How will the markets play out after the US stock market is expected to cool down?

HOW TO DEPLOY IN THE EVENT THAT INTEREST RATE CUTS ARE EXPECTED TO FALL IN THE U.S. CANNOT BE SQUEEZED?

(Source: CME)

BELIEVE THAT MANY BULLS KNOW BY NOW THAT THE NEWLY RELEASED US CPI DATA IS HIGHER THAN EXPECTED, CAUSING THE MARKET TO LOWER EXPECTATIONS FOR FURTHER RATE CUTS. ACCORDING TO THE ABOVE CHICAGAS' FEDWATCH RATE FUTURES, THE PROBABILITY OF A RATE CUT IN JUNE HAS BEEN REDUCED TO BELOW 17%, FROM A POST 3 DAYS AGOImpact on U.S. equity market expectationsThe 49% showed signs of a significant decline, and under inflationary pressure, the possibility of interest rate cuts in the near term would vanish.The top three U.S. stock indexesThe more obvious adjustment that emerged last night and how investors should respond is exactly what this article will mention.

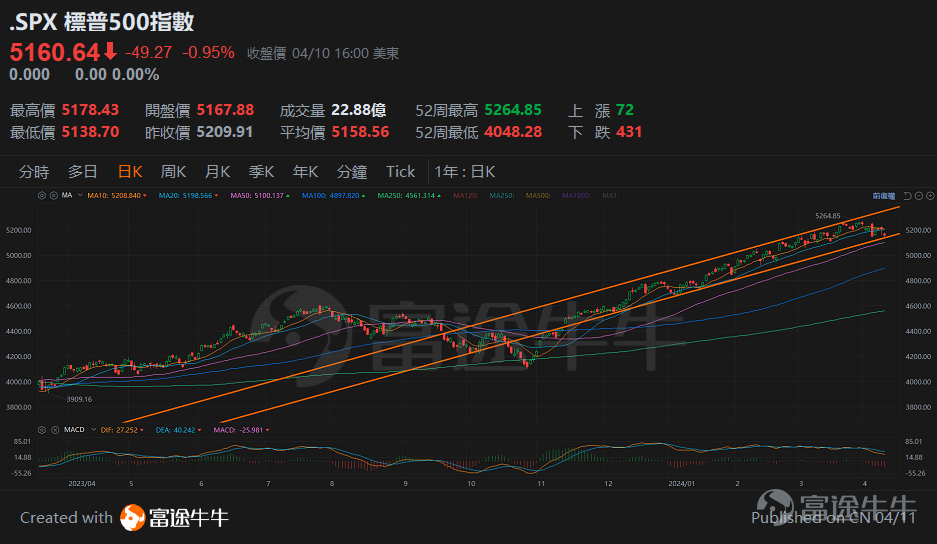

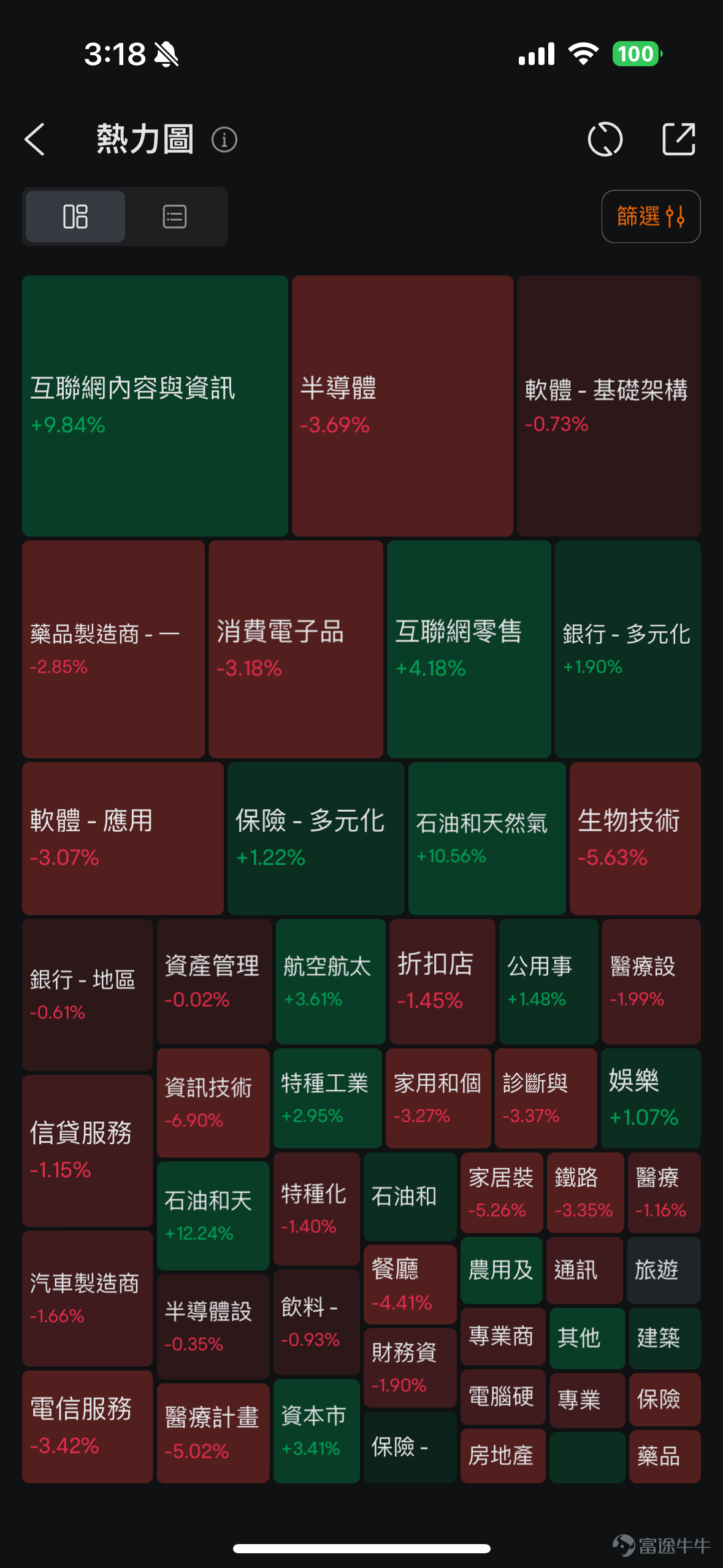

$S&P 500 Index(.SPX.US)$ The chart's upward channel is slightly different from that of April 8, but not significant, reflecting the fact that the index has not broken the upward trend. The main reason behind this is that the rise of US stocks this year is not entirely driven by interest rate cuts, corporate profitability and economic activity are also an important indicator, and recent non-farm gains And the CPI data are showing that the US economy is still strong, so this has not broken the upward trend. However, the expected change in interest rates may strengthen the trend of capital inflows into resource stocks and value stocks, as opposed to some yield-sensitive stocks such as real estate stocks, utilities or high-growth stocksTechnology StocksYou may face some stress. From the heat chart below, the author filters the performance of US stocks over almost 20 trading days to clearly see the difference in the flow of funds

After almost 20 trading days, funds are no longer flowing in unilaterallyTechnology StocksOr Semiconductor-related shares, more information from us at FutubullRun to beat S&P and surpass Inweida? The industry is becoming the new darling of Wall StreetEveryone knows the strength of energy stocks. And coming soonInterest Rate Reduction ExpectedChanges in this momentum will continue in the short term.

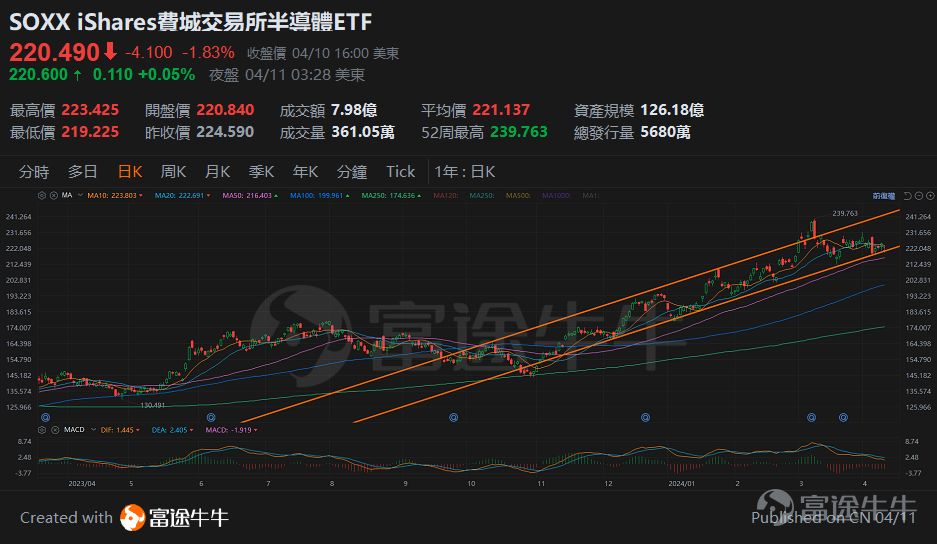

But the author points out that individuals think that the United StatesInterest Rate Reduction ExpectedOne thing you can still see from the above interest rate futures data is that there is still a high probability of a rate cut this year, which is unlikely to be the case in the first half of the year, but with long-term high interest rates, there will also be some high debt issues. In the last two months, interest rate cuts are expected to continue to warm, resulting inU.S. TreasuryThe auction response is getting worse. When economic indicators show they can't handle high interest rates, interest rate cuts are likely to flare up again, while individuals think that some semiconductors are once again offering investment opportunities, investors can also look out for some semiconductor ETFs again.

Finally, some bulls may wonder how to judge whether interest rate cuts are expected to occur again. As mentioned in an article 3 days ago, the greater likelihood will be a weakening of PPI performance or geopolitical factors. The former is unlikely to change too much this month, and the latter is not advisable to speculate wildly. Therefore, US retail sales data and consumer confidence indices due later this month will also be subject to attention, with the performance of economic activity being a major factor in market speculation about changes in interest rates and money options.

Short summary:

Dividend changes aren't the only factor affecting U.S. stocks, but it's encouraging for funds to choose to track stocks in that category.

In the case of high-yielding enterprises ~

Resource stocks will be a stronger segment with strong cash flowTechnology StocksIt will also show resistance to falling.

When the return port reappears ~

SEMICONDUCTOR STOCKS CAN BE SEEN AGAIN, AND GROWTH STOCKS ARE THE FOCUS OF THE MARKET.

(Of course, we believe that this change will not be overnight. Investors who are not very confident in their actions in the rotation of funds should be used firstCash BabyIt's not a bad thing to earn daily interest income, code can be flexible and profitable, wait for the next opportunity)

Last Ad Time

The goal of the future is to make investing easier, and this is the right line that will guide the development of the financial markets. What are the big things that people need to write and read。 If you have any difficulties with investing afterwards,Welcome to the physical store to answer your questions

The market is hot. Ever wanted to know me about the post-market division? You can join Futu's official investment exchange group and interact with me in real time

How to trade with Futu?

Before investing (buying and selling) stocks, you first need to open a securities (stocks) account. Just like depositing money in a bank, you need to open a bank account first.

Securities (Stock) Account Opening Process

Step 1: Head over to the Futubull network and sign up for a new account.(Register now)

Step 2: Open a securities account on the basis of the Futu account.(Open account now)

Step 3: Fill in your personal and financial details (includingBank Code and Account Number), and then deposit funds via EdDA Quick Deposit, Fast Transfer (FPS), Bank Transfer.(Invest immediately)

Step 4: Download the Futubull Customer Portal and log in.(Download now)

>> Futu Securities offers 5x24 hours trading of individual US shares and free LV2 emotions, open your wallet now and enjoy new rewards

>>Resource Source: Futubull Information, Chisao

>> Images are for illustrative purposes only and do not constitute any investment advice or guarantee

The author is a licensee of the Securities and Exchange Commission and its affiliates do not have a financial interest in the proposed issuer of shares mentioned above

Senior Strategist, Futu Securities

Tam Chi Lok