Technical Analysis - From Getting Started to Trading

Technical Analysis Teaching - Use of MACD Indicators

What does MACD mean?

The MACD indicator (Moving Average Convergence/Divergence), known in Chinese as the “Index Smooth Heterogeneous Moving Average”, is known by many as the “King of Technical Indicators”. Under the main chart of many software, the MACD indicator is displayed by default, showing how popular MACD is. Created in the 1970s by the American Gerald Appel, the MACD indicator is a long-standing and widely used technical analysis tool.

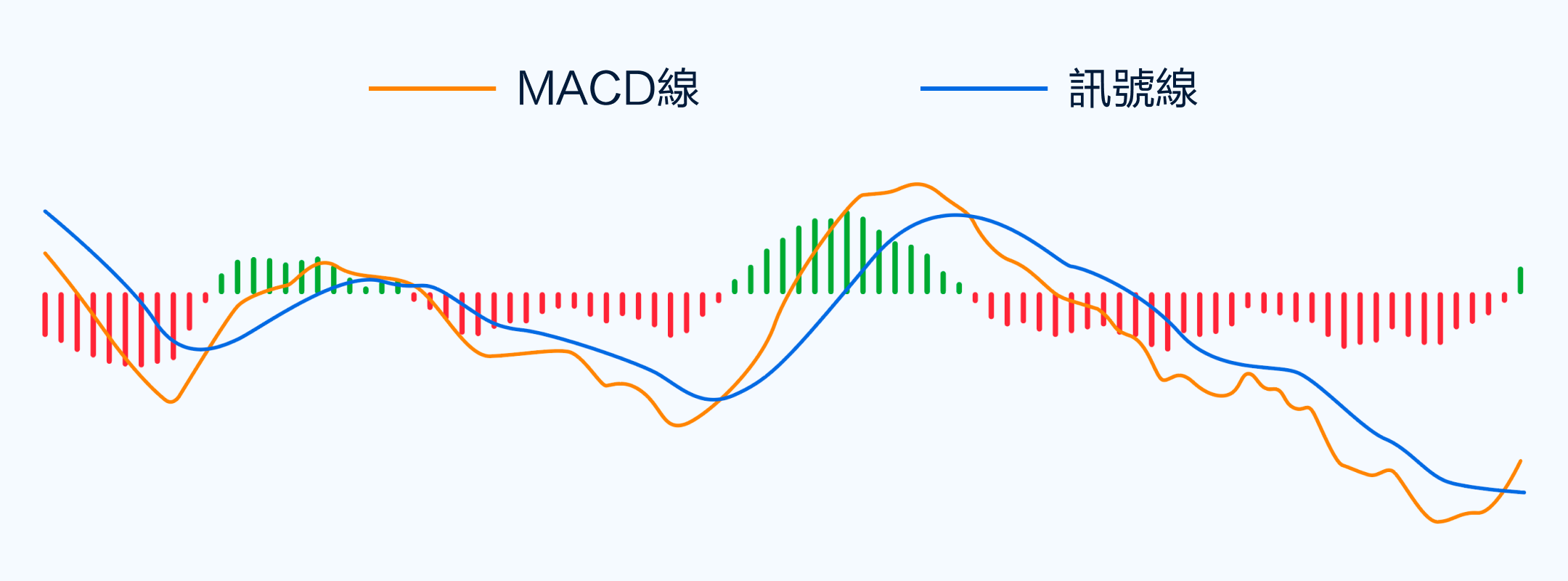

The MACD indicator consists of three key parts: the MACD line, the signal line and the column chart. By analyzing the intersection and divergence of the two indicator lines of the MACD indicator, it helps us to intuitively understand price trends and strength changes.

MACD Parameter Settings

The MACD indicator has three parameters, the default parameters are set to 12 days, 26 days, 9 days. This article contains a few highlights that will bring you together to understand the principles and uses of MACD indicators.

MACD Indicator Principle: How to Calculate MACD Indicator?

The MACD indicator consists of DIF, DEA and MACD histograms in three parts, the calculation formula is as follows:

MACD Line (DIF, Fast Line) =12-Day Moving Average (EMA) - 26-Day Moving Average (EMA)

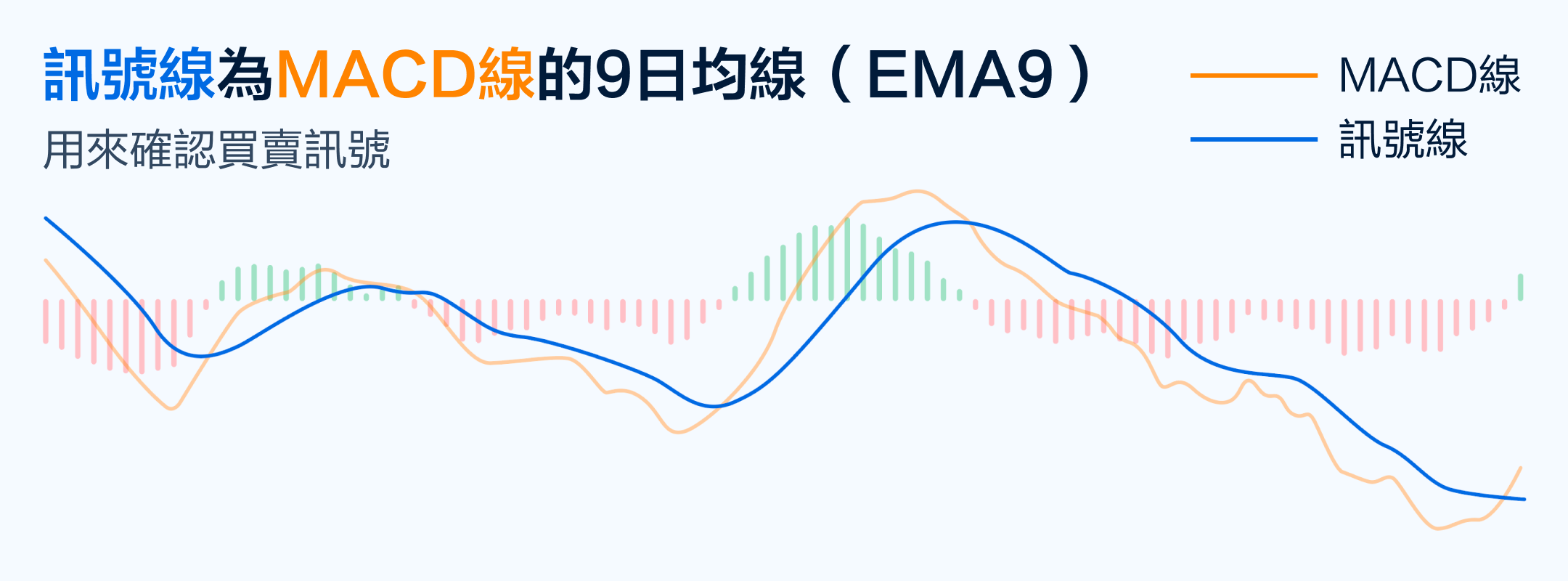

Signal Line (DEA, Slow Line) =9-Day Moving Average (EMA) of MACD Line

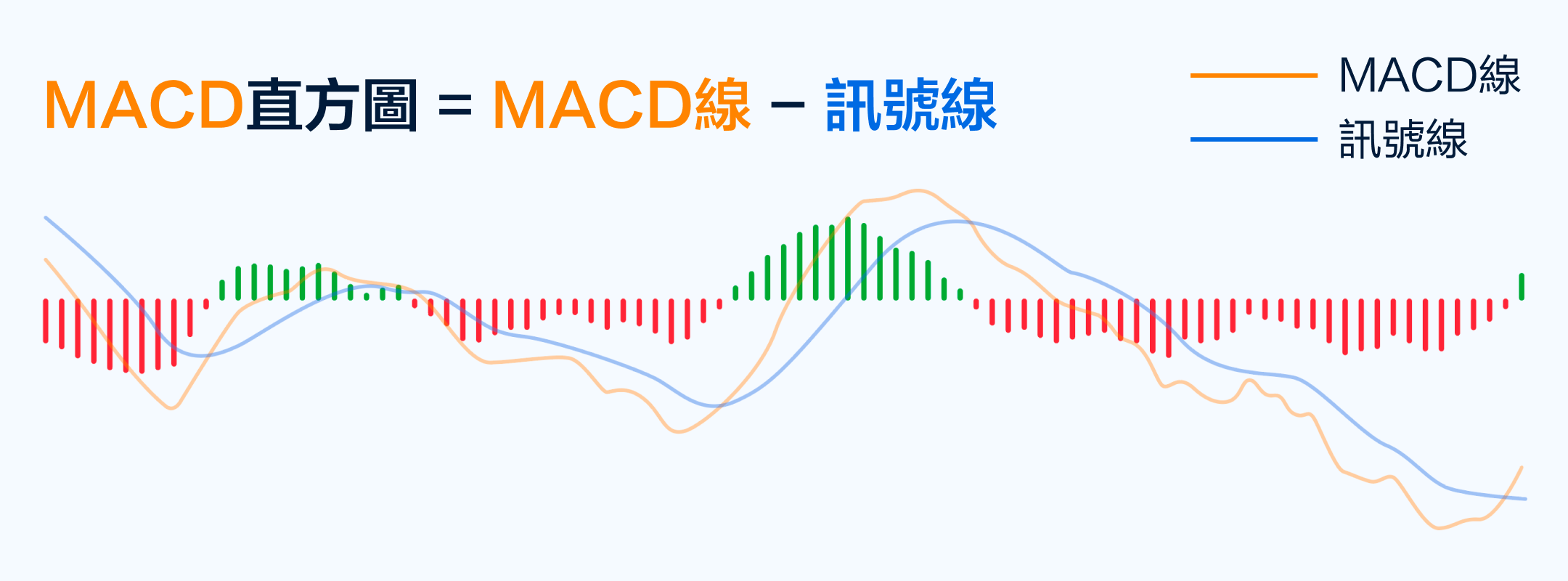

Column Chart (MACD Histogram) = MACD Line - Signal Line

Note that in some Trading Software, the MACD line switches the DIF line and the signal line to the DEA line.

The formula for calculating the MACD indicator is all you need to do is understand the principle behind it. Many stock software will automatically help us calculate and display it, and all we have to do is analyze the MACD indicator.

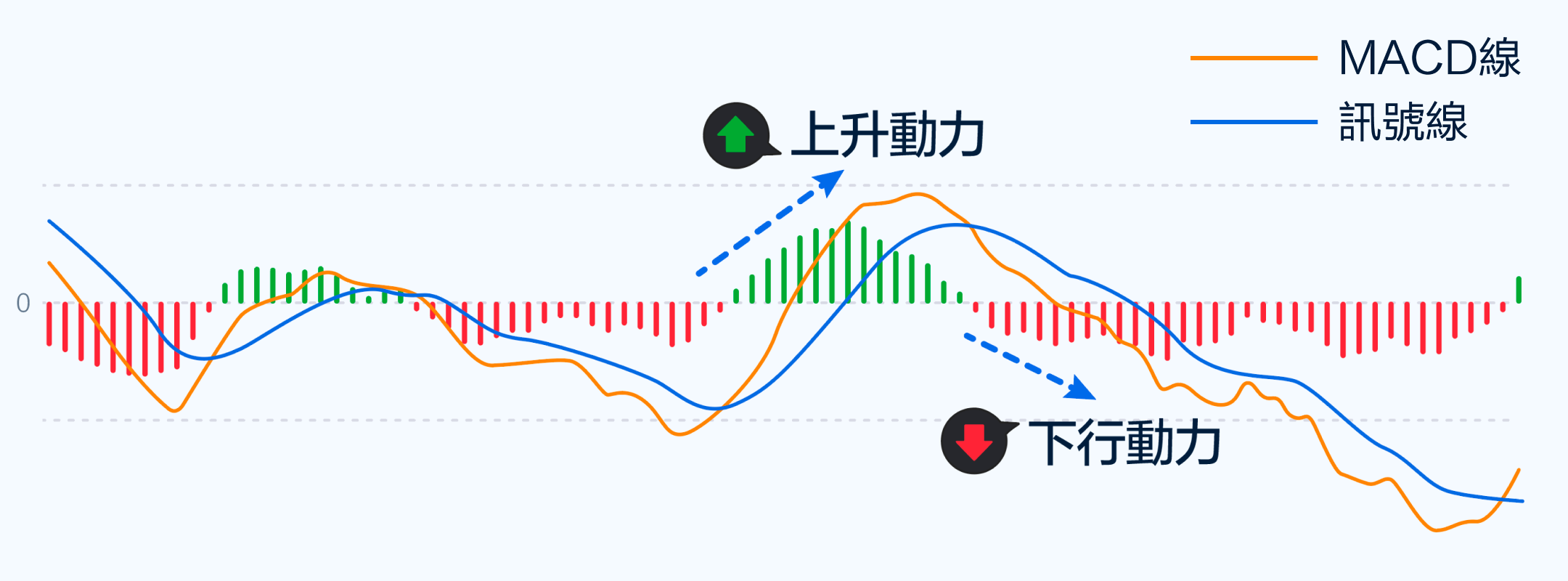

The principle of MACD Indicators is that the average price of a short period (short term EMA) subtracts the average price of a long period (long EMA). The difference obtained is the MACD line (DIF line), which can reflect the upward or downward trend of the market dipping.

On this basis, a further buy and sell signal is generated through a signal line. The signal line is the index average of the MACD line, which is relatively slow to react to stock price movements. It lags behind the MACD line, hence it is also called the “slow line” and the MACD line is the “fast line”. This fast and slow crossing or reversing lines releases potential buy and sell signals.

The column chart is simpler, with its value equal to the fast line minus the slow line, distinguishing positive and negative values in red and green for easy observation. If the column chart is positive (green) and constantly expanding, it indicates a strengthening of the upstream energy; if the column chart is negative (red) and constantly expanding, it indicates a strengthening of the downward energy. Note that some software magnifies its numeric value twice in order to display the column chart more intuitively, i.e., the column chart = (MACD line - signal line) ×2.

What do MACD indicators look like: How to spot buy and sell points with MACD?

The MACD indicator generally has two uses, namely a cross strategy and a backswing strategy.

Cross-strategy

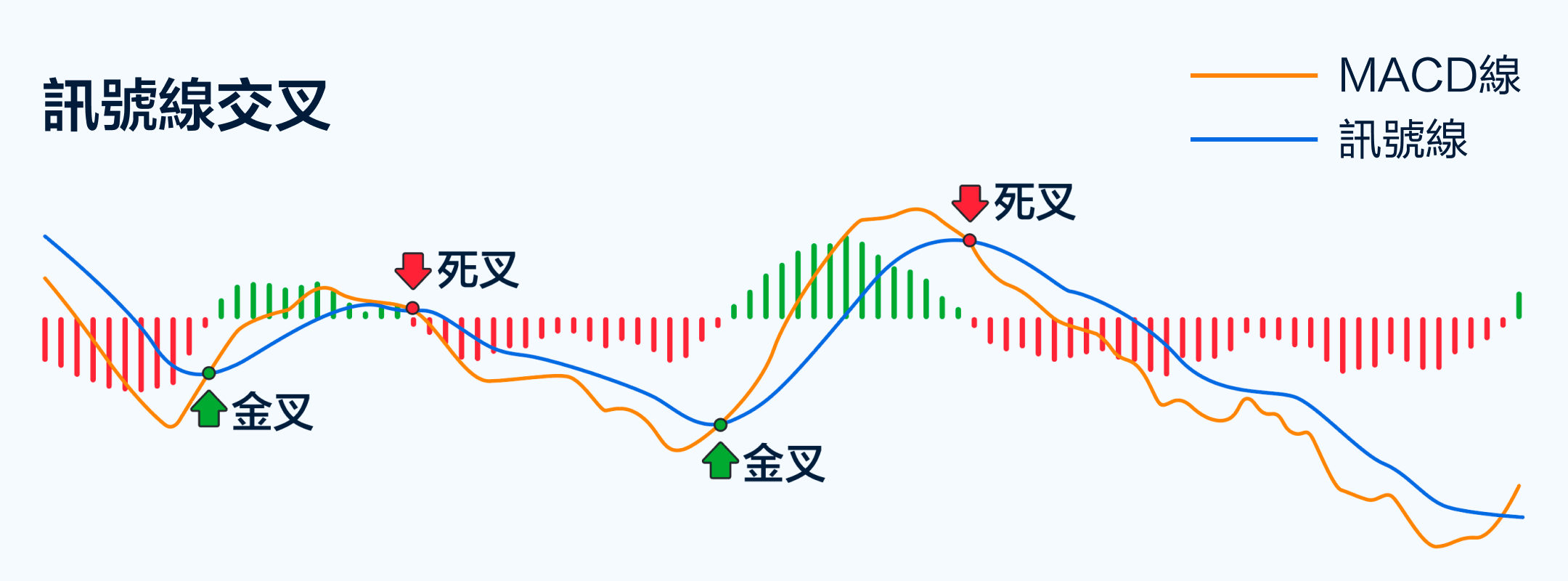

The cross strategy is divided into Gold Cross and Gold Cross Fork, Simple Gold Fork and Long Fork.

Gold Cross

A gold cross (fork) refers to the MACD line crossing the signal line (fast line up through the slow line), at which point the column chart changes to negative and the color changes from red to green, indicating that the movement is changing from weakness to strength, and then there may be a bullish wave, which is a potential buy signal.

Death Cross

A straight line is a signal that the line is moving upwards the MACD line, at which time the column pattern is straight, the color changes from green to red, the expression is a strong trend to a sharp trend, and there may be a wave fall following it, is a downward Sell signal.

It is important to note that the simplest and quickest way to identify a Gold Cross and a Gold Cross is not to look at the fast and oblique line trends, but to see the change in size and color of the pattern. When the column pattern shrinks, and changes from red to green, it is a gold cross fork reversal, when the column pattern shrinks, and when green changes to red, it is a cross junction.

Backlash strategy

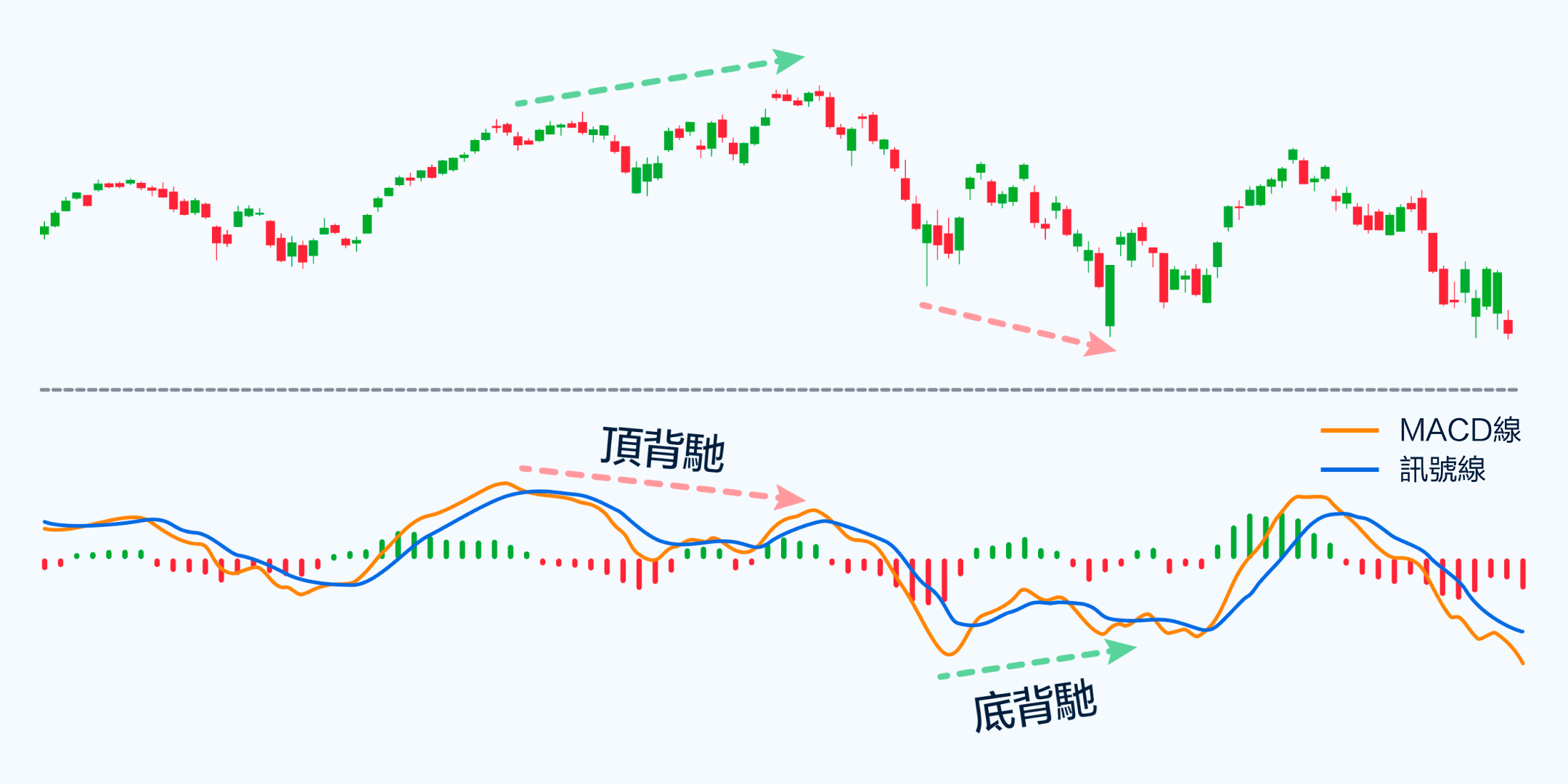

The rear-end Mercedes is strategically divided into rear-end Mercedes and top-back Mercedes, also known as multi-head Mercedes and open-back Mercedes.

Backlash refers to the phenomenon of divergence between technical indicators and price movements. For leading indicators such as the MACD, since their movement is ahead of the price, if the latter take a back, it means that the price may gradually correct in the future, so we find a buy and sell signal from it.

MACD Underside

A bottom-line is a fall from a pre-term low, while the MACD line (fast line moves higher than the preterm low, an uptrend appears immediately, this indicates that the price will move up, or it will move up, is a bullish signal.

MACD TOP BRACKET

The upper back is an indicator that the price rises from the previous high point, while the MACD line moves lower to the previous high, a downtrend appears immediately, which indicates the price or will move upwards, is a sell signal that is on the downside.

What to see MACD: How to see MACD indicators through Futubull?

Step 1: Go online to Futu and sign up for a new account.(Register now)

Step 2: Open a securities account on the basis of the Futu account.(Open an account now)

Step 3: It is very convenient to view the MACD Indicators of the MACD Trade classes of Hong Kong Stocks, Stocks and other Apps in the Futubull App.

First, go to a stock trading page, where you can see a series of technical indicators below the Yinyang candlestick chart, click on the MACD indicator to activate the display, and click again to hide and not show.

2. If you need to modify the parameters of the MACD indicator, you can go to the indicators management page to set the indicator.

3. On the Indicators Setup page, you can add more system-supported technical analysis indicators. We click on the MACD Indicators to see how many customizations can be made.

4. It can be seen that the system supports modifying the parameters of the MACD indicator and setting the color of the indicator line and column chart. The default parameters for MACD are 12, 26, 9, and in general no modification is required.

MACD Indicators Usage: MACD Indicators FAQ

The MACD indicator is very useful, but it is easy for some beginners to generate cognitive and use error zones. Here you can easily brush up on MACD related issues.

How is the MACD different from the moving average (MA)?

The MACD is called the Index Smooth Heterogeneous Moving Average in Chinese, and there is some overlap with the name of the moving average (MA), which is confusing to some.

Simply put, MACD is an upgraded version of MA. MACD has the following advantages over MA:

First, MA generally refers to the simple moving average (SMA), while MACD uses the index moving average (EMA), the calculation method of EMA is slightly more complex than the SMA, equivalent to an improved SMA.

Second, the MACD is calculated from the divergence of two EMAs, which reflects changes in trend and intensity, a feature that a single MA does not have.

Thirdly, MA is the main chart indicator, which is superimposed above the Yinyang candlestick chart, while the MACD is a sub-chart indicator, generally displayed in a separate window below the Yinyang candlestick chart. It does not overlap with other indicators, causing the Yinyang candlestick to appear bloated.

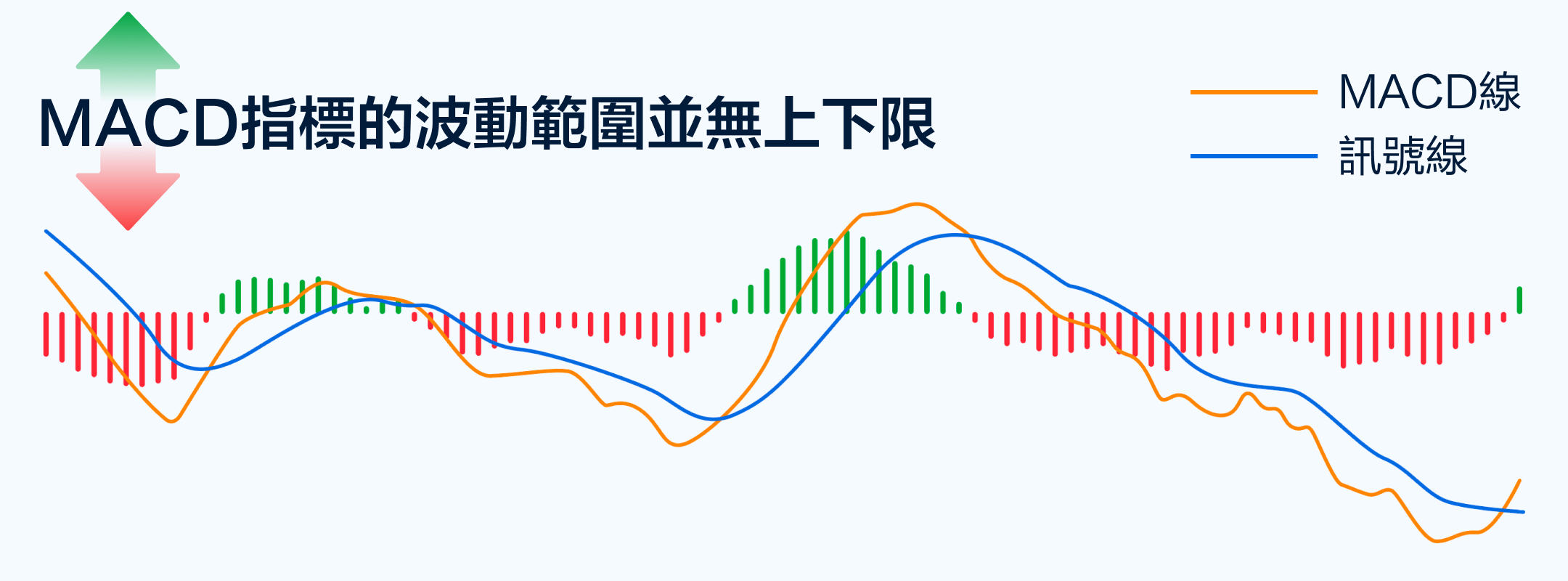

Can MACD be used to assess overbought and oversold?

Over-selling refers to an imbalance of buying and selling power in the short term, which leads to excessive rise/fall in price, so that the opposite trend may occur in the future.

Many energy indicators can be used to assess the overbought and oversold of a security, such as the Random Indicator (KDJ), Relative Weak Indicator (RSI), and more. Some people mistakenly also use the MACD to assess overbought and oversold, but this approach is not appropriate. Since the MACD indicator theoretically has no boundaries, it is difficult to say that when the MACD exceeds a certain limit, it will mean that the movement may reverse.

A more appropriate approach is to pair the MACD indicator with some overbought and oversold indicators. If the MACD releases the same buy and sell signals at the same time as other technical indicators, investors can have a greater grip when making trading decisions.