1. Introduction

Futures correlation is a statistical indicator calculated based on the degree to which the price trends of two futures are linearly related. It is used to show the degree of correlation between two futures.

2. Entrance

2.1 Mobile Phone

Detailed Quotes - Analyses - Correlation;

2.2 Desktop

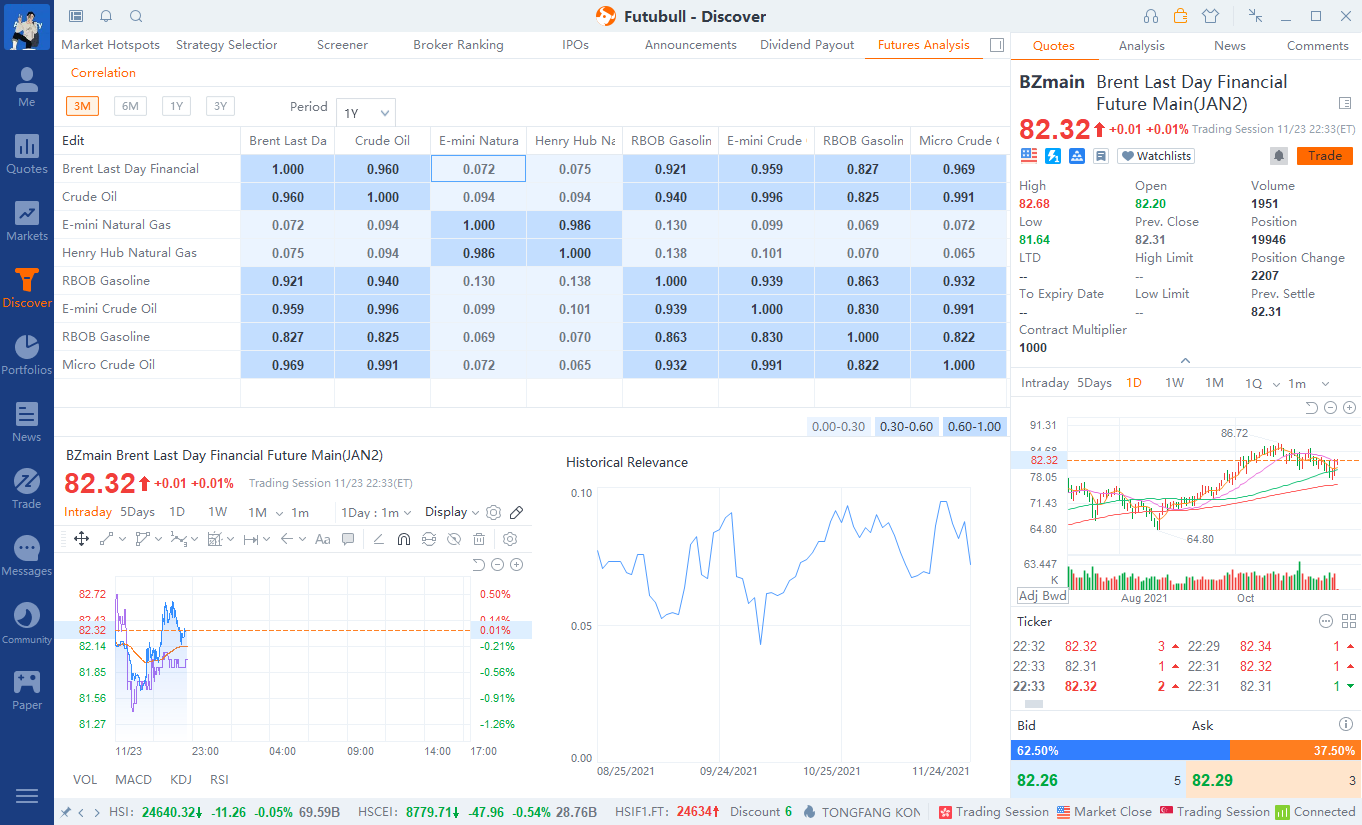

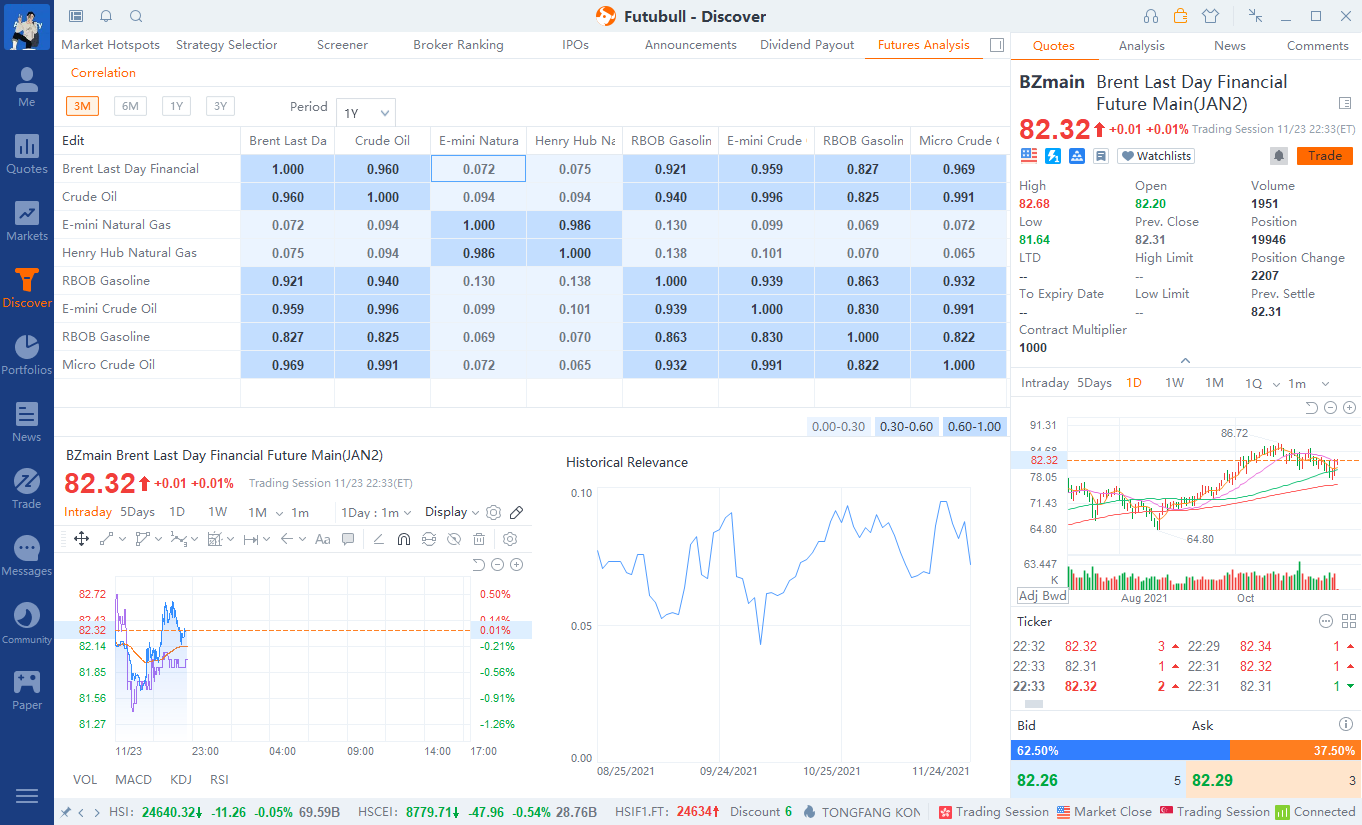

● First entrance: Futures - Analysis - Correlation

● Second entrance: Discover - Futures Analysis

3. How to Apply

3.1 Correlation Coefficient

The value of the correlation coefficient ranges between 1 and -1. It is a general indicator of the strength of the linear relationship between two variables.

The value of the coefficient indicates whether the variables move in the same or opposite directions. When the two variables move in the same direction, the value is positive. In contrast, when two variable move in opposite directions, the correlation coefficient is negative.

The absolute value of a correlation coefficient tells the magnitude of the correlation: the larger the absolute value, the stronger the correlation.

3.2 Correlation Law

There are two circumstances that futures could be correlated:

● Belong to the same class. For example, copper, aluminum and zinc are different types of metals. Even if the aluminum industry is booming, the sudden bearish news of copper could lead to the price decline of aluminum.

● Stock markets at home and abroad interacts with each other. Changes in the global futures markets will affect the price trends of domestic futures.

Futures correlation contributes to the increase of risks and uncertainties in futures markets. When evaluating a specific futures, it is necessary to take the correlated ones into account. Investors could make use of the correlation coefficient to exploit the arbitrage opportunity in futures markets. For example, one may go long on a specific futures and short on another futures in domestic or overseas markets to lock in profits. The trading strategy could lower the risks of investing.