IPO Subscription | Real 0 Interest 0 Handling Fee

IPO OF NEW SHARES | HENG RUI PHARMACEUTICALS IPO, EXPECTED TO BE LISTED ON 23 MAY, WITH INITIAL SUBSCRIPTION AMOUNT OF HK$8898.85

Futu Information News on May 15, $HENGRUI PHARMA(01276.HK)$ The announcement was made that in the IPO on May 15-May 20, the company intends to offer approximately 0.225 billion shares worldwide and is expected to be listed on May 23.

Hang Rui Pharmaceuticals Stock Price

$Jiangsu Hengrui Pharmaceuticals(600276.SH)$ A-share live share price:

About Heng Shui Pharmaceutical Company

Founded in 1970 and listed on the Shanghai Stock Exchange in 2000, Hubei is an innovative international pharmaceutical company dedicated to the development, production and promotion of high quality medicines, to carry out new drug development in the fields of anti-glaucoma, cardiovascular diseases, immunization and respiratory diseases, and neurosciences. One of the most innovative pharmaceutical faucet companies in the country. On its own stock market, it is expected that the company's share capital of RMB8.029 billion is about RMB8.029 billion, which is equivalent to 16.8 billion shares of the company's current share capital market capitalization.

In R&D mode, the company is dedicated to developing drugs with different characteristics against identified available drug targets. His field of research has expanded from traditional small molecule drugs to protein-hydrolysis-targeted enzymes (PROTAC), peptides, monoclonal antibodies (mAbs), binospecific antibodies (BSab), multispecific antibodies, antibody-dopants (ADCs), radioactive matching therapies (RLT) and oligonucleotides The form of the drug.

The company owns more than 110 commercialized drugs, including 19 new molecular solid innovative drugs and 4 other innovative drugs. At the same time, its pipeline covers more than 90 candidate new molecular solid innovation drugs and 7 other innovative investigational drugs in the clinical and post-clinical stages, and more than 30 innovative investigational drugs in critical clinical trials or later stages.

Financial Overview

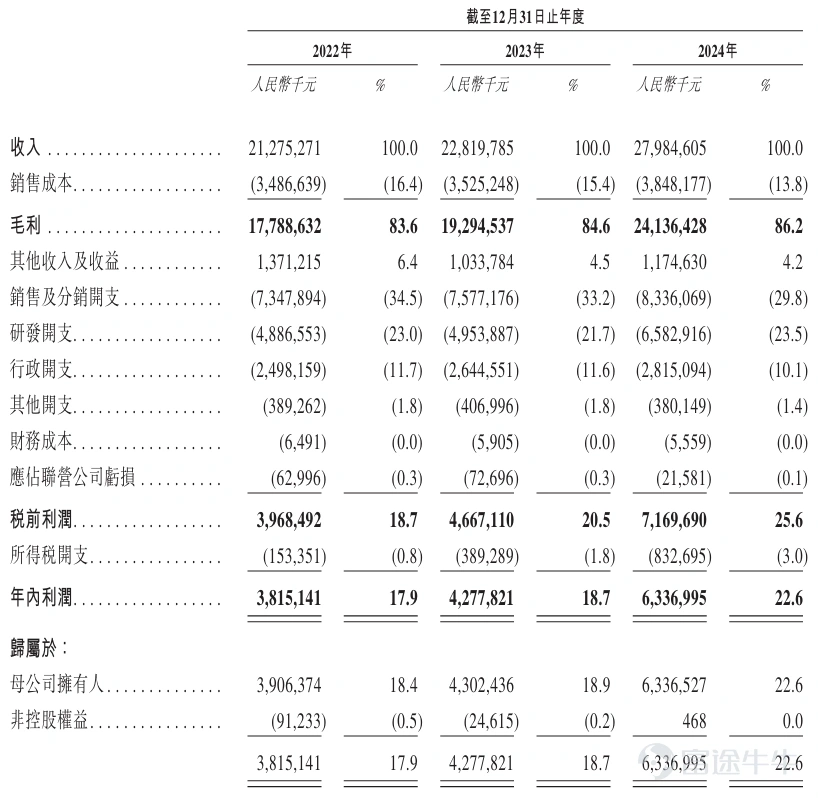

According to the report for 2024, the company achieved revenue of 27.985 billion USD in 2024, a year-on-year increase of 22.63%. Net income attributable to shareholders of listed companies of 6.337 billion USD and a corresponding increase of 47.28% due to amortization of non-ordinary losses by shareholders of listed companies 6.178 billion, a year-on-year growth of 49.18%. Ensuring innovation output, the company continues to increase its innovation drive and maintain high R&D investments, reports that the company projected R&D investment of 8.228 billion dollars in the period, while spending chemical R&D invested 6.583 billion, and 29.4% of total R&D investment income in 2024.

For the years ended December 31, 2022, 2023, and December 31, 2024, the company's gross profit was $17.789 billion, $19.295 billion, and $24.136 billion, respectively.

Industry Overview

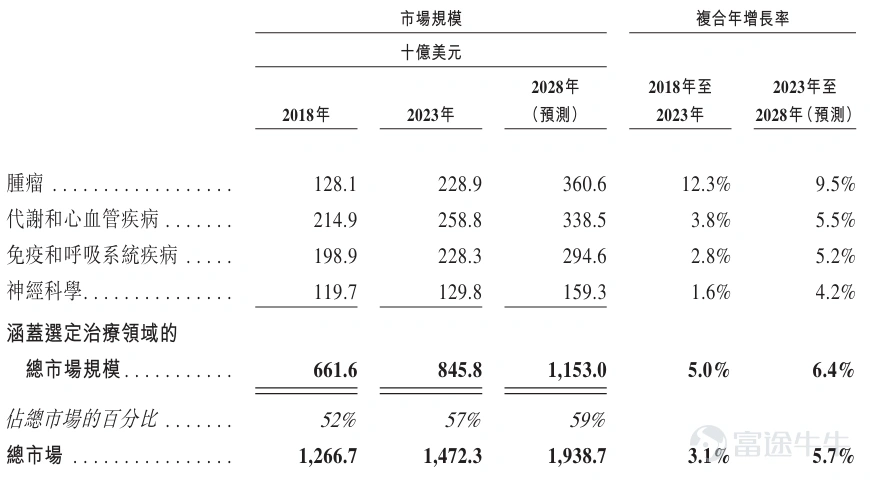

Driven by an aging population, increased health awareness and life expectancy, and increased R&D spending, the global pharmaceutical market grew from US$1266.7 billion in 2018 to US$1472.3 billion in 2023, with a compound annual growth rate of 3.1%, projected to reach US$1938.7 billion by 2028 and a compound annual growth rate of 5.7%. Meanwhile, the Chinese pharmaceutical market grew from RMB 1533.4 billion in 2018 to RMB1618.3 billion in 2023, and is expected to reach RMB2342 billion by 2028, with a compound year growth rate of 7.7%. DRIVEN BY SOCIO-ECONOMIC FACTORS SUCH AS ACCELERATED APPROVAL OF INNOVATIVE MEDICINES, EXPANSION OF HEALTHCARE COVERAGE AND IMPLEMENTATION OF HEALTHCARE REFORM PROGRAMMES, CHINA'S PHARMACEUTICAL MARKET IS EXPECTED TO ACCELERATE GROWTH.

Source: Analysis by Frost Sullivan

Cornerstone Investors

Cornerstone investors have agreed to subscribe or induce their designated entity to subscribe for the relevant number of shares available for purchase at the offering price, subject to certain conditions, for a total amount of approximately $0.533 billion (based on the median of the offering price range). Key investors include GIC, Invesco Advisers, UBS AM Singapore, Cordial Solar (a controlled subsidiary of Boyu Capital Opportunities Master Fund), Hillhouse, Millennium, Oaktree.

Funding Purposes

In terms of financing, Heng Shui Pharmaceuticals expects net proceeds from global sales of HK$9.4578 billion (based on the median sales range of HK$42.75). Under the terms of the offering, Heng Shui Pharmaceuticals will use the global IPO for the following purposes:

Approximately 45% will be spent on the Group's innovative drugs and clinical research in investigational drugs; approximately 20% will be spent on the development of innovative drugs; approximately 10% will be used for the Group's potential global acquisitions and collaborations to strengthen the Group's product pipeline and innovation capabilities; and approximately 15% will be used to build new production and R&D facilities in the Chinese and overseas markets; and the remainder Approximately 10% will be used as the Group's working capital and other general corporate purposes.

Read more:Prospectus for Hang Rui Pharmaceuticals

New Share Futures, 0 Interest, 0 Handling Fees, 0 Cash Purchase, Fast Track Trading,Come and experience it >>