Achieving diversified investments

Capture Market Opportunities

at Low Cost

at Low Cost

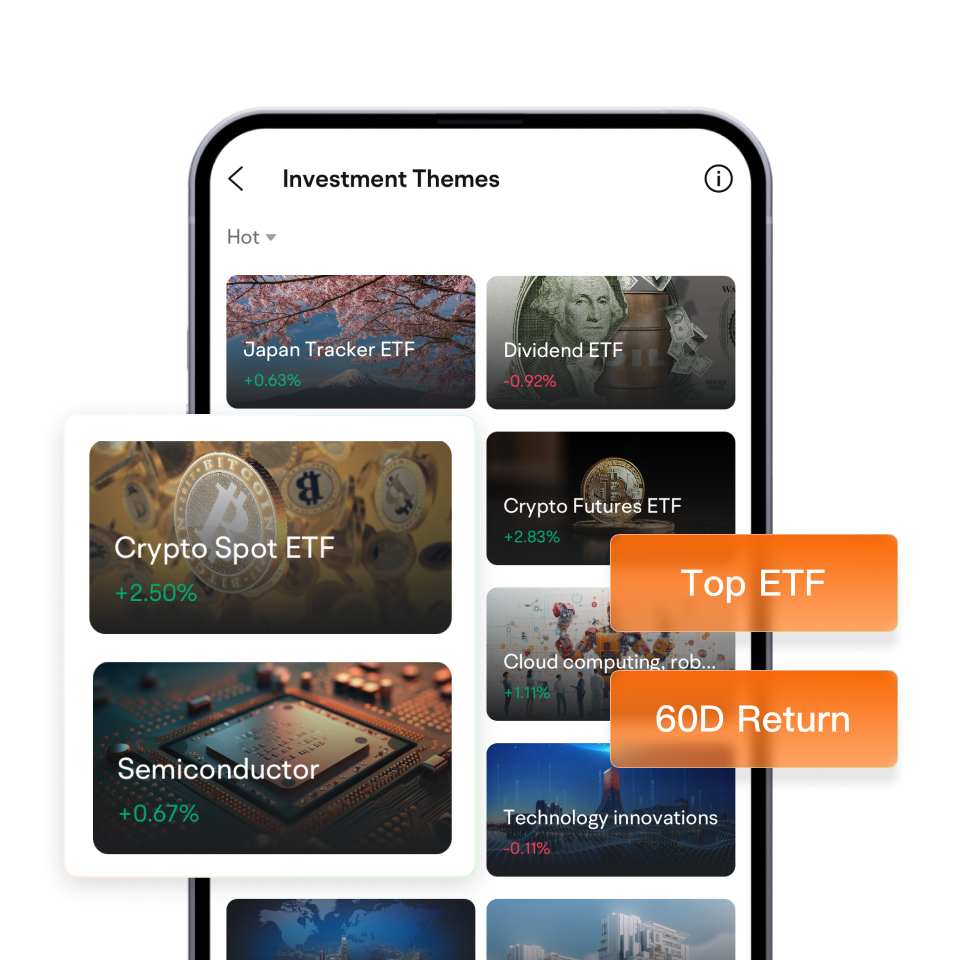

Quickly Filter Your Favorite Industry ETF

Find Potential ETF in Just 3 Seconds

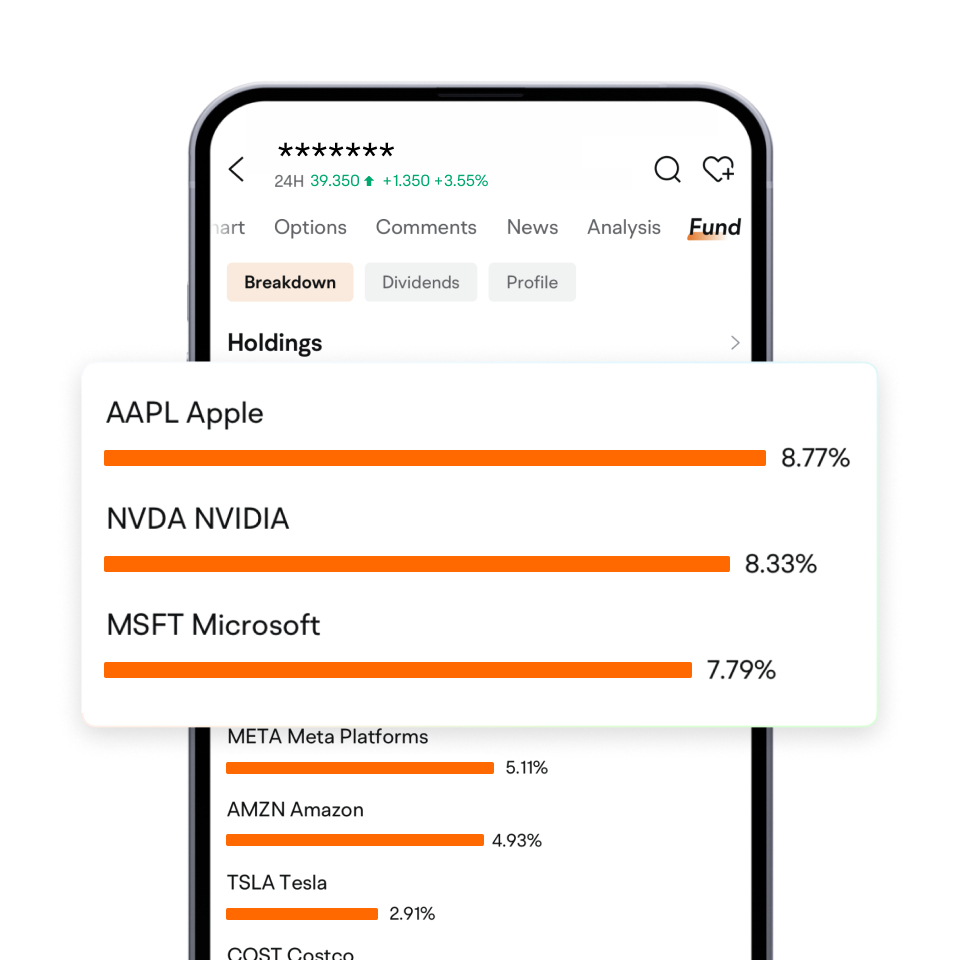

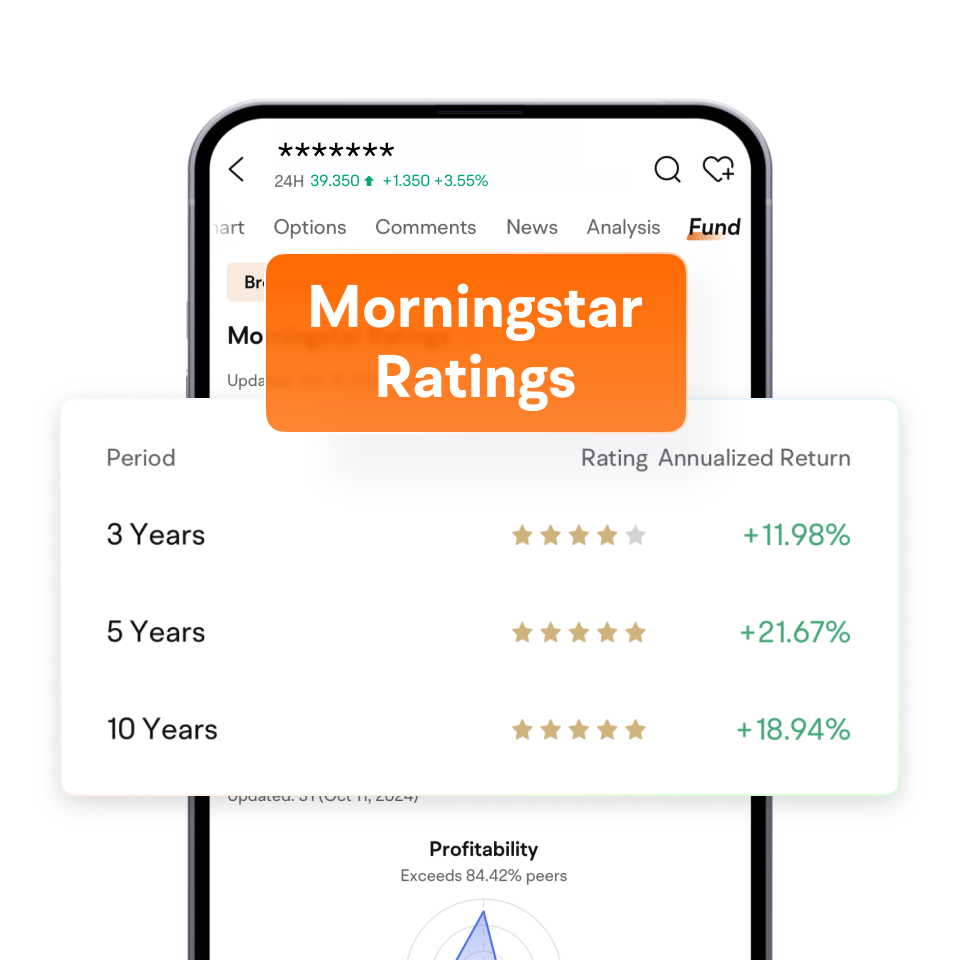

ETF Holdings and Composition Ratios View at a glance

Stay Updated on Wall Street's Potential ETF Picks

*Filtering for the top three active U.S. stock ETFs on Futubull. Date: November 27, 2024.

A Wide Range of Investment Products

ETFs that aim to track particular stock indices and industries to achieve investment returns. Among all the types of ETFs, stock and index ETFs are the largest and most varied type of ETF available. Investors can invest in major indices such as S&P 500, NASDAQ, and Hang Seng Index.

*Data source: Futubull. The above market data represents the real-time performance of that ETF, and past performance is not indicative of future results.Filter conditions: Top 5 real-time trading volumes of various types of ETFs. Partially available for professional investors (PI)

Open an Account to Catch the Market!

*Offers are subject to terms and conditions.

HK stock trading app by downloads

Global users

NO.1

HK$1.24Trillion

Total client assets

Total annual trading volume

28.16Million

HK$7.8 Trillion

Data source*: Futu Q3 2025 Financial Results as of 30th September, 2025, while the total annual trading volume data is from Futu's 2024 full-year financial results.

Safeguard Your Investment Journey

Licensed securities broker regulated by the Hong Kong Securities and Futures Commission (CE No.: AZT137) with type 1/2/3/4/5/7/9 licences

Licensed &Compliant

Hong Kong Investor Compensation Fund (ICF) and US Securities Investor Protection Corporation (SIPC) covers each investor up to a maximum compensation of HK$500,000 and US$500,000 for assets in US stocks

Investor Protection

Account Protection

Client assets are securely custodied at independent banks. With our proprietary risk control system, we are dedicated to protecting all user data

ETF stands for Exchange Traded Fund, an investment product that trades on the HKEX's spot market. It invests in a basket of securities or commodities to follow benchmark indices/commodity performances, allowing investors to invest in particular markets/investment portfolios instead of individual stocks. By investing in ETFs in the HK market, investors can bypass geographical barriers and investment channel restrictions, invest in different asset classes globally, achieve diversified investment portfolios, and benefit from cost-effectiveness.

After opening the Futunull app, tap on "Market", then select "ETF" to choose the ETF you want to trade. Futu also offers regular savings plan, allowing you to invest a fixed amount regularly to reduce market risk. Simply open the Futubull app, click on "Account", then select All. You will find the "RSP", where you can view the available ETFs for monthly investment in the RSP Hot List.

Yes, ETFs charge a management fee that is usually collected annually in the form of a total expense ratio (TER). Like other mutual funds, ETF management fees are calculated and accrued daily based on the ETF's net asset value (NAV) and are automatically deducted from the ETF's assets. Generally, ETFs have lower fees than mutual funds.For more information on other ETF fees, you can click here to learn more.

If an ETF is delisted, any unfulfilled subscription orders for the ETF will be cancelled and considered invalid. The funds deducted from the subscription (including subscription amount and fees) will be returned to your account within one trading day after the delisting.

Disclaimer

The pictures shown here are for illustrative purposes only and do not constitute any investment advice. Displayed third-party logos, brands, or trademark images on screens or web pages are only for identification purposes and remain the property of their respective owners.This page is not and should not be regarded as an offer, solicitation, invitation, or recommendation to buy or sell any investment products or the basis for investment decisions, nor should it be construed as professional advice. People who read this page or before making any investment decisions should fully understand the risks and the characteristics and consequences of relevant laws, taxes, and accounting, decide whether the investment is in accordance with their individual financial situations and investment goals and whether they can endure relevant risks based on their personal circumstances, and seek appropriate professional advice when necessary.

Investment involves risks. Investors should carefully read the relevant fund's information and other documents, including the risk factors. The prices of funds may fluctuate, sometimes dramatically in a short time, and the worst case may result in the loss of your entire investment amount. Past performance is not indicative of future performance. Where this page contains any content similar to forward-looking statements, such content shall not be deemed as guarantees of future performance, and actual results may be substantially different from such content.