IPO Subscription | Real 0 Interest 0 Handling Fee

New Shareholder Acquisition of 6082Qiao Technology Listed IPO Procurement News

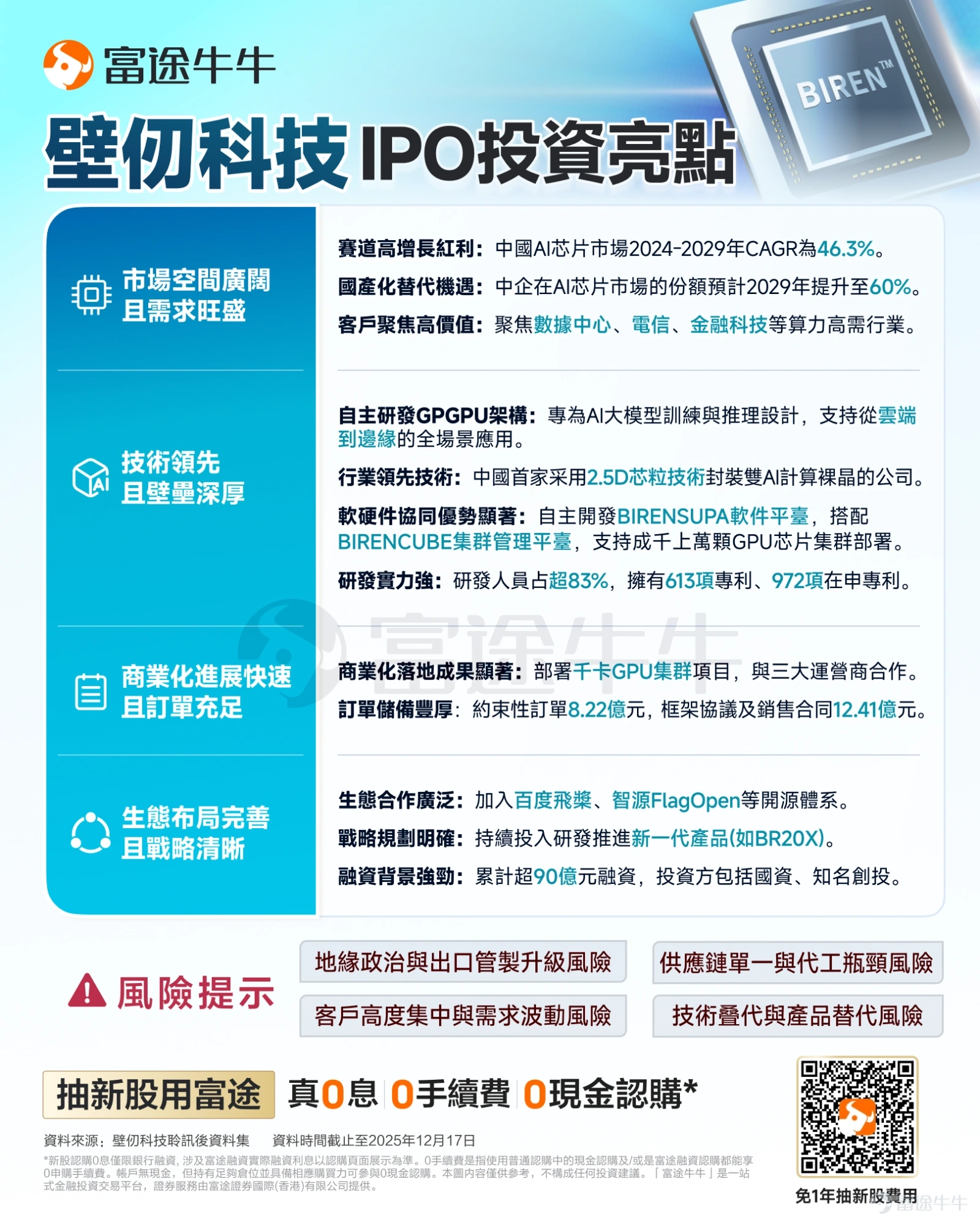

Wall Technology IPO

One of the “Four Little Dragons of Domestic GPU” $BIREN TECH(06082.HK)$ The announcement was made that in the IPO on December 22 - December 29, the company intends to sell approximately 0.248 billion shares worldwide, which will be listed on January 2, 2026, in a move that will impact the “Hong Kong IPO first share”.

Wall Technology Company Overview

Wall Technology is a domestic provider of general-purpose intelligent computing solutions that provides computing infrastructure facilities to a wide range of industries, based on its own development of Wallpaper™ series of GPU products. By integrating GPGPU-based hardware from proprietary development and the proprietary BIRENSUPA software platform, the company's solutions support the training and management of AI models in widespread applications from cloud to edge.

As of the last practicable date, the company had 24 pending orders with a total value of approximately RMB 0.822 billion. The company has signed 5 framework sales agreements and 24 sales combined, with a total value of approximately RMB 1.241 billion. The two main companies in the Smart Computing Solutions, Customer Coverage Telecommunications, AI Data Centers and Internet Industry, are presented in the combined Dive Revenue Reserves of more than $2 billion.

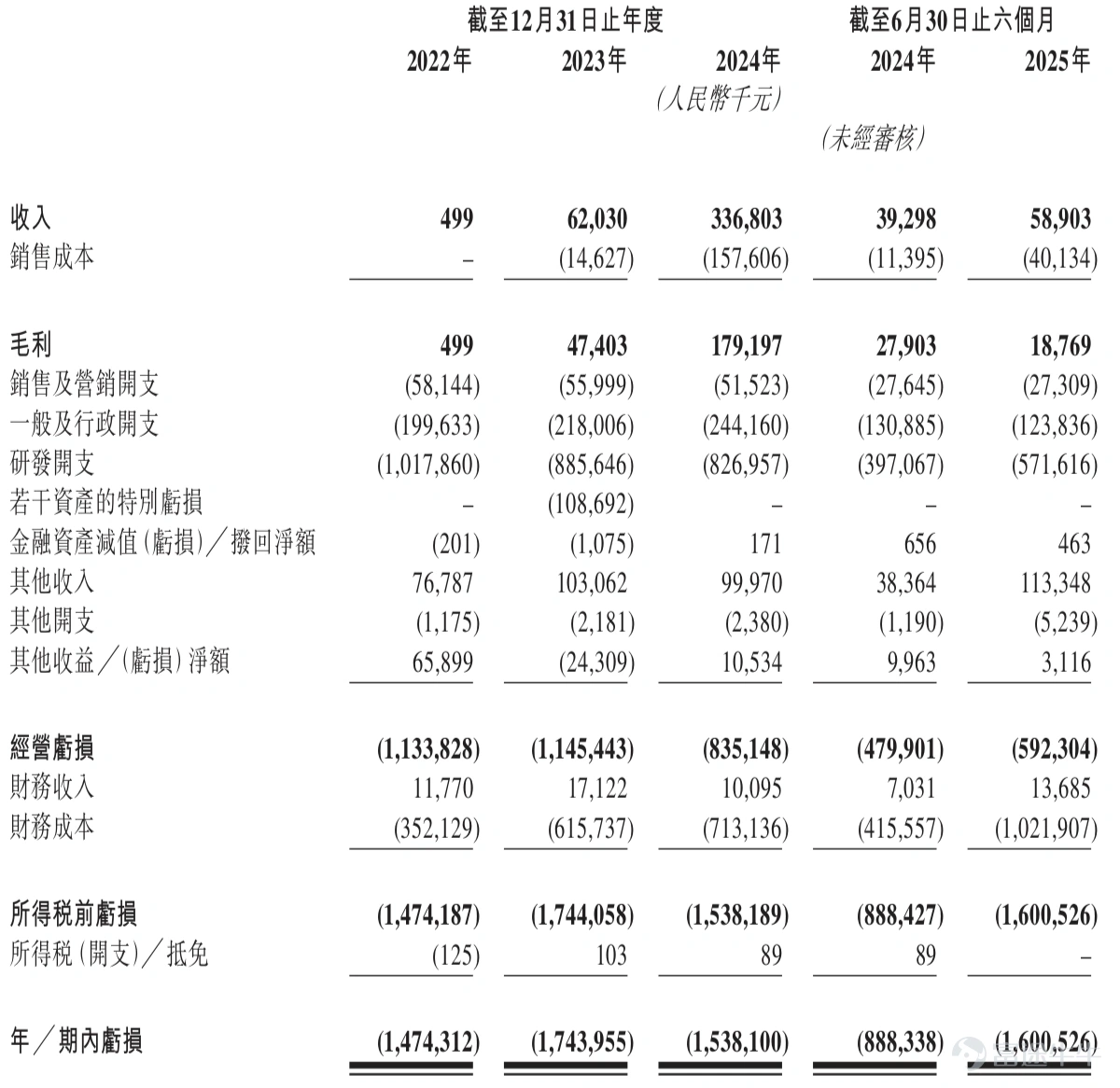

Financial Overview of Masonry Technology

In terms of financial condition, the company's intelligent computing solutions began to generate revenue in 2023. Between December 31, 2024 and the six months ending June 30, 2025, the company's Specialty Technology products have 14 and 12 customers, respectively, earning RMB0.3368 billion and RM55.5 8.9 million USD.

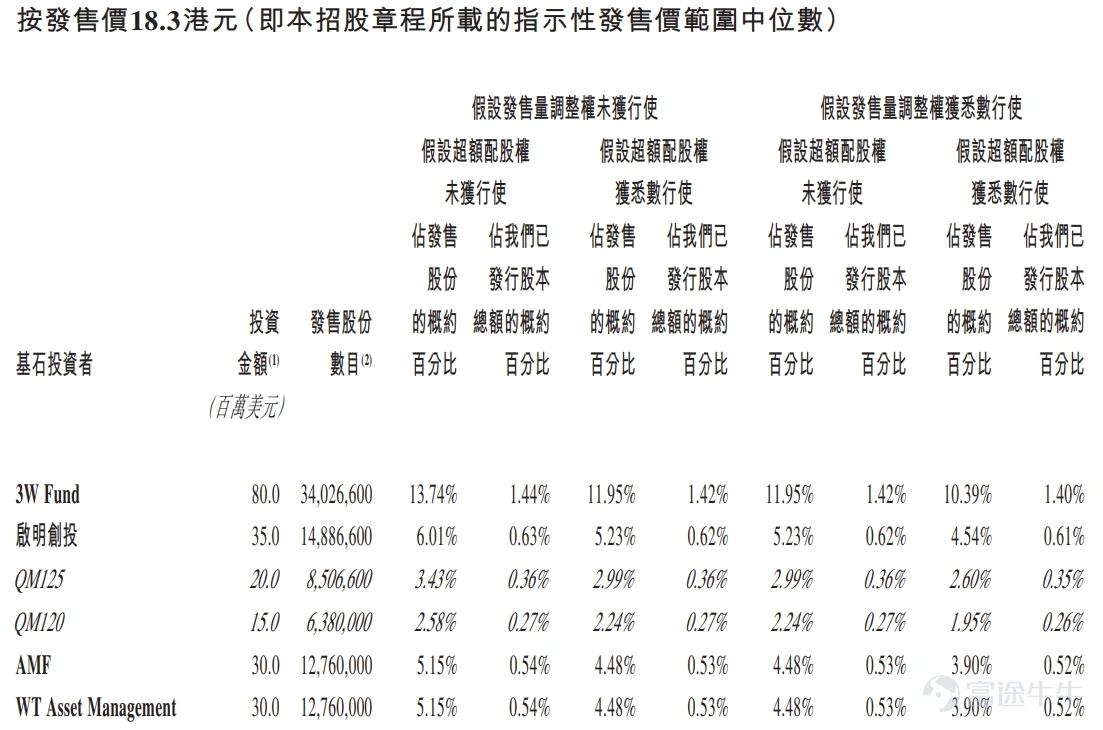

Masonry Technology IPOFoundation Investors

The cornerstone investor has agreed, subject to certain conditions, to subscribe for certain shares at the offering price for a total amount of approximately $0.3725 billion. Cornerstone investors include:

3W Fund Management Limited; Founder Aspex Master FundsWT Asset Management LimitedHao Great China Focus Fund; Mutual Life Insurance Huadeng Technology Peak Fortitude Ventures LtdLion Global Investors Limited CICC Financial Trading LimitedMy Asian Opportunities Master Fund, L.P.Eastspring Investments (Singapore) LimitedUBS Asset Management (Singapore) Ltd.; Thai Life Insurance Limited Liability Company Aspirational China Growth GP LimitedCharoen Pokphand Robot LimitedDigital (Hong Kong) Limited Liaotai Securities Investment (HK) Limited Liability Fund Management Co., Ltd.Fullgoal Asset Management (HK) LimitedEnhanced Investment Products LimitedTessy Holding Limited New Opportunities SPC.

Uses of Wall Technology IPOs

In terms of utilisation, Wall Technology expects a net total of HK$4.351 billion in global sales (the superannuation option has not been exercised, with a mid-sale price figure of HK$18.30 per share). Based on the solicitation of shares, Wall Technology will use the global sales pool funds for the following purposes:

Approximately 85.0% will be used for intelligent computing solutions developed by future R&D companies. Approximately 5.0% will be used for the commercialization of the company's smart computing solutions. Approximately 10.0% will be used as working capital and general corporate purposes.

Read more:Masonry Technology Auction

Upcoming Share Futures 0 Yield 0Ongoing Fees 0Cash Redemption

The New Stock Gold Season Has Arrived! Upcoming Share Futures, 0 Interest, 0 Operating Fees, 0 Cash Purchase. The opportunity to participate and participate in the event is exempt from 1 year of renewal fees,Learn more >>