IPO Subscription | Real 0 Interest 0 Handling Fee

Subscription of New Shares 2589 | Aunty Shanghai launches IPO on May 8

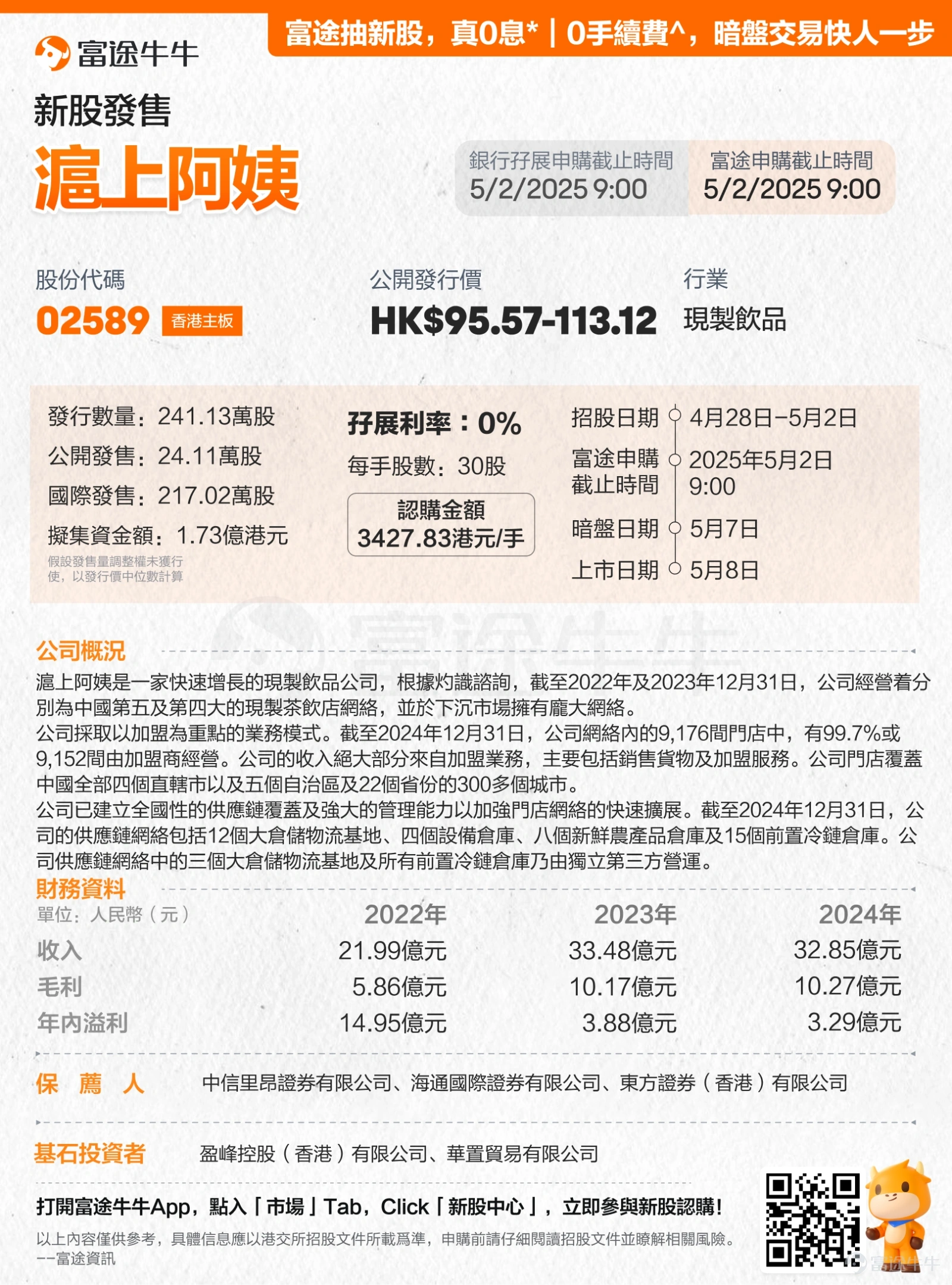

$AUNTEA JENNY(02589.HK)$ It will be official on May 8IPOs, the offering price will not be higher than HK$113.12 per share offered, and it is expected to be no lower than HK$95.57 per share offered for 30 shares per share, with a subscription amount of HK$3427.83/hand.

Aunty Shanghai (2589) IPO Basic Info

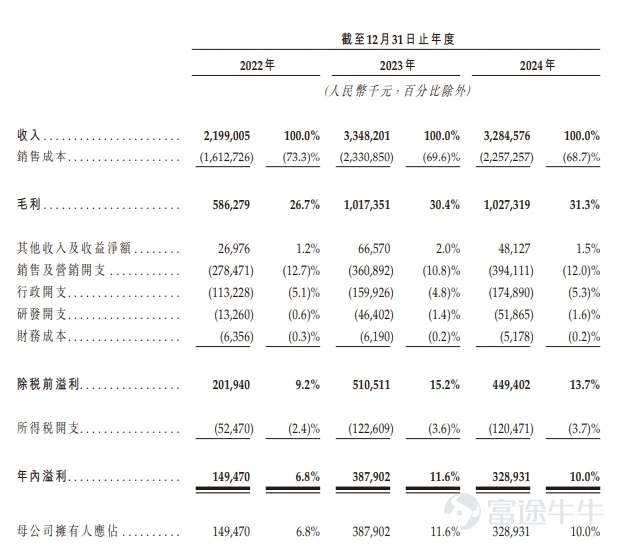

Financial Overview

Shanghai Aunty is the fastest growing ready-to-drink tea shop brand in the top five ready-to-eat tea shop brands in terms of total number of stores. During the record period, Shanxi Aunty achieved revenues of $2.199 billion, $3.348 billion and $32.85 billion for the combined period of 22.22%; year-over-year gross profit of $0.586 billion, $1.017 billion and $10.27 billion, and compounded year-on-year growth of 32.37%; and gross profit for the same period was 26.7%, 30.7%, 30.7%, respectively. 4% and 31.3%.

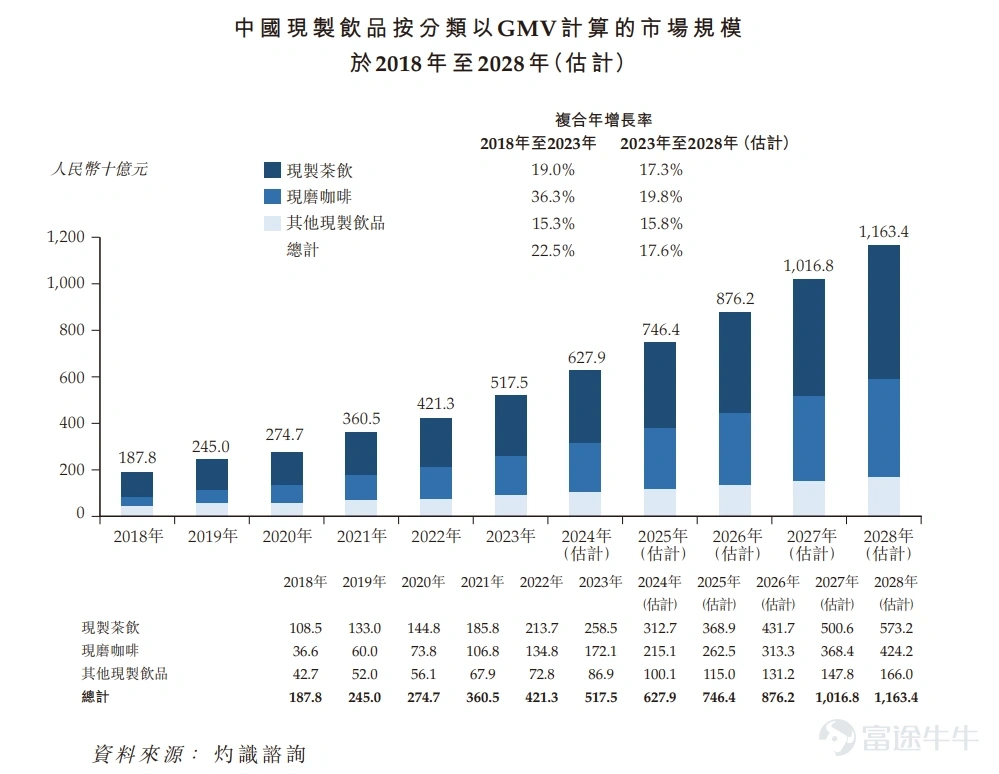

Industry Overview

Ready-made beverages are beverages that are made on-site and made available directly to consumers for immediate consumption. Ready-made drinks are available in a variety of options, including ready-to-drink tea, freshly ground coffee, and other ready-to-drink beverages such as yogurt and freshly squeezed juice. The ready-to-drink market has maintained rapid growth over the past five years, increasing the GMV market size from RMB187.8 billion in 2018 to RMB517.5 billion in 2023, for a compound year growth rate of 22.5%.

As the fastest growing emerging segment in terms of GMV over the past five years, the coffee market has shown significant expansion in China. With innovation and flavor diversification as a selling point, China's freshly ground coffee market jumped from RMB36.6 billion in 2018 to RMB172.1 billion in 2023, and is expected to grow further at a compound annual growth rate of 19.8% to reach RMB424.2 billion by 2028.

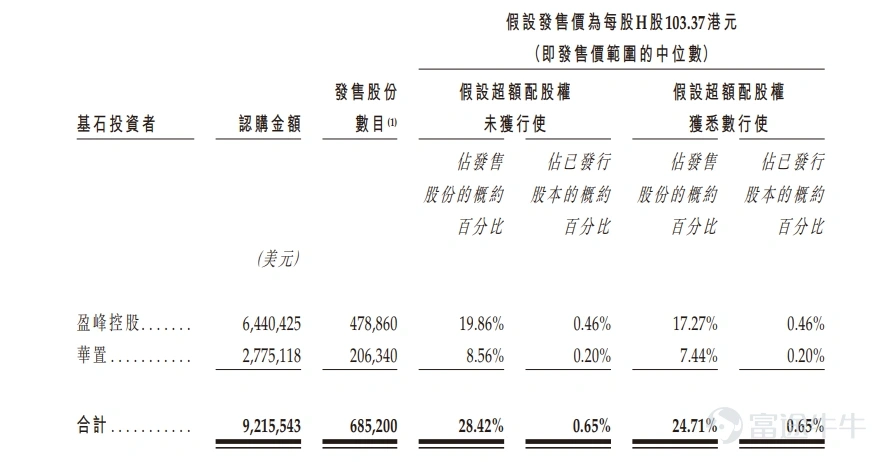

Cornerstone Investors

For cornerstone investors, Ying Fung Holdings and Huawei have agreed to subscribe for or induce, under certain conditions, the relevant number of shares available for purchase at the offering price by their designated entity, for a total of approximately US$9.2155 million. WHOLLY OWNED BY HUABAO IN CHINA, HUBAO IS THE COMPANY'S SUPPLIER OF EXPLOSIVE BALLS. ITS PURCHASE AGREEMENTS ARE CONCLUDED IN ACCORDANCE WITH FAIR AND NORMAL COMMERCIAL TERMS IN THE COURSE OF OUR BUSINESS.

Funding Purposes

In terms of financing, Aunty Shanghai expects net proceeds from global sales to be approximately HK$0.173 billion (based on the median issue price of HK$103.37). According to the tender offer, Aunty Shanghai intends to use the global IPO for the following purposes:

Approximately 25% will be used to enhance the company's digitization, About 20% will be used for research to improve the quality of raw materials and food materials, create hot selling products, select the company's product types, and about 20% of the upgrade company's equipment and machinery will be used to enhance the company's production, processing, warehousing, logistics and marketing capabilities. This strengthening of the company's supply chain capacity of about 15% will be used to improve the company's brand profile and further expand, and the company's store network will be used to invest about 10% in various marketing activities, and about 10% will be used for operating funds and other general corporate uses.

Read more:Aunty Shanghai Stock Exchange

How to order Auntie Shanghai (2589)

Buying new shares in Futu is just two steps away!

Step 1: Open a Securities Account for New Share Purchases

Open a combined account on Futu, click below to open now and enjoy the opening reward of over $USD.(Open an account now)

Step 2: Click on the image below to subscribe

Latest Offers on Draft Shares

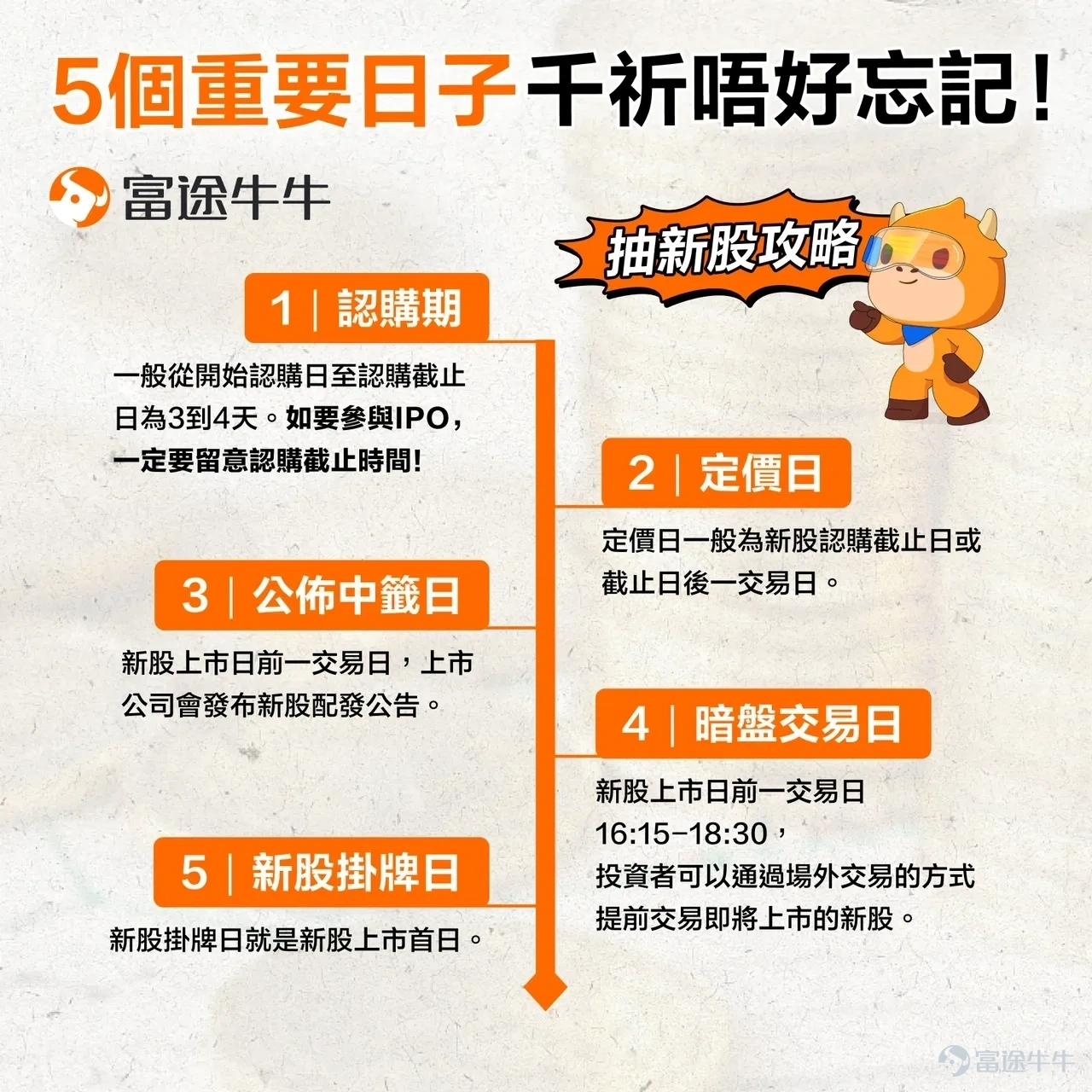

Notes on the IPO

For details, please click >> Beginner's Guide: How to Subtract New Shares?