IPO Subscription | Real 0 Interest 0 Handling Fee

IPO | CAO JIANG COMPANY 2643 LAUNCHES IPO, PROJECTED TO GO PUBLIC ON JUNE 25

Futu InformationNewsJune 17, Launch Announcement (2643.HK), June 17-June 20IPOs, the Company intends to issue approximately 44.1786 million shares worldwide and is expected to go public on June 25.

>>BOOK NOW CAO JIANG TRAVEL (2643.HK)<<

CAO XIAO EXPORTING COMPANY PROFILE

CAO JIANG TRAVEL IS A CHINESE ONLINE CAR DATING PLATFORM INCUBATED BY THE JILI GROUP. As of 31 December 2024, it operates in 136 cities. The company's strategic partnership with the Geely Group enables the company to jointly develop and deploy the company's custom cars at scale. As of December 31, 2024, the company has a fleet of more than 34,000 custom cars for use by its subsidiary drivers in 31 cities. According to Frost Sullivan, Cao Xiang's fleet is the largest of its kind in China.

Beyond that, the company's strategic cooperation with the Gili Group increases the Company's Operating Efficiency. The company provides vehicle service solutions that incorporate comprehensive driver safety incentives to reduce insurance costs, and use clean repair plans to reduce maintenance and maintenance costs. The company uses the extensive network of exchange stations and car repair shops within the Gili Group to increase our net income. The company's custom car drivers benefit from economy and driving experience.

Focusing on the vehicle design process, the company is able to design vehicles that fit the needs of passengers and drivers, including improving vehicle durability, maintainability, and adopting innovative switchgear and installing intelligent seating functions. The company's ability to build vehicles further solidifies the company's competitive advantage. Vehicles also benefit from a large modeling economy and supply chain capacity to achieve high cost efficiency. By December 31, 2024, the company's fleet of more than 34,000vehicles was used by subsidiaries of its fleet of vehicles in 31 cities, according to the information provided by Vfrestal, the largest vehicle fleet in China. Beyond that, the company will launch 85 Shenzhen New Land Tool Planning & Architectural Design projects in 2024, partnering with local operating partners to sell custom-made vehicles.

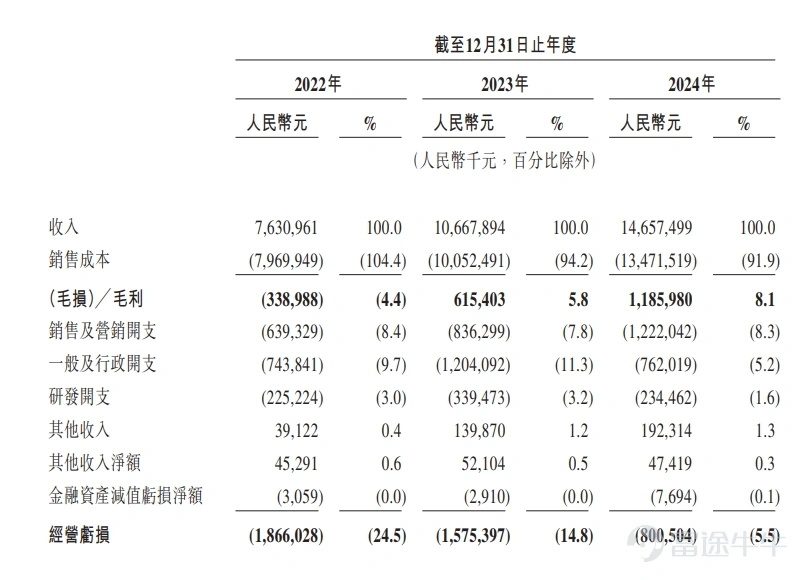

Financial Overview

There has been an increase in operating output, while profitability continues to increase. From 2022 to 2024, operating revenues increased by RMB7.6 billion to RM14.7 billion, and gross margin increased by 4.4% to 8.1%. In 2023 and 2024, the company recorded a gross profit of RMB0.615 billion and RMB1.186 billion, up from a loss of RMB0.339 billion in 2022. The company's income is generated by the outbound services provided in the form of Online Car-hailing. In the words of outbound services, the company approves income in bicycle rentals, vehicle sales and other services.

Source: Prospectus

Industry Overview

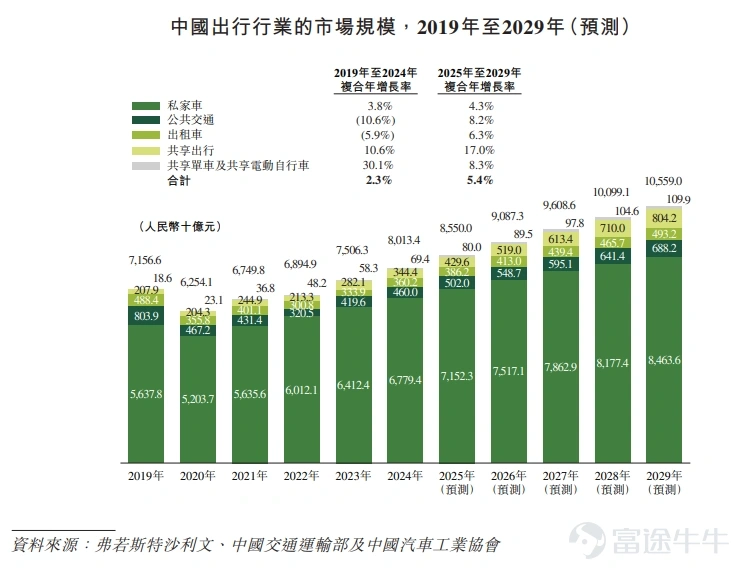

Traveling is an integral part of people's daily lives, with huge business opportunities. As the second largest economy in the world, China has the second largest population in the world and a large number of densely populated cities, making it the largest travel market today. China's export market enjoyed strong gains, growing from 8.9% in 2022 to RMB7.5 trillion in 2023. The market size further grew to RMB8 trillion by 2024. China's export market is expected to grow from RMB8.6 trillion in 2025 to RMB10.6 trillion in 2029, with a compound year growth rate of 5.4%. In particular, in 2025 to 2029, shared travel is expected to grow fastest across different modes of travel.

Shared travel options in China include online charter and windmills. Online carpooling uses the online platform to match the needs of platform users with drivers and vehicles that can be provided by registering on the platform. Windmill refers to private car owners sharing their real-time trip information online in advance to let others with similar itineraries join in order to enable shared trips. In addition, with the continuous acceleration of urbanization and the upgrading of consumption, Chinese consumers are increasingly demanding on the travel experience. In addition, private cars are mainly used in China for daily commuting and are often parked for long periods of time. In 2024, the average utilization rate of private cars in China is less than 30%, which is a serious waste of resources. Therefore, sharing travel in China with low cost and high quality of service is a huge business opportunity.

The rapid development of the sharing industry has been supported by various government incentives and the digitalisation of the traditional car hire industry. The policy promotes the joint development of car rental and online car rental services, promotes the financing of traditional car rental with the online car model, reduces rental downtime, increases the efficiency of rental car operations and improves the passenger experience. The CHP provider is bringing traditional car rental to other platforms and introducing a car rental agreement solution, making the traditional car rental industry look forward to upgrading its in-demand service products.

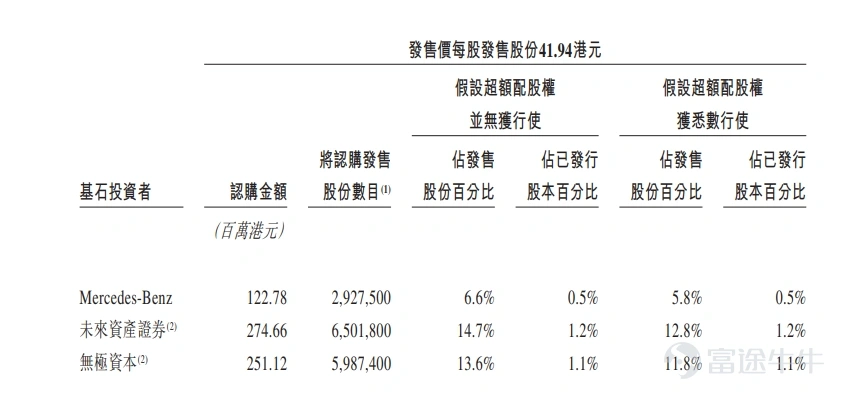

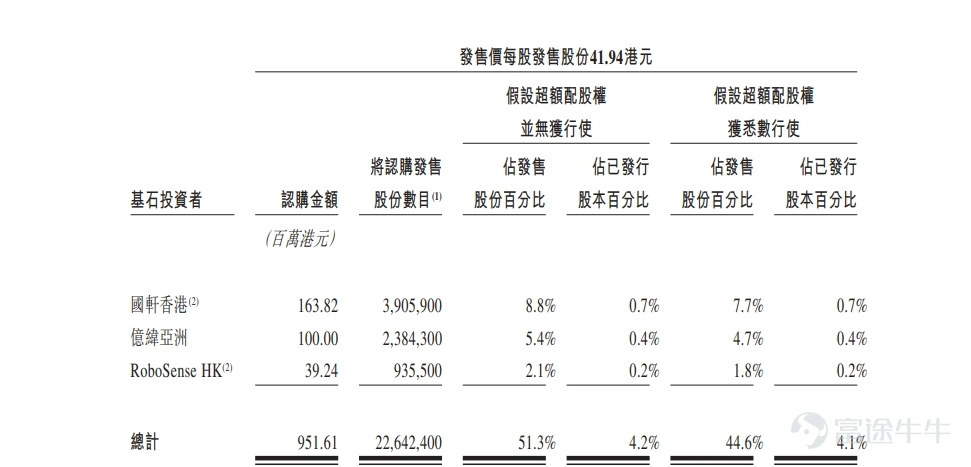

2643 IPO Cornerstone Investors

Cornerstone investors have agreed to subscribe or induce their designated entity to subscribe for the relevant number of shares available for purchase at the offering price, subject to certain conditions, for a total amount of approximately HK$0.952 billion. The cornerstone investors include: Mercedes-Benz, Future Asset Securities, Axiu Capital, Guoxin Hong Kong, Billion Way Asia, RoboSense HK.

Based on the offering price of HK$41.94 per share offered, the total number of shares subscribed for by the cornerstone investor will be 22.6424 million shares, representing approximately 51.3% of the shares sold worldwide and approximately 4.2% of the total issued share capital following the completion of the global offering (assuming no overallotment rights are exercised).

2643 IPO Funding Purposes

In terms of financing, Cao Xiang expects net proceeds from global sales of HK$1.718 billion (assuming no excess dividend rights are exercised at an offer price of HK$41.94). According to the prospectus, Cao Xiang Corporation intends to use the global IPO for the following purposes:

Approximately 19.0% will be used in the next three years to improve the company's automotive solutions and improve the quality of its services; approximately 18.0% will be used in the next three years to upgrade and launch a range of custom cars; approximately 17.0% will be used in the next three years to enhance the company's technology and investment in autonomous driving; approximately 16.0% will be used in the next three years To expand the geographic coverage of the Company; approximately 20.0% will be used to repay some of the principal and interest on certain bank borrowings; approximately 10.0% will be used as working capital and general corporate purposes.

Read more:IPO prospectus for Cao Xiao

New Share Futures, 0 Interest, 0 Handling Fees, 0 Cash Purchase, Fast Track Trading,Come and experience it >>

BecomingFutubull MemberEnjoy up to HKD 100HKD free application fee and redeem store member zone discount!