IPO Subscription | Real 0 Interest 0 Handling Fee

2097 IPO | HONEYMOON GROUP LAUNCHES IPO FUTUU FOR TUNE OF 600 billion

HONEYMOON GROUP (02097) STOCK PRICE

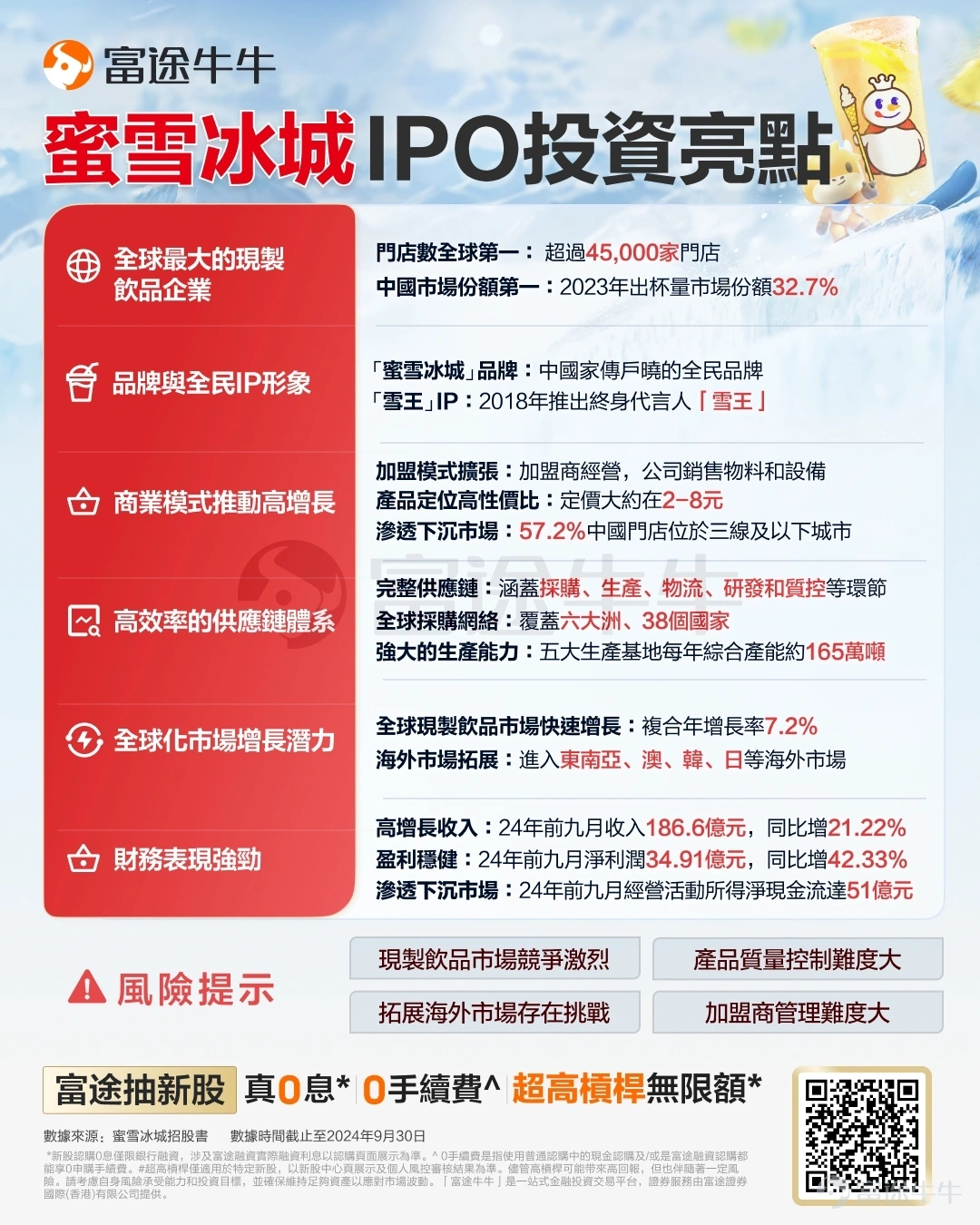

Honeymoon Group IPO Fundamentals

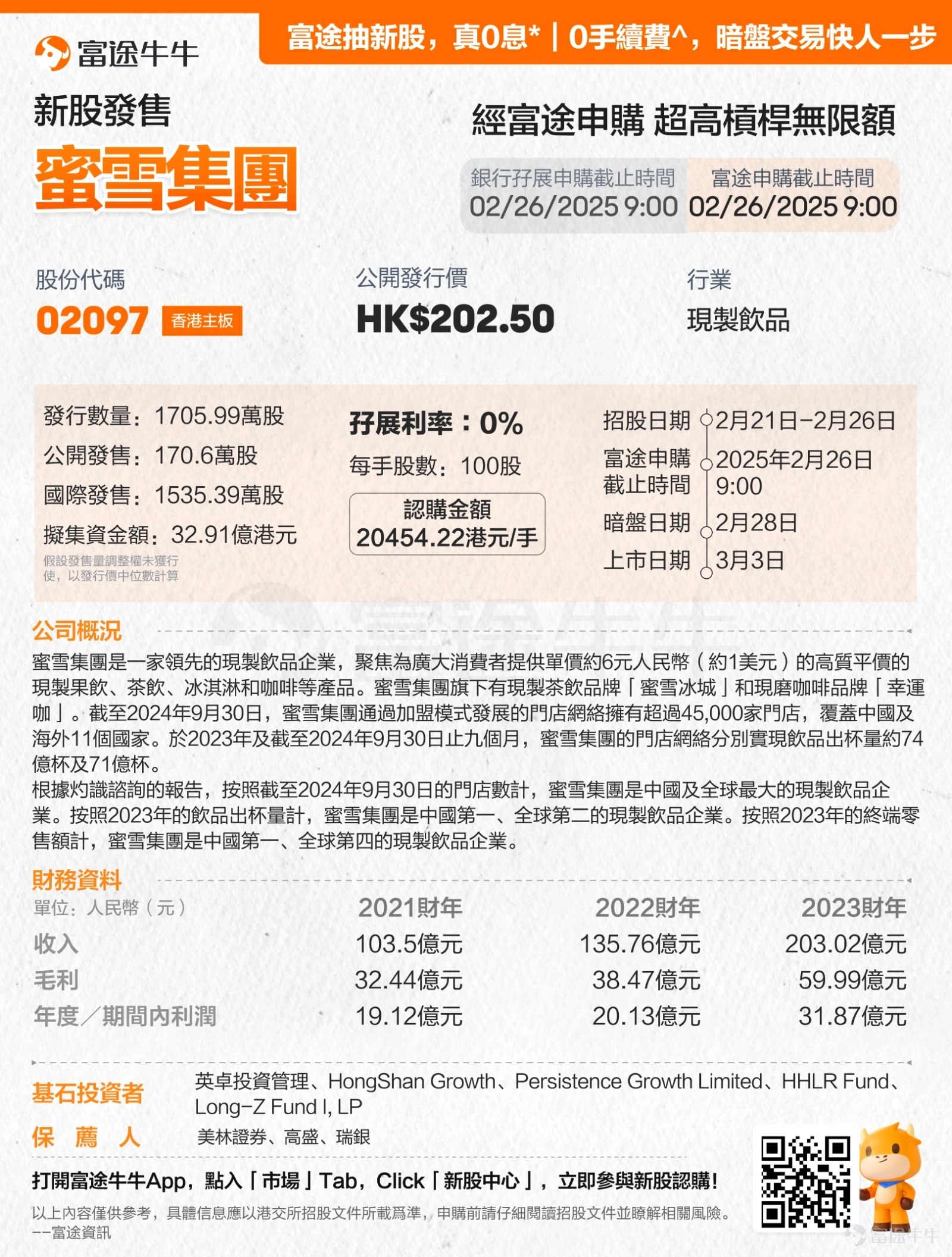

Futu InformationNewsFebruary 21, $MIXUE GROUP(02097.HK)$ Announcement launched on February 21-February 26IPOs, the Company intends to issue approximately 17.0599 million shares worldwide and will be listed on March 3.

FINANCIAL OVERVIEW OF MIXUE GROUP

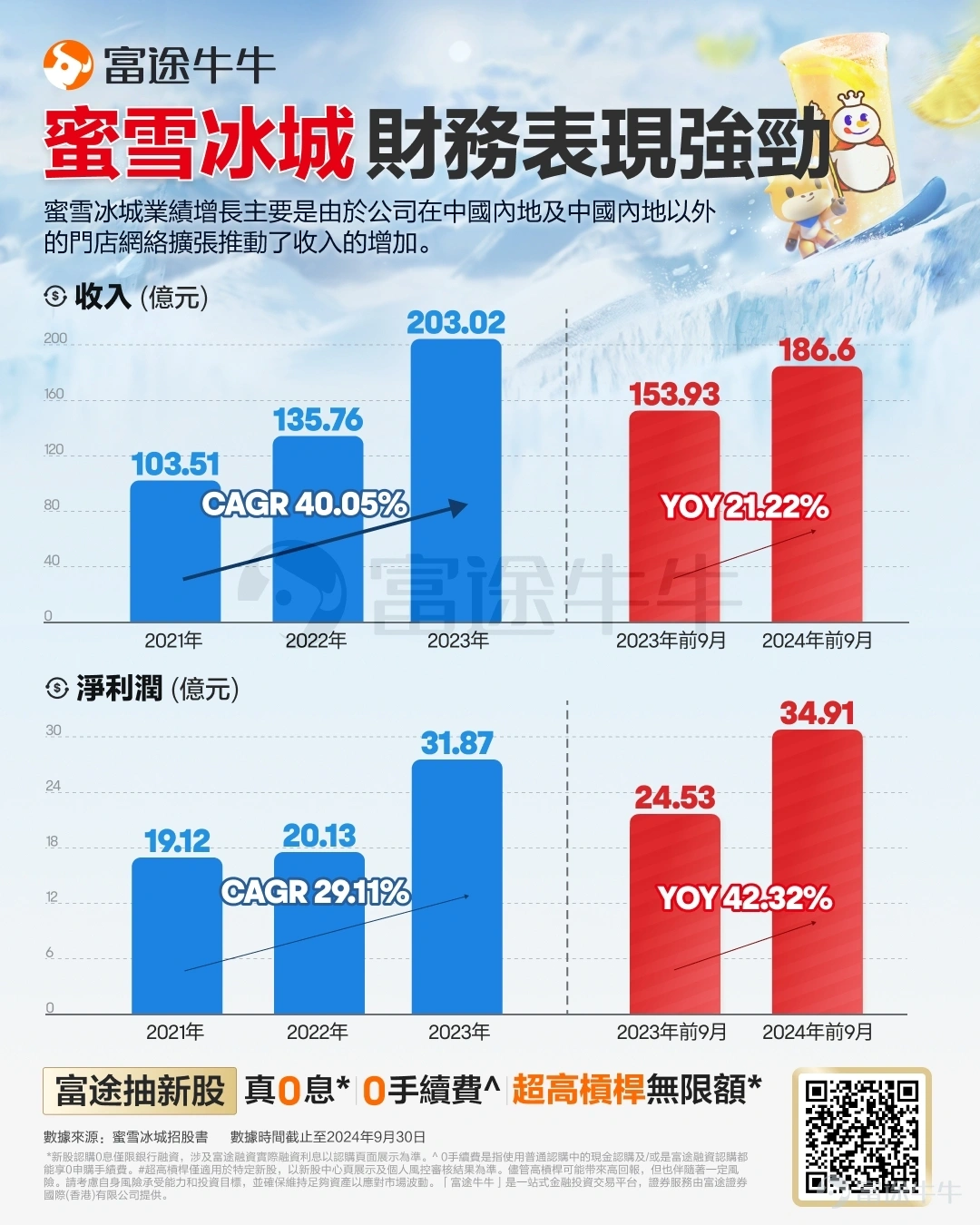

DURING THE RECORD PERIOD, HONEY SNOW GROUP'S PRODUCTION TEA BEVERAGE BRAND RECEIVED MORE THAN 95% OF ITS TOTAL REVENUE AND MORLEY'S SEPARATE REVENUE. For the year 2021 to 2023, Honey Group's operating income was 10.351 billion, 13.576 billion and 203.02 billion, with a year-to-date Net income split of 1.912 billion, 2.013 billion and 31.87 billion, and a gross margin of 31.3%, 28.3% and 29.5%.

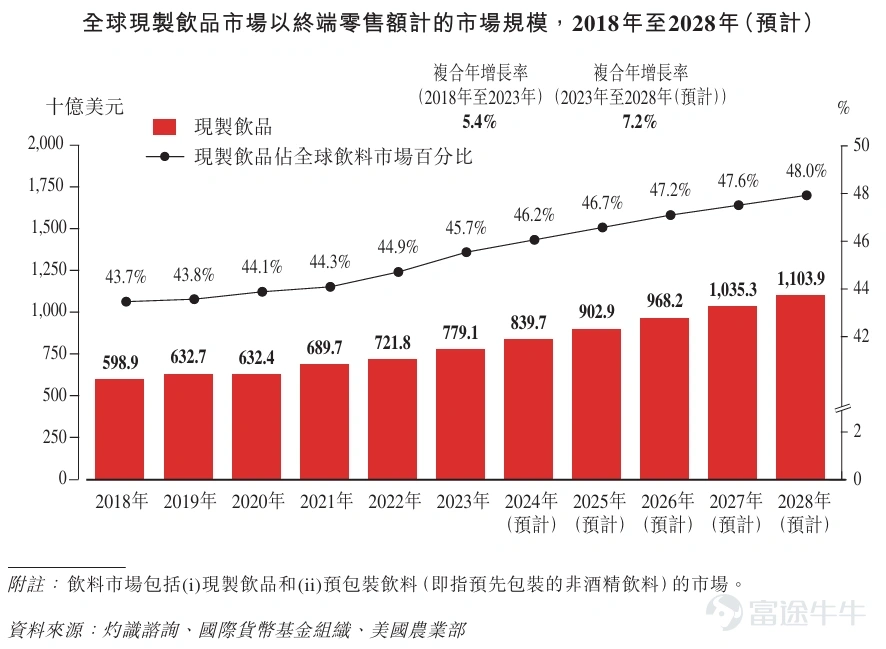

Overview of the Fine Beverage Industry

Modern Beverages refers to Non-alcoholic Beverages products made on site, including modern fruit drinks, beverages, ice cream and coffee. The global beverage market model is large and is not expected to accelerate. In terms of total retail sales, the global beverage market grew from US$598.9 billion in 2018 to US$779.1 billion in 2023, a compound year growth rate of 5.4%. The combined year growth rate for 2023 to 2028 is forecast to increase further to 7.2%, with a dynamic market pattern growth of $1103.9 billion in 2028, roughly one-half of the global beverage market.

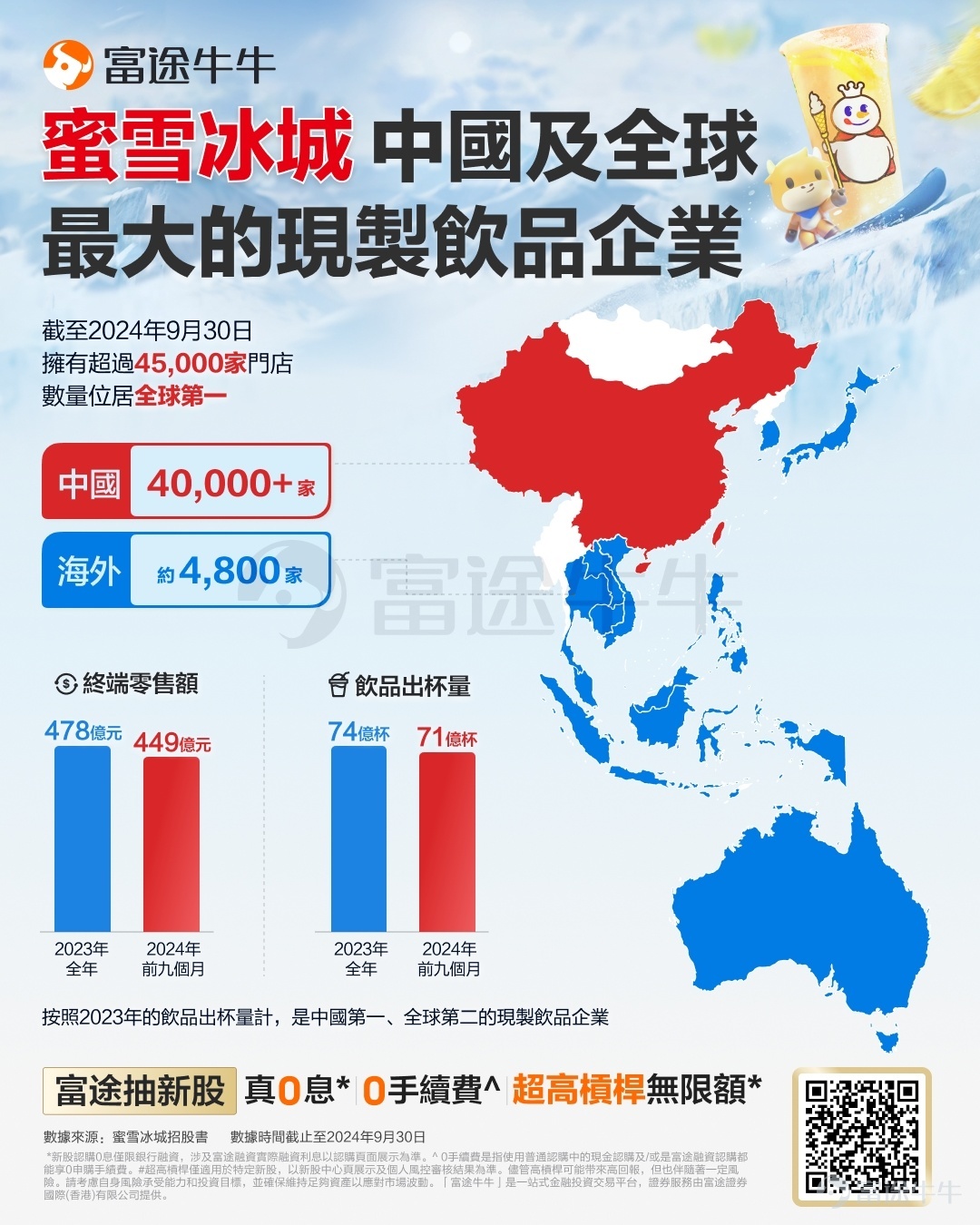

With more than 45,000stores as of 30 September 2024, the Honey & Beverage Group is the world's largest fine beverage company. By 2023, Honey Group is the world's second largest factory beverage company. In total terminal sales in 2023, the Honey Group accounted for approximately 2.2% of the global market. In terms of final retail sales in 2023, volume of beverages exported, and number of stores as of December 31, 2023, Honey Group is the largest ready-to-drink company in China. By 2023, in terms of final retail sales, Honey Group's market share in China was about 11.3%. By 2023, the volume of drinks in the Honey Group store network will exceed the number of drinks sold in the Industry's second to fifth place.

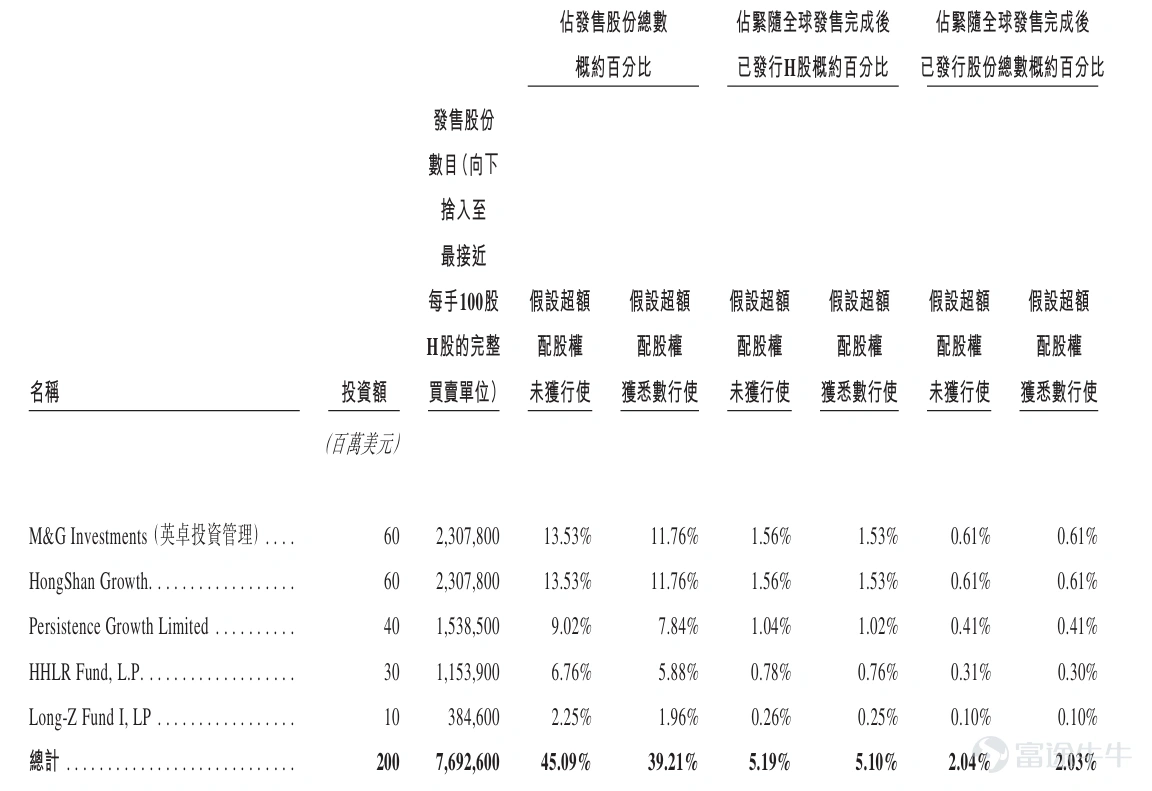

Cornerstone Investors

For the cornerstone investors, Elite Investment Management, HongShan Growth, Persistence Growth Limited, HHLR Fund, Long-Z Fund I, LP have agreed to subscribe or induce, under certain conditions, the relevant number of shares to be purchased at the offering price by their designated entities, for a total amount of US$0.2 billion (approximately HK$1,558).

Funding Purposes

In terms of financing, the company expects net proceeds from global sales to be approximately HK$3.291 billion (calculated at an issue price of HK$202.5). Pursuant to the Offer Letter, Honeysnow Group intends to use the global IPO for the following purposes:

Approximately 66% is used to increase the breadth and depth of the enterprise end-to-end supply chain, approximately 12% for the construction and promotion of brands and IP, approximately 12% for enhancing digitization and intelligence capabilities in various business environments, and about 10% is used for operational finance and other general enterprise applications.

Read more:MIXUE Group HighlightsStock book

How Futu acquired MIXUE Group

Step 1: New Shares MIXUE Group to Open a Securities Account

Open a combined account on Futu, click below to open now and enjoy the opening reward of over $USD.(Open an account now)

Step 2: Enter the New Share Centre to subscribe

After entering the Futu Beef FutuBullApp, select the market cap and select [Hong Kong stocks】, then click on “New Share Center” to select the new shares you need to subscribe for.

Step 3: Confirm order quantity and order method

Select the method you hope to purchase (Ordinary, Futures, or Bank Expansion) and enter the quantity and proceed with the purchase.

Futu repurchase of shares, fact0*|0Renewal fees^

A Quick Step by Step for Dusted TradeCome and experience the IPO >>

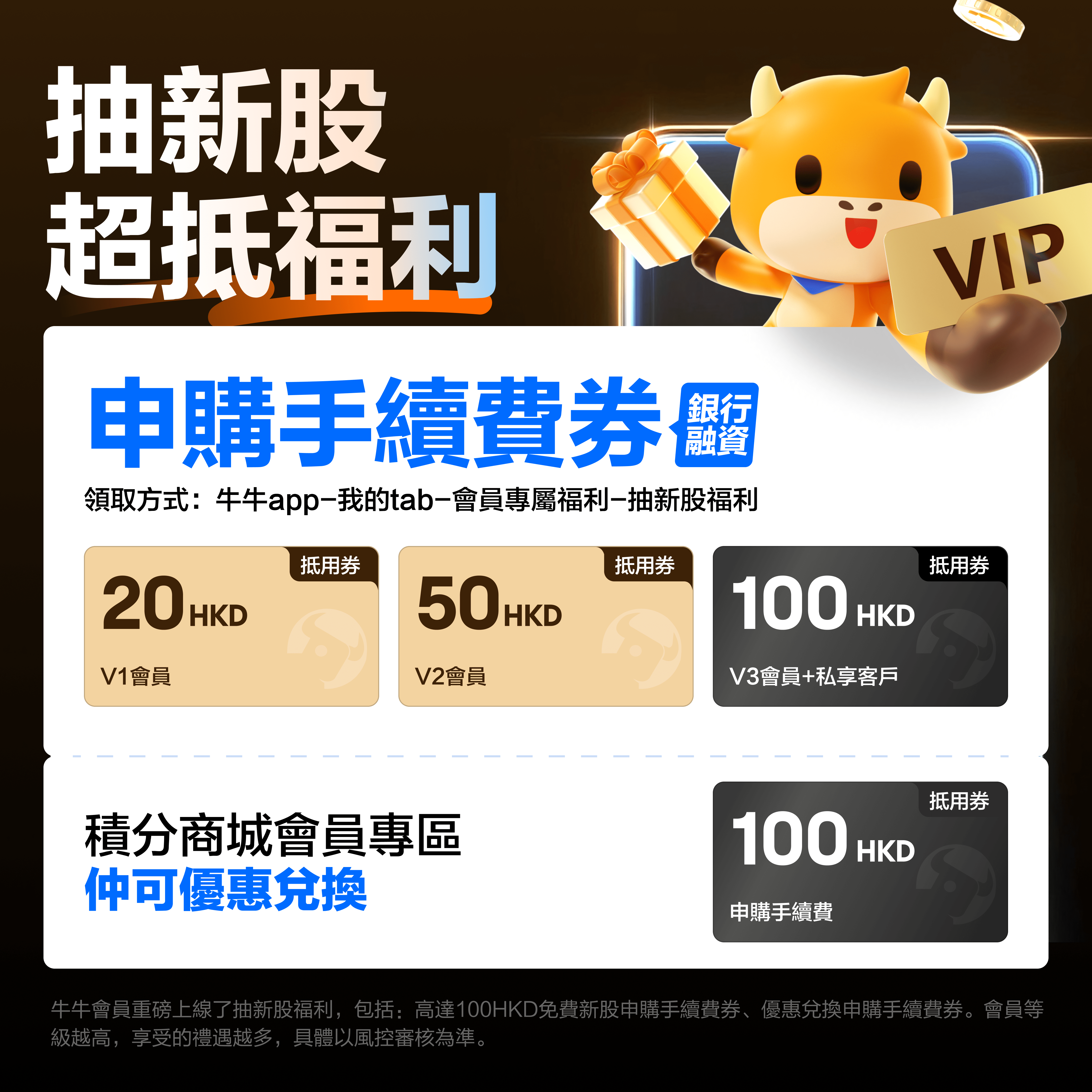

Become a Futubull member and enjoy the new share offer >>

For details, please click:The three main interests of members in the IPO! One article to master

*New share buybacks are limited to Bank Expansion, and Futu and Futu will demonstrate international earnings on the purchase page as standard.

^0Real-time fee refers to the cash purchase and/or the Futu Expansion Procurement Fee0 application fee.

#Superfast bar is only applicable to specific new shares, as per the new share center page presentation and personal wind control audit results. A high profile can carry a high return, putting the opponent at risk of a certain risk. Take into account your own risk underwriting capabilities and investment objectives, and maintain sufficient Assets to keep the market moving.

Disclaimer: Futu Bank's financial statements may be subject to change. Please refer to the New Share Announcement column as appropriate on the page for the latest information.