How to get passive income? 2026 Ways to Increase Passive Income in Hong Kong

What is Passive Income?

Passive income means that income can be earned continuously by not engaging directly with work, providing services, or exchanging time and movement. While it does not mean that you have a complete lack of work or energy, it is common to invest a certain amount of time and resources in the early stages to create and manage the corresponding Investments or Assets. The advantage of passive income is that it is possible to create a stable income for the individual without using it to generate income through mobile time. The change allows people to spend more time and space to do what they want, while helping to achieve financial freedom.

Generally, the products that generate cash flow include: Bank term deposits, hedge currencies, bonds and bond fund funds, gilt gold, and other products such as FUTUs, the main investment government short-term cash portfolio. Banks, Bonds, and Bank Bank's highly secure fixed-term deposit equivalent currency MMF tool is suitable for you with relatively stable passive income.

If you want a steady passive income, Futu Cash is one of the options to consider.

Get Passive Income Method 1 - Regular Deposits

Regular DepositIt is a financial product, usually provided by banks, and supports different currencies such as HKD and USD. It is a method of saving money by depositing your money into a fixed term account opened by the Bank, and at a specific time (called a deposit term or an inactive loan, usually a deposit period of 7 days, 1 month, 3 months, 6 months, 1 year), depending on your needs. From this point on, the deposit amount will receive an agreed interest. Once the deposit period is complete, you will be able to get back the cash and interest earned.

However, there will be a lack of cash flow during the period of time, and those who wish to withdraw in advance may lose interest due to the need to pay cash or recurring fees. Fixed-term deposits are a safe investment method, and the Hong Kong Deposit Insurance Scheme provides security of up to HK$0.8 million for each depositor's funds in each Member Bank.

But it should be noted that deposit rates can be affected by inflation and other economic factors that may not fully offset the depreciation of funds brought about by inflation.

To summarize: Regular deposits have the following advantages

Fixed Rate: Time deposits usually offer a fixed interest rate, which means you can determine your return over the term of your deposit. This helps you make accurate financial planning and know how much interest you will get.

Safe and free: Term deposits are a simple and easy financial product. All you need to do is deposit money into the Bank, agree on the deposit term and interest rate, but after waiting for the deposit period, you can immediately withdraw the money and interest, without leaving the market for a long time.

Low Risk: For other investment choices, such as Stocks or Bonds, term deposits are a low-risk savings method. Your deposit amount is usually covered by a deposit insurance plan, which means that the Bank loses money, and deposits of 0.5 million or less can be protected.

But there are also certain limitations to regular deposits:

Low liquidity: Due to the nature of regular deposits, your funds are fixed for the duration of the deposit and cannot be accessed at any time unless a penalty or processing fee is paid. If you have the opportunity to use these funds in the short term or need to move these funds urgently, a regular deposit may not be the best option.

Minimum Deposit: The Bank's general term deposit cities have a minimum deposit requirement. Currently, the minimum deposit amount is HK$10,000. If you want to get a higher return, the minimum deposit requirement will be higher. A fake bank may not set minimum deposit requirements.

Inflation risk: Fixed interest rates over the term of the deposit may not fully offset the effects of inflation. If the inflation rate is higher than the rate on a fixed deposit, the actual purchasing power of your funds may decrease.

How to Obtain Passive Income 2-Futu Cash

Futu Cash TreasureLive your life and make a difference in your money. Cash is the name of the money market funds brand of futu money funds, the brand name of the money market funds under the jewelry brand, the money funds under the money commodity brand moneymarketfunds Main investments in government short-term money market funds Major investments in government short-term bonds Bonds, bonds, banks Fixed term deposit collateral The higher the security of the MMF currency instrument, the higher the duration of the investment period and the higher the stability, are suitable for all types of investors, such as hedge investors.

Futu Cash Benefit

Low Threshold: Orders as low as HK$0.01 can be purchased even with $100.

High Flexibility: You can Trade at any time according to your cash flow needs, Buy or withdraw money at any time.

Intentional and stable returns: Average return of USD money market funds 4.5*+5% opening bonus^

0Application Fees: All Funds are exempt from application fees, the net account value discount is the real benefit of the investment after the management fee is eliminated.

Set up automatic cashback mechanism: Futu Cash Set up automatic application function to automatically buy cash from your securities account after daily market collection into money funds moneymarketfunds at the same time as money market funds MoneymarketfundsAsset assetsAsset assetsThe power to buy securities can be directly applied to money market funds Asset Assets will be able to purchase securities directly for Stock Stocks trading, to purchase new shares (without financial interest), to purchase securities directly to Stock trades, to buy new shares (without financial assets), to buy new shares (without financial assets), to buy new shares (without financial assets) If you purchase new shares (without financial capital), MoneyMarketFunds will generate funds in Buy Non-money Funds MoneyMarketFunds Account AccountAutomatic RedemptionSame-market money market funds can be refunded without the need for manual refunds.

Funds in the MMF are highly secure, but are now subject to extreme conditions, such as a ban on short-term ticket purchases by fund companies, a sharp rise in interest rates causing a storm in the price of bonds and a return of market volatility, resulting in losses for investors.

How to Obtain Passive Income3-Investing in Bonds

BondsIt is the issuer of a financial ticket issued in connection with pooled funds, which undertakes to pay interest at the fixed interest rate at a specified time, and to return the funds on the due date. As an investment tool with a long history, Bonds have long been appreciated by different types of investors due to their fixed payment and due return. Sovereign Bonds issued by a country or government with a higher security rating are particularly important. As investors in Hong Kong, the most easily accessible bonds are Treasuries issued by the US government.

U.S. Treasury Bonds, also known as U.S. Treasury BondsIt is a long-term debt tool issued by the US government to coordinate to support other operations and settle debts. These Treasuries are primarily issued by a wide range of investors including large Institutions and individual investors, and enjoy high circulation and confidence in the global financial markets. Due to their stability and safety characteristics, US Treasuries are often considered to be one of the preferred investment tools in risk management strategy. Provided by FutuU.S. DEBT OF DIFFERENT MATURITIESTo meet investors' goal of obtaining stable dividends.

What are the benefits of buying US bonds?

Security: Because US bonds are issued by the US government, they are essentially protected by their credibility and ability to repay their debts.

Fixed Report:This is why US bonds are generally considered to be non-negotiable bonds, which are known as one of the safest investment tools in the world.

HIGHER LIQUIDITY: US DEBT PROVIDES FIXED RETURNS TO INVESTORS, SO INVESTORS CAN EARN STABLE INTEREST INCOME AFTER BUYING US BONDS.

Balance sheet risk: Relative to other types of bonds, the US bond has a high liquidity. Purchasing high-risk products at the same time as buying US bonds can lead to balancing risks and returns.

What are the risks of buying US bonds?

However, although the risk of default on US bonds is lower, we do not rule out the possibility of it happening. In addition to this, there are:

Interest Rate Risk: The price of bonds and the interest rate are inverted. The real interest rate is low, the price of bonds will move higher, the interest rate will be high, the price of bonds will be low, the investors will be inclined to deposit their money in the Bank, the absorption capacity of bonds will decrease, as a result of the decline in the market price, investors who have entered the bonds or will make losses.

Exchange Rate Risk: If you buy bonds abroad, you will be exposed to exchange rate risks.

How to Obtain Passive Income 4 - Dividend Stock Portfolio

For those who lose active income after retirement, a stable passive income can provide you with ample cash flow to help support your retirement life! And investing in stocks with relatively stable yields or is one option for you to increase passive income. Today we will introduce you to Hong Kong stock dividend stocks and US equities dividend stocks.

Hong Kong Stock Dividend Portfolio

SENIOR STOCK COMMENTATOR KNOWN AS “UNCLE LU”Yong Lu ChenThe theme of Futu Investment's investment strategy sharing in March 2025: Analysis of Hong Kong's stock market, the share loss value will be taken into account in the reporting period When considering the outlook for the company, it will be possible to obtain as little information as possible, and the company has no shares repurchased and will continue to operate. Buying income shares should look at the long lines, be calculated and the investment portfolio should be considered It shows that a large part of their own wealth is derived from self-income.

We can also choose to invest in some excellentHong Kong Stocks High Yield SharesIncrease your passive income as an enabler.

U.S. Stock Dividend Portfolio

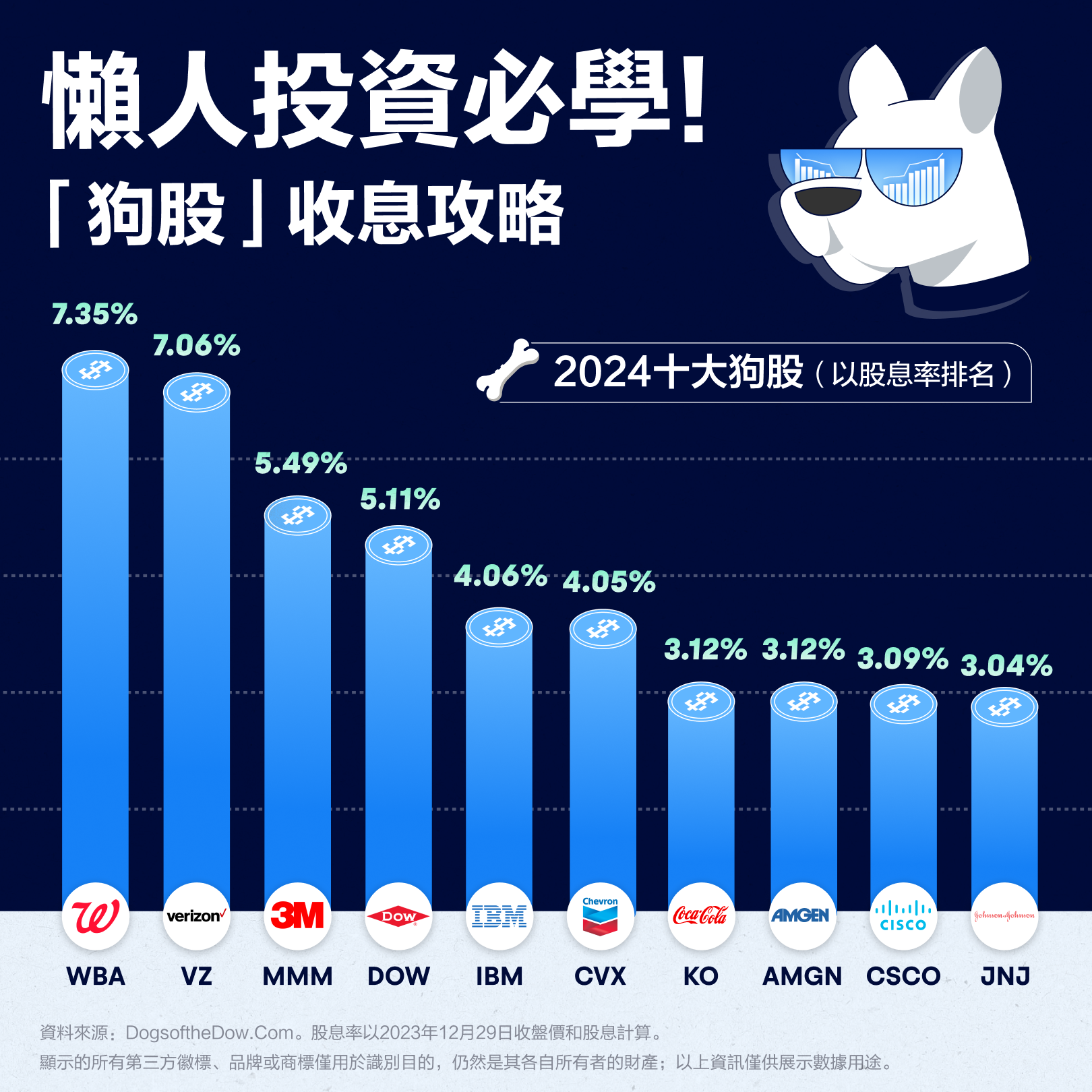

“Dao Dog Stock” is a kind ofUS Equity Income SharesThe investment strategy, developed by Michael B. O. Higgins in 1991, focuses on investors seeking dividend income. This strategy works in three ways: Choose the Stocks with the highest dividend yield from the Dow Jones Industrial Average, buy at the beginning of each year and sell at the end of the year.

In 2022, when the stock market is not performing well, the combination of the channel index strategy showed a bright appearance, with the stock index rising by 2.2%, while the Dow Jones Industrial Average fell 8.8% and the S&P 500 and NASDAQ fell by more than 10%. This shows that when the market is volatile, the portfolio of investments that seek dividend income can be a safe haven for investors.

The strategy is suitable for investors with low risk underwriting and a stable dividend income with the expectation of a certain capital gain in the long run. However, hearing becomes stable, without the possibility of loss, for example, stopping the party at any time and informing about the price.