IPO Subscription | Real 0 Interest 0 Handling Fee

【New Share 2506 Subscription】Information on IPO IPO of Sietfei Medical Technology

Futu Information News December 18, $Therapeutic Technology (02506.HK)$ Announcement to launch from 18 December 2024 to 23 December 2024IPOs, the company intends to issue 7.0356 million shares worldwide and is expected to go public on December 30, 2024.

Telefei Medical Technology Real-time Quotation

Telefei Medical Technology Financial Profile

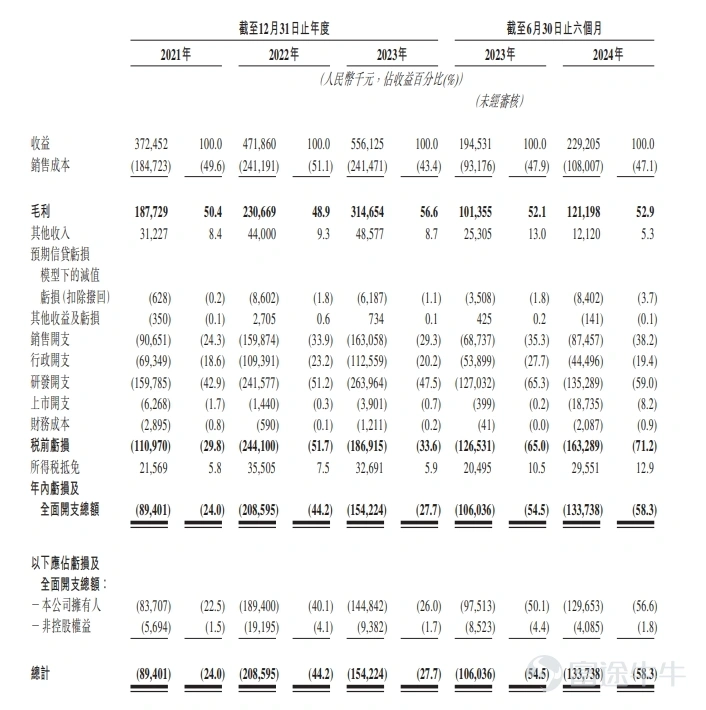

The Company's revenue increased 26.7% from RMB0.372 billion in 2021 to RMB0.472 billion in 2022 and increased 17.9% to RMB0.556 billion in 2023; the Company's gross profit increased 22.9% from RMB0.188 billion in 2021 to RMB0.231 billion in 2022 and increased 36.4% to RMB 2023 0.315 billion yuan.

Source: Prospectus

Industry Overview

China's Medical Services Industry mainly includes disease prevention, treatment and rehabilitation services. China's Medical aid in 2023 amounted to RMB9095.7 billion and is expected to increase to RMB14542.8 billion by 2030, a compound year growth rate of 6.9%. Medical Services Providers in China include Institutions of Undergraduate Medical Institutions, Hospitals and Other and Other Medical Institutions. As of 31 December 2023, China had 1016,000 Institutions of Primary Medical Institutions and 39,000 Hospitals and 39,000 Home Hospitals.

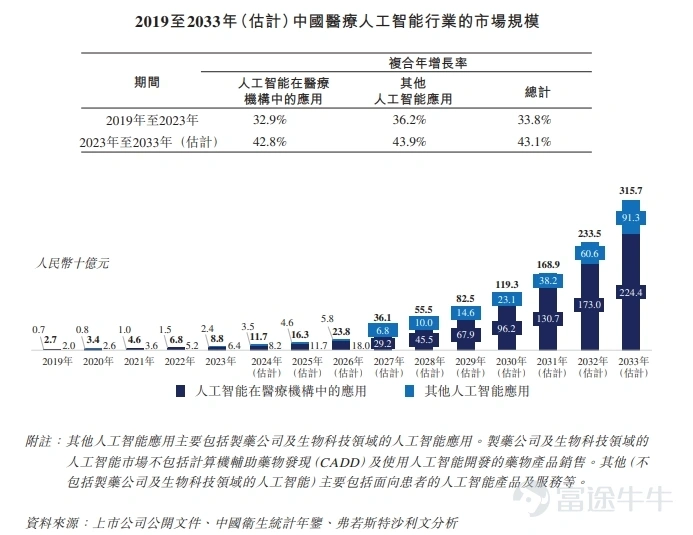

The market model of China's Medical Artificial Intelligence Industry shows growth. From RMB 2.7 billion in 2019 to RMB8.8 billion in 2023, a compound year growth rate of 33.8%. Further growth is expected to reach RMB315.7 billion by 2033 and a compound year growth rate of 43.1% from 2023 to 2033. In 2021, 2022 and 2023, the company ranked first in terms of revenue, with a market share ratio of 8.0%, 6.8% and 5.9%.

Source: Prospectus

Linefei Medical Technology Cornerstone Investor

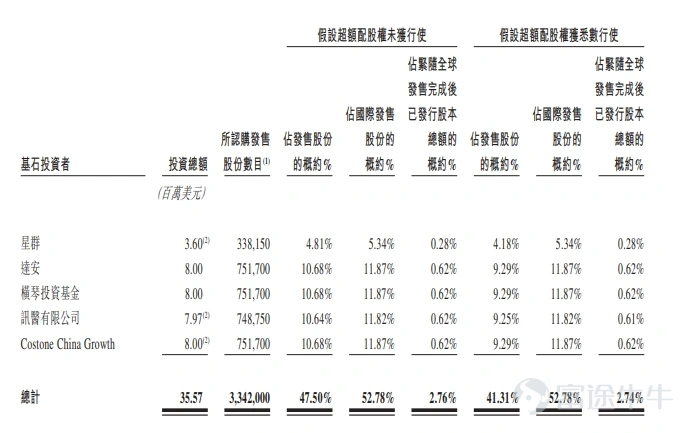

As far as investors are concerned, Star Group, Dayan, Piano Investment Funds, Medical Services Limited, and Costone China Growth have agreed to agree to the terms and conditions for a total purchase price of approximately US$35.57 million at the sale price or by means of other specified entities.

Source: Prospectus

Funded uses of Telefei Medical Technology

In terms of financing, Airplane Medical Technology expects global sales to be around HK$0.5071 billion (resort development price is calculated at HK$82.8 billion). According to the charter of shareholders, Inflight Medical Technology will use the global sales pool funds for the following description: about 32.4% will be used for investment research, so as not to strengthen the company's core capacity. Approximately 26.6% will be used to upgrade existing products and develop new products and services about 24.724.7About 6.4% of the company's service network that will be used to enhance commercialization and expand will be used for acquisitions that may be compatible with the company's existing production partnerships. Approximately 10% will be used for operating capital and other general corporate uses.

Read more:Newfly Medical Technology Procurement

How to Get 0 Interest 0 Processing Fee Medical Technology Subscription

It only takes three steps to buy new shares in Futu!

Step 1: Open a Securities Account for New Share Purchases

Open a combined account on Futu, click below to open now and enjoy the opening reward of over $USD.(Open an account now)

Step 2: After entering the New Share Center, enter the Futui Beef FutuBullApp, select the market cap, select the Hong Kong shares, and select the new shares required to be purchased again.

Step 3: Confirm order quantity and order method

Select the method you hope to purchase (Ordinary, Futures, or Bank Expansion) and enter the quantity and proceed with the purchase.

New customers open an account for a limited time and enjoy up to 1,000 mosquitoesAccount Opening Offer, seize the time to find money now!

*New share buybacks are limited to Bank Expansion, and Futu and Futu will demonstrate international earnings on the purchase page as standard.

^0Real-time fee refers to the cash purchase and/or the Futu Expansion Procurement Fee0 application fee.