Futu developed a systematic fund

rating model.

Only funds with a

passing score and which rank

high

can appear on the platform.

Global Top Funds

Quality Assets Selected

from Across the World

Open Account

Established partnerships

with 110 global

financial institutions

with 110 global

financial institutions

110 Financial

Institutions

Institutions

Futu wealth

management AUM

Reached HK$1.756 trillion*

management AUM

Reached HK$1.756 trillion*

HK$1.756 Trillion

*Data as of Q3, 2025

Futu Money PlusProprietary

Fund Company

Selection Method

A comprehensive fund analysis

based on performance,

philosophy, portfolio, people,

parent, and process.

based on performance,

philosophy, portfolio, people,

parent, and process.

Process

投資流程

People

團隊管理

Parent

基金公司

Portfolio

投資組合

Philosophy

投資理念

Performance

業績表現

Based on the 6Ps,

Select Funds from Multiple Dimensions

Fund ranking lists based on big data

See what everyone is buying

See what everyone is buying

Hot Subscription List

Funds with top net subscription amounts in the past month

*Data as of April 1, 2024

Funds with top net subscription amounts in the past month

Download the APP to view more rankings >

1

Taikang Kaitai Overseas Short

Tenor Bond Fund

Tenor Bond Fund

USD

+10.33%

2023 Return

+10.09%

2022 Return

+1.78%

2021 Return

-0.06%

2020 Return

+2.42%

2019 Return

+5.23%

1Y return

15w+

Average subscription amount

2

JPMorgan Funds-US Technology

Fund YDis

Fund YDis

USD

+55.74%

2023 Return

+65.71%

2022 Return

-44.89%

2021 Return

+12.75%

2020 Return

+86.94%

2019 Return

+41.25%

1Y return

3w+

Average subscription amount

3

JPMorgan Funds-US Technology

Fund

Fund

HKD

+55.24%

2023 Return

+66.05%

2022 Return

-44.92%

2021 Return

+13.33%

2020 Return

+86.21%

2019 Return

+40.17%

1Y return

2w+

Average subscription amount

Position Amount List

Funds with top position sizes in the past month

*Data as of April 1, 2024

Funds with top position sizes in the past month

Download the APP to view more rankings >

1

Allianz Income and Growth

Fund MDis

Fund MDis

HKD

+16.18%

2023 Return

+17.43%

2022 Return

-19.65%

2021 Return

+12.37%

2020 Return

+21.37%

2019 Return

+18.91%

1Y return

8w+

Average subscription amount

2

BlackRock World Technology

Fund

Fund

USD

+46.75%

2023 Return

+49.78%

2022 Return

-43.06%

2021 Return

+8.01%

2020 Return

+85.50%

2019 Return

+43.48%

1Y return

6w+

Average subscription amount

3

Taikang Kaitai Overseas Short

Tenor Bond Fund

Tenor Bond Fund

HKD

+10.07%

2023 Return

+10.30%

2022 Return

+1.77%

2021 Return

+0.53%

2020 Return

+1.96%

2019 Return

+4.64%

1Y return

8w+

Average subscription amount

Bank Hot List

Best-selling funds in HK local banks in the past month

*Data as of March 18, 2024

Best-selling funds in HK local banks in the past month

Download the APP to view more rankings >

1

AB American Income

Portfolio MDis

Portfolio MDis

USD

+4.05%

2023 Return

+8.32%

2022 Return

-13.09%

2021 Return

-0.34%

2020 Return

+4.62%

2019 Return

+12.31%

1Y return

173.5B

Fund size

2

AB Low Volatility Equity

Portfolio Fund

Portfolio Fund

USD

+20.01%

2023 Return

+18.43%

2022 Return

-12.11%

2021 Return

+19.82%

2020 Return

+4.49%

2019 Return

+24.03%

1Y return

43.14B

Fund size

3

BGF Systematic Global Equity

High Income Fund MDis

High Income Fund MDis

HKD

+15.14%

2023 Return

+14.34%

2022 Return

-15.53%

2021 Return

+16.77%

2020 Return

+8.84%

2019 Return

+16.57%

1Y return

37.04B

Fund size

* The above fund sizes are the latest data disclosed by the funds and are converted to HKD at the latest exchange rate. The data is from Morningstar.

Past performance is not indicative of future results and is for reference only

Download the APP to view more rankings >Past performance is not indicative of future results and is for reference only

Cash Plus

Excellent Cash

Management Tool

Futu carefully picks Cash Plus

Combining stability, low risk, and convenience

Combining stability, low risk, and convenience

Returns from Cash Plus in a yearWith a HK$100,000 position

Open Account

Open Account

* 3.9% is the average 1-year return of all USD money market funds established at least one year ago on Futu's platform. The data is as of December 31, 2025. Past performance is for reference only and is not indicative of future returns. Receiving a positive dividend does not mean you can get a positive return.

* 3.9% is the average 1-year return of all USD money market funds established at least one year ago on Futu's platform.

The data is as of December 31, 2025. Past performance is for reference only and is not indicative of future returns. Receiving a positive dividend does not mean you can get a positive return.

The data is as of December 31, 2025. Past performance is for reference only and is not indicative of future returns. Receiving a positive dividend does not mean you can get a positive return.

Grow Wealth

Cash Plus USD Money Market Fund reaches an

average yield of 3.9%

Hold a HK$100,000 position for a year for a return

up to HK$3,900

With SmartSave, Cash Plus positions will also add to

buying power

average yield of 3.9%

Hold a HK$100,000 position for a year for a return

up to HK$3,900

With SmartSave, Cash Plus positions will also add to

buying power

Make Idle Cash Work

With SmartSave, uninvested cash will be used to buy Cash Plus

automatically

Cash Plus positions can be used to trade stocks and subscribe to IPO

shares directly

Automatic repayment of financing interest and direct currency

exchange in cross-market trading

automatically

Cash Plus positions can be used to trade stocks and subscribe to IPO

shares directly

Automatic repayment of financing interest and direct currency

exchange in cross-market trading

Low Fees to Help You

Kickstart Your Fund

Investments Easily

$0 Commissions

No fees for fund subscription

and redemption

and redemption

$0 Platform Fees

No additional platform

charges

charges

Low Minimum Investment

Start investing in funds

from HK$/US$0.01

from HK$/US$0.01

Professional 1-on-1 Fund Investment Advisor

Futu's advisors have received strict training on single-asset investment and research. They dive deep into underlying assets and keep tracking the strategies and styles of major public and private funds. Therefore, they are familiar with funds' past performance over a long time and can make professional analyses for you.

How to Start Investing

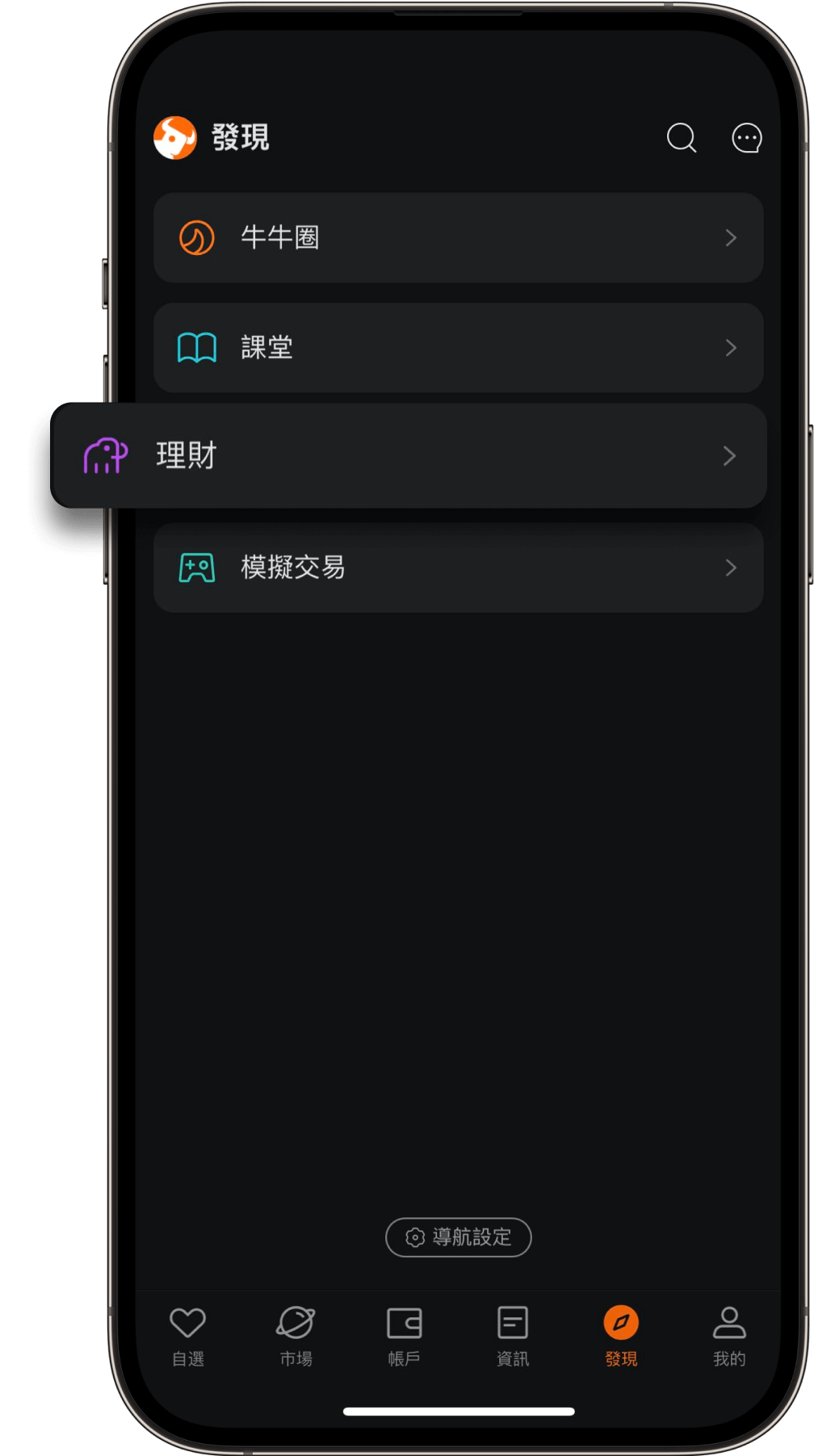

1.

Open the app, go to Discover > Funds

You can find diverse wealth management products including funds, bonds, private investment funds, and fund portfolios

2.

Tap Rankings to view all funds

You can choose the fund you want to invest in

3.

Tap Subscribe on the Fund Details page and enter your trading password

Complete the purchase

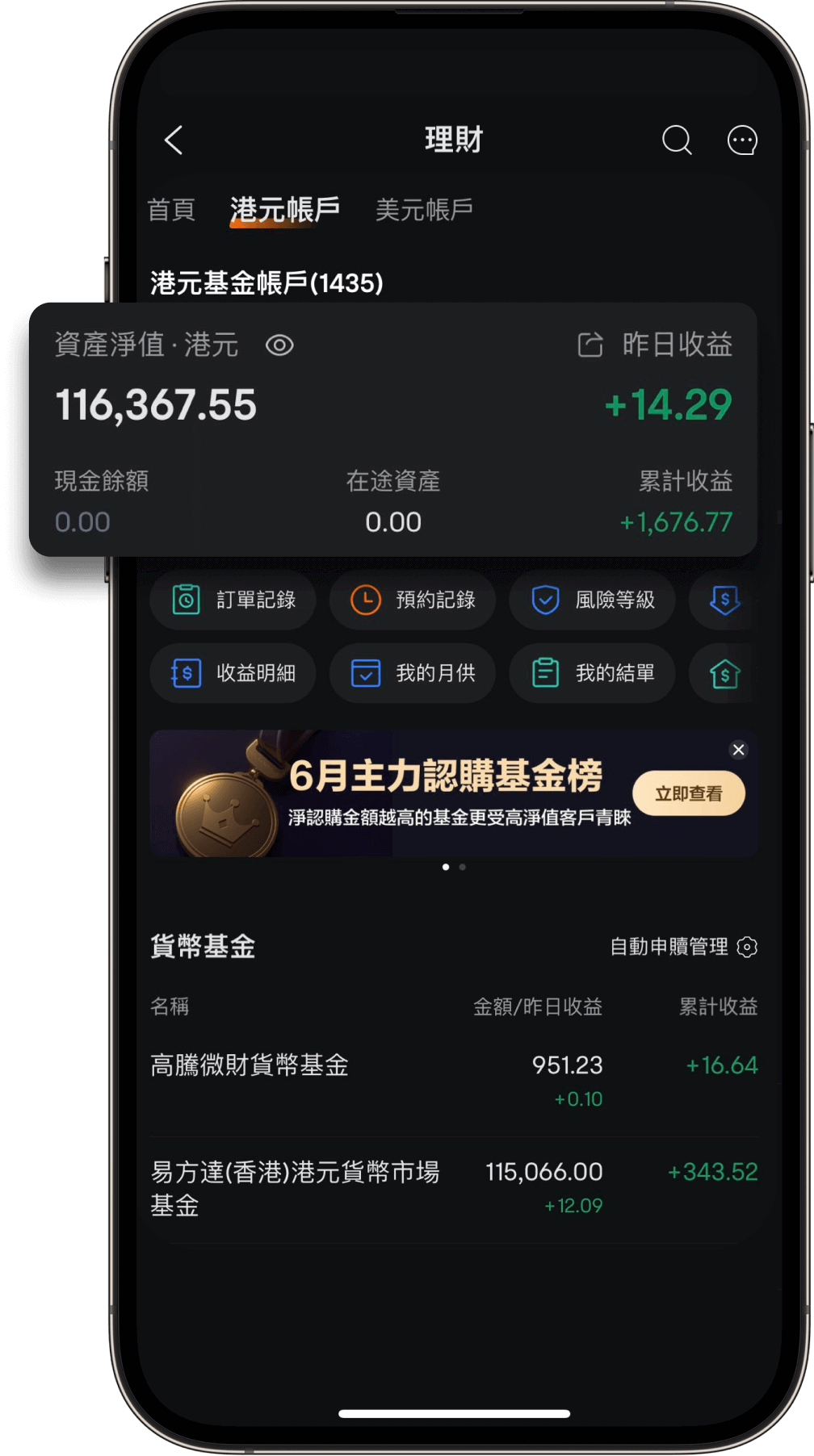

4.

View returns every day

After buying funds, you can check the returns on the corresponding account page

Disclaimer and Risk Disclosure

The content on this site does not constitute any offer, solicitation, or recommendation of any investment product, or any advice or guarantee. Futubull is a one-stop investment platform. This content and securities services are provided by Futu Securities International (Hong Kong) Limited. This content hasn't been reviewed by the Securities and Futures Commission of Hong Kong. Futu Securities International (Hong Kong) Limited reserves the right to make the final decision on any disputes.

Investment involves risk. Investors should read the news on and relevant documents of a fund carefully (including the risk factors). The prices of funds may fluctuate, sometimes dramatically in a short time, and the worst case may result in loss of your entire investment amount. Past performance is not indicative of future results. Where this page contains any content similar to forward-looking statements, such content shall not be deemed as guarantees of future performance, and actual results may be substantially different from such content.

Investment involves risk. Investors should read the news on and relevant documents of a fund carefully (including the risk factors). The prices of funds may fluctuate, sometimes dramatically in a short time, and the worst case may result in loss of your entire investment amount. Past performance is not indicative of future results. Where this page contains any content similar to forward-looking statements, such content shall not be deemed as guarantees of future performance, and actual results may be substantially different from such content.