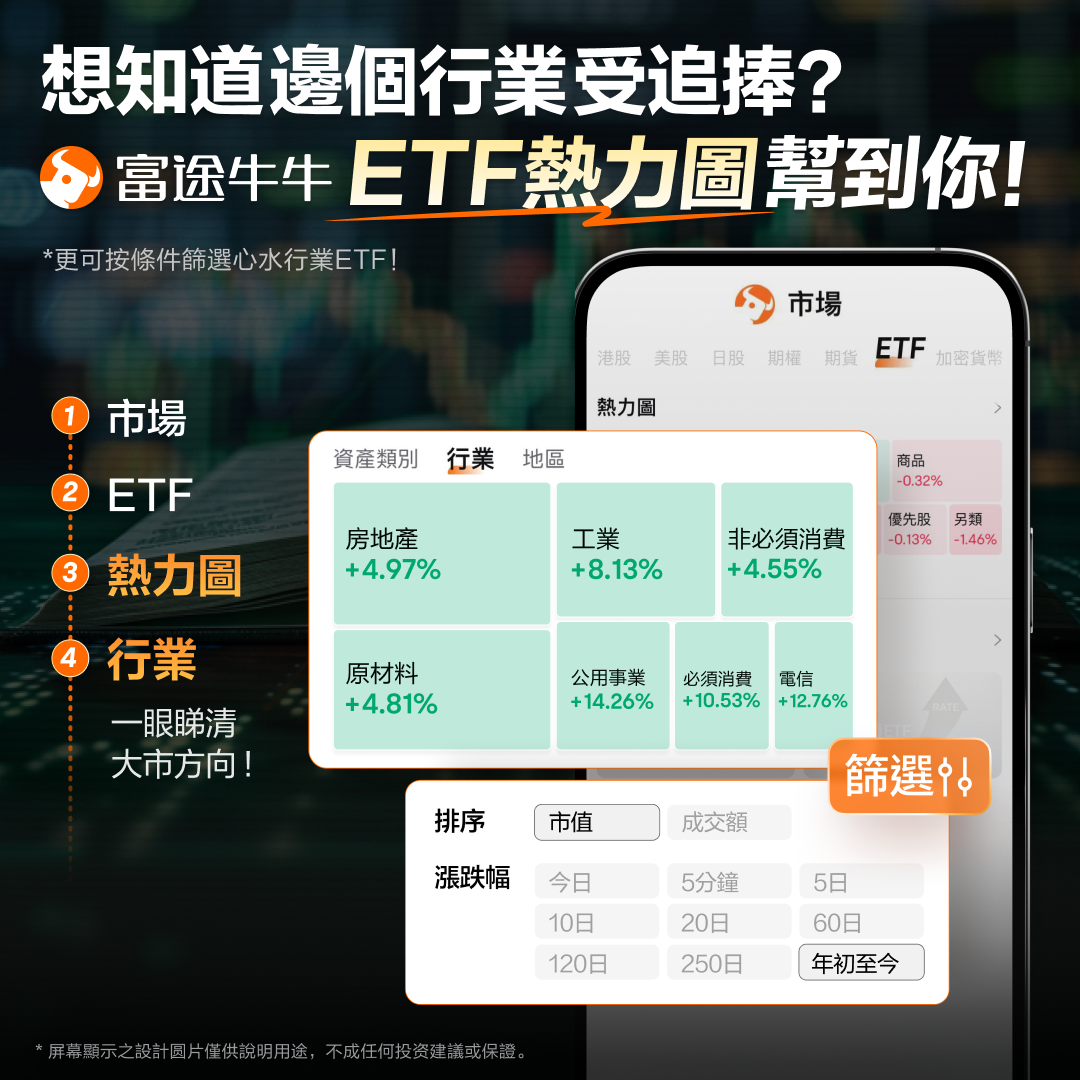

Or if you want to know which industry is the most followed right now, you can also find out at a glance with ETF hot graphic power!

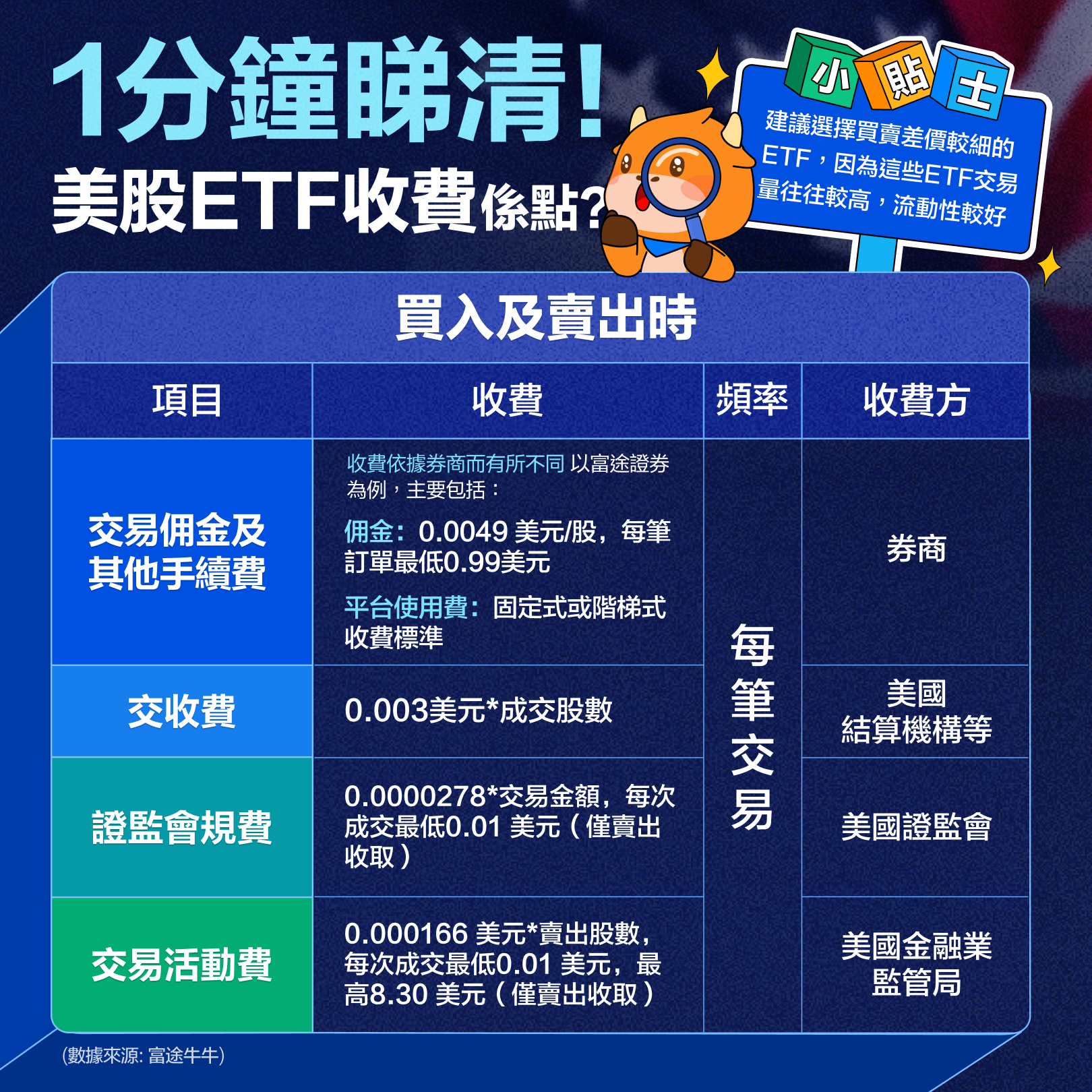

Transaction Fees for US Equity ETFs

The trading costs and fees for Hong Kong investors to trade US equity ETFs are as follows.>>Learn more about Futu Securities' fees<<

When trading ETFs, you also need to keep an eye on the ETF's trading spreads. Trading spreads are an important factor that can easily be overlooked, but which directly affects the final benefit. Too large a spread can result in a hold order that cannot be traded, or a discount is sold. The spread amount for each ETF is different, and the spread of ETFs with lower trading volumes tends to be larger.

How to invest in ETFs in Futu?

1. FIND THE ETF YOU WANT TO TRADE: PATH 1: SEARCH ETF OR KEYWORD, PATH 2: MARKET>ETF

ETF" style="width:692px;height:691px;" loading="lazy" data-description="1. 找到想要交易的ETF:路徑1:搜索ETF或者關鍵詞,路徑2:市場>ETF">

ETF" style="width:692px;height:691px;" loading="lazy" data-description="1. 找到想要交易的ETF:路徑1:搜索ETF或者關鍵詞,路徑2:市場>ETF">2. Read more: ETF quote details page > View more information under Fund Category

View more information under Fund Category" style="width:692px;height:691px;" loading="lazy" data-description="2. 查看更多資訊:ETF報價詳情頁>查看基金分類下更多資訊">

View more information under Fund Category" style="width:692px;height:691px;" loading="lazy" data-description="2. 查看更多資訊:ETF報價詳情頁>查看基金分類下更多資訊">3. Place an order to complete a transaction: Transaction > Enter order information > Buy > Confirm transaction details > Wait for order completion

Enter order information > Buy > Confirm transaction details > Wait for order completion" style="width:692px;height:691px;" loading="lazy" data-description="3.下單完成交易:交易>輸入下單資料>買入>確認交易明細>等待訂單完成">

Enter order information > Buy > Confirm transaction details > Wait for order completion" style="width:692px;height:691px;" loading="lazy" data-description="3.下單完成交易:交易>輸入下單資料>買入>確認交易明細>等待訂單完成">What are the benefits offered by Futu?

Futu opens in 3 minutes fast, online hosting! New customer offers are now open to more than half a dozen new rewards in Futu!