Zero commissions on HK/US fractional shares*

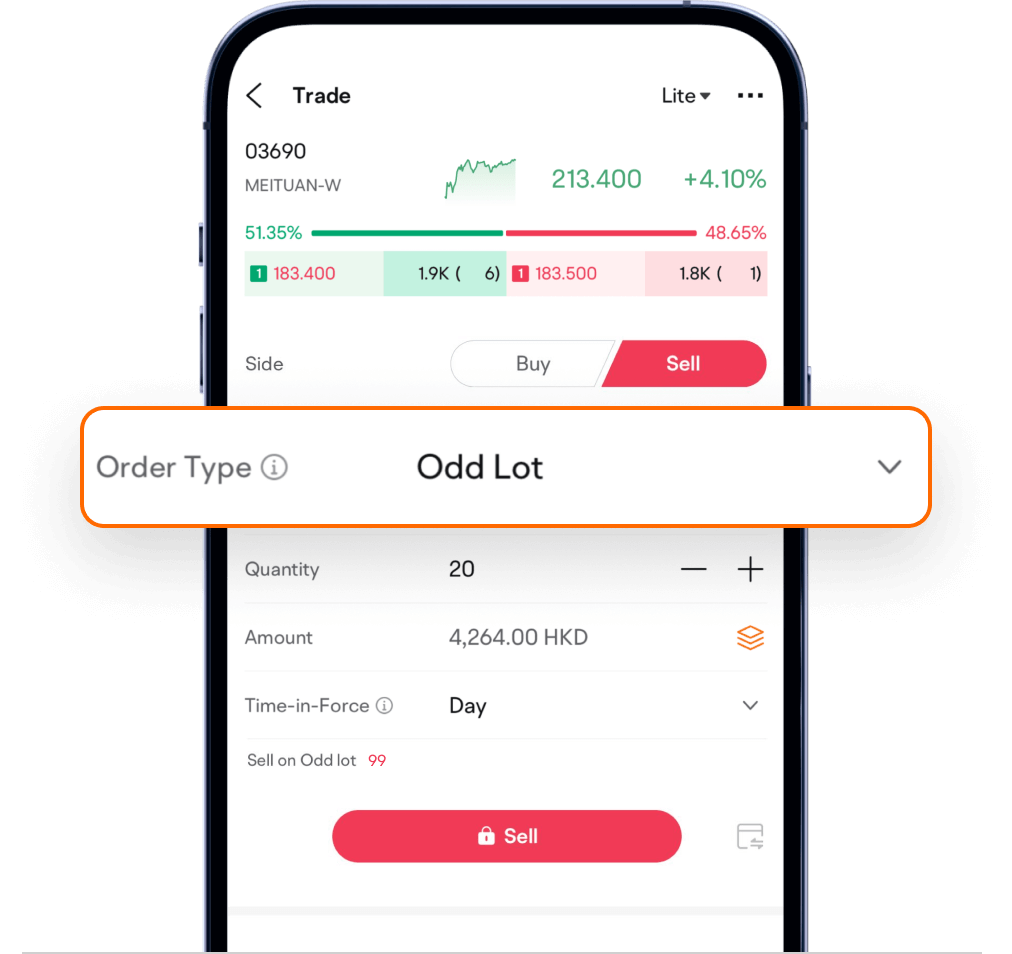

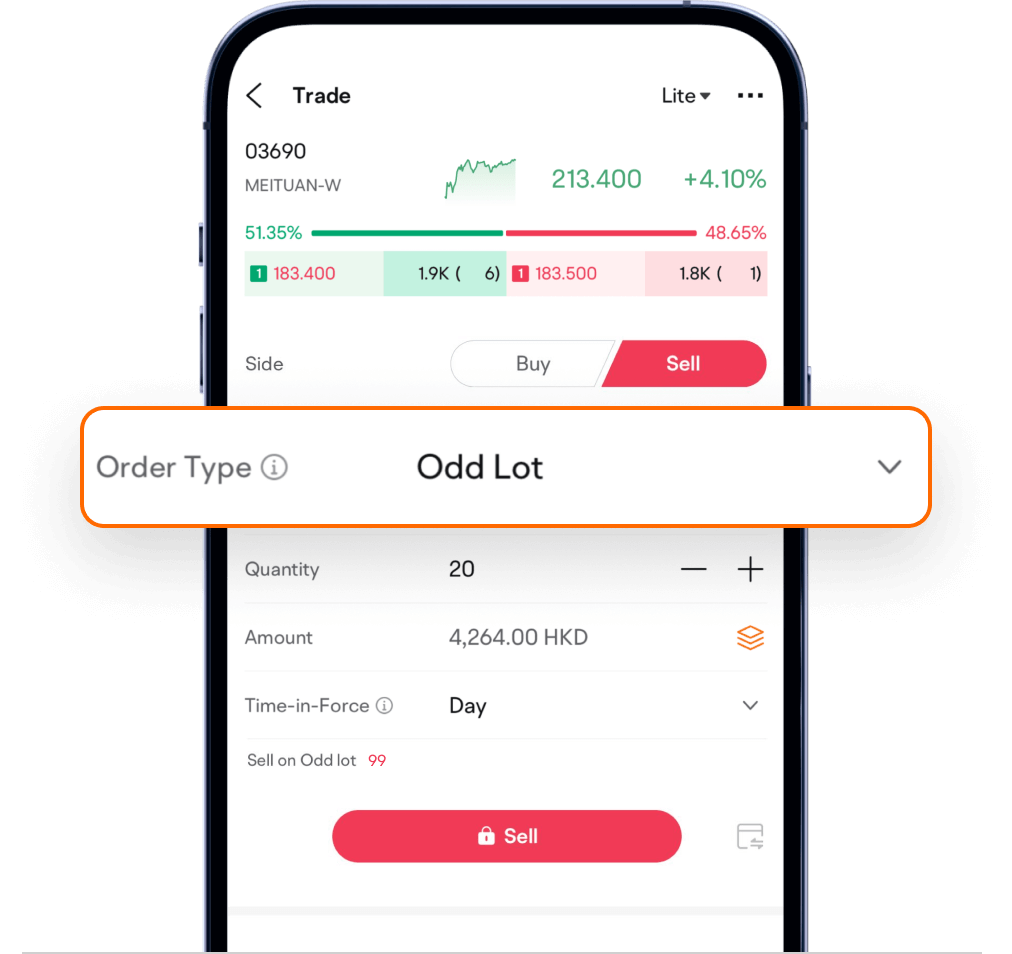

Invest as you wish, by shares or amount

No minimum lot in HK stocks or share in US stocks

From just HKD1,000/USD10 each

investment

Dive into select HK & US stocks

Track market dynamics

Gain from global sector spikes

Choose from monthly, weekly, and more

Revise your plan as needed

Achieve average cost through regular buys

Smooth out market fluctuations

Amount per investment:USD 1,000

Investment Month | Purchase price per share (USD) | Number of shares purchased (share) |

|---|---|---|

| 1 | 48.857 | 20.47 |

| 2 | 42.849 | 23.34 |

| 3 | 43.234 | 23.13 |

| 4 | 44.111 | 22.67 |

| 5 | 30.048 | 33.28 |

| 6 | 31.03 | 32.23 |

Average price:USD 38.68 | Number of shares purchased:155.12 |

*The above example is for illustrative purposes only and does not guarantee future returns.Transaction fees will be charged separately.

*US fractional shares trading involves trading units of less than one share of US stocks, with no commission and exchange pass-through fees.

Try it*Offers are subject to terms and conditions.