What are index options

Index options are a type of product where the underlying asset is an index, rather than a specific stock or commodity. They are a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell an underlying index at a specified price on or before a certain date.

Each region or country may have their own types of index options available for trade, but the following information is for index options in the US market.

1. Contract terms

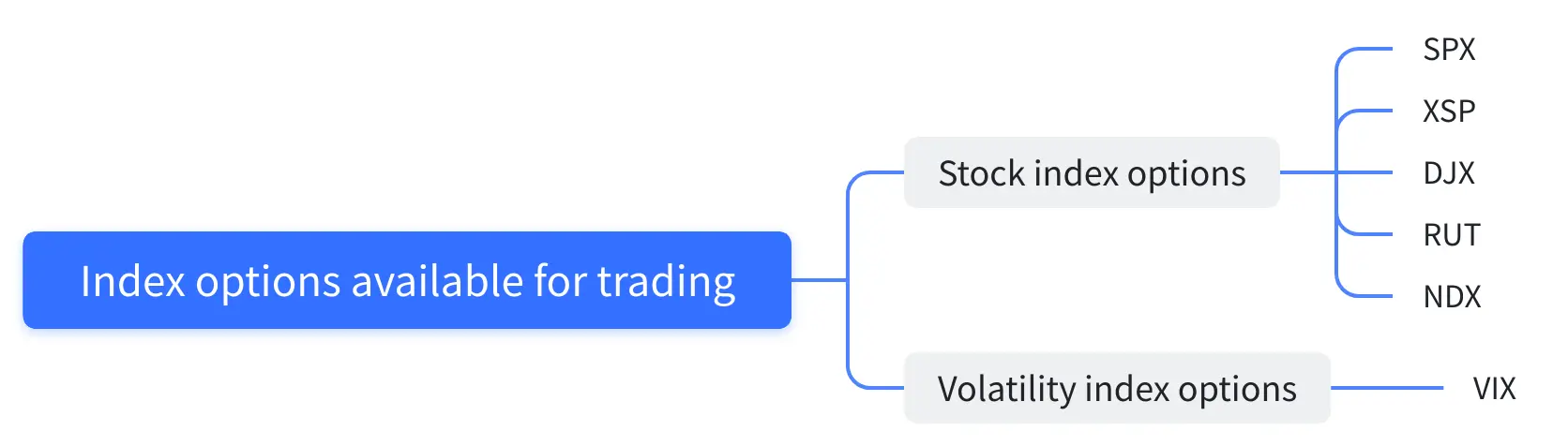

Index options are a type of derivatives product where the underlying asset is an index, rather than a specific stock or commodity. Functionally, they operate similarly to stock options, except that the asset being traded is the price index for a particular market. Depending on the type of price index being traded, these options can be categorized into stock index options and volatility index options.

FUTU currently supports trading US index options including SPX (S&P 500 Index), VIX (CBOE Volatility Index), XSP (Mini S&P 500 Index), DJX (1/100 Dow Jones Industrial Average Index), RUT (Russell 2000 Index), and NDX (Nasdaq 100 Index). More index options will be available soon.

SPX, VIX, XSP, DJX, and RUT are exclusively traded at the Chicago Board Options Exchange (CBOE), while NDX is traded at the Nasdaq GEMX, ISE, and PHLX. All the aforementioned index options are cleared by the Options Clearing Corporation (OCC).

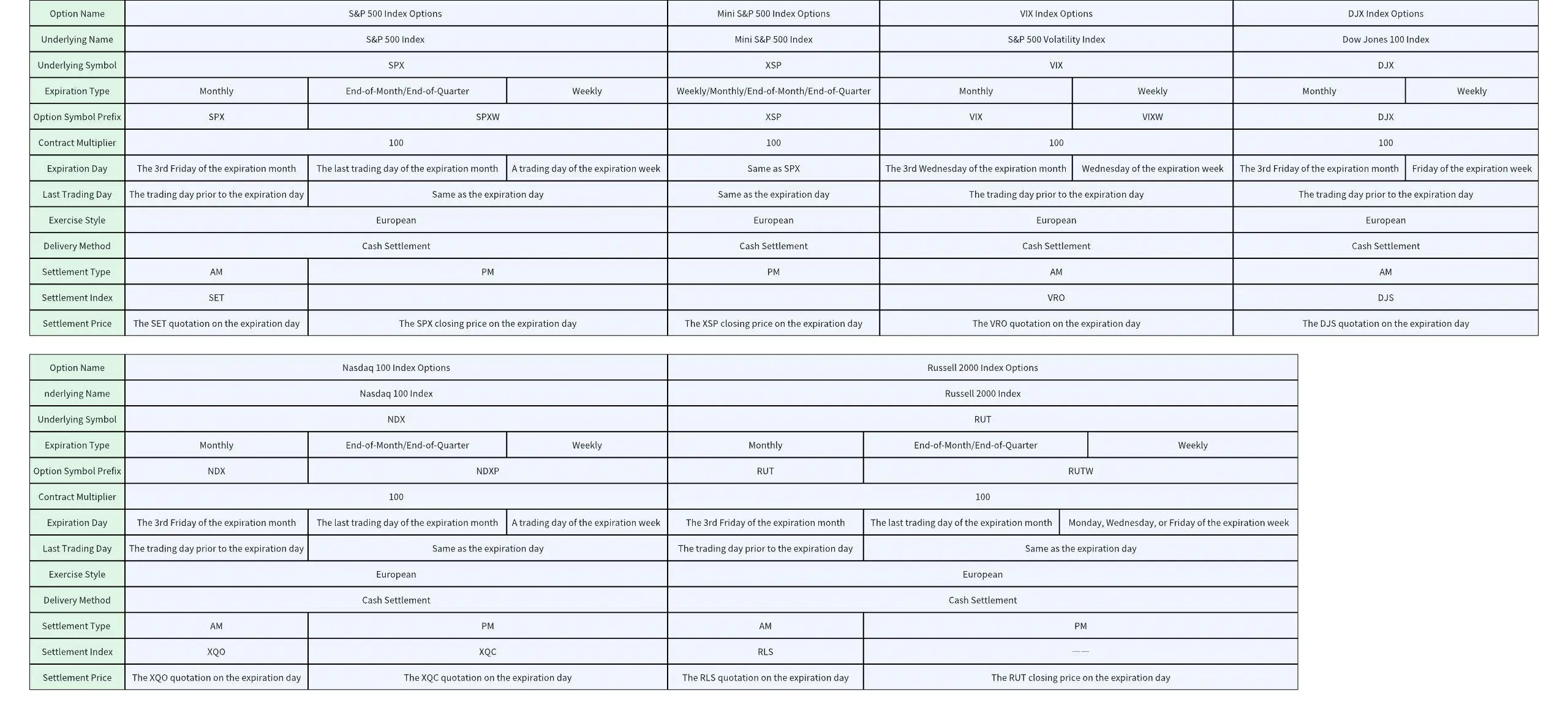

The core contract terms of the index options are as follows:

2. Index options vs stock options

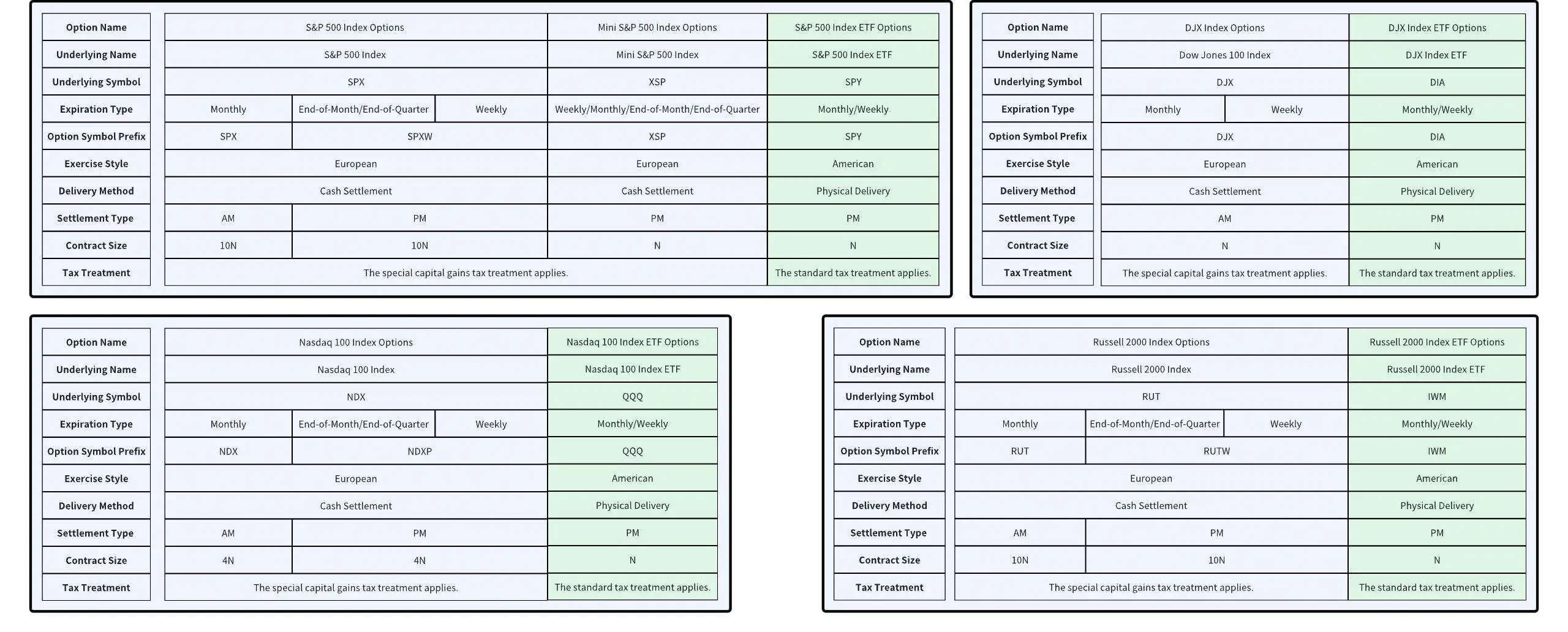

Index options and ETF options are available for various stock indices in the US market. Index options and ETF options are types of derivative products with exposure to a broad market, sector, or industry.

Consider the following attributes below for how index options differ from individual stock options and ETF options.

2.1 Exercise style: American vs European

Individual stock options and ETF options are typically American-style options, while the majority of index options are European-style. Unlike American-style options, European-style options do not allow for early exercise or assignment.

FUTU currently only supports trading European-style US index options.

2.2 Delivery method: Physical delivery vs cash settlement

For individual stock options, the delivery method is physical delivery. By comparison, the delivery method for index options is cash settlement, as they are non-tradable. Cash settlement does not involve the transfer of underlying assets. Instead, it calculates the contract value after option exercise based on the strike and settlement price.

Example

Suppose the strike price for an SPX index call option is $4,420:

● If its settlement price upon expiration is $4,432, the settlement value of the option: ($4,432 – $4,420) * 100 = $1,200.

● If its settlement price upon expiration is $4,418, the settlement value of the option will be $0.

Note: “100” is the contract multiplier.

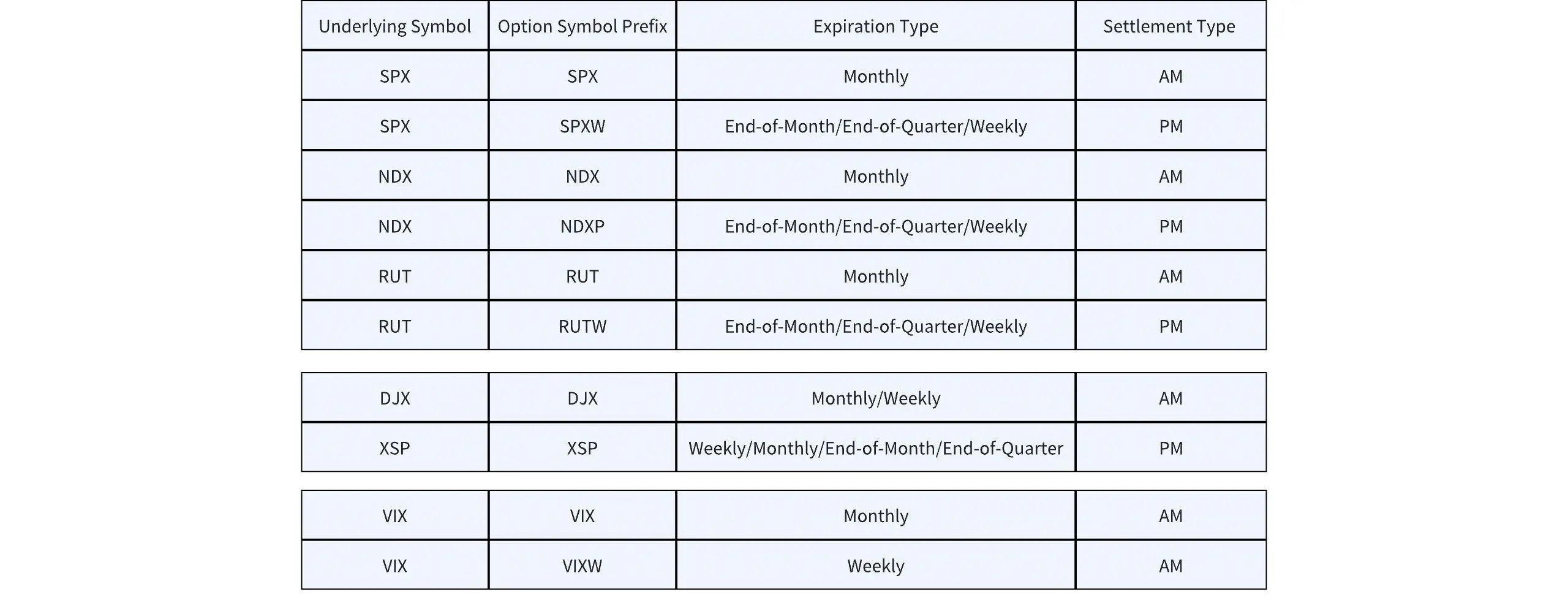

2.3 Settlement Type: AM vs PM

● AM-settled options:

○ The last trading day is usually the trading day prior to the expiration date.

○ The settlement price is calculated based on the opening price of the underlying index on the expiration date and is subject to the settlement index.

● PM-settled options:

○ The last trading day is the same as the expiration date.

○ The settlement price is calculated based on the closing price of the underlying index on the expiration date.

All individual stock options are PM-settled options, whereas there are either AM-settled or PM-settled index options.

Note: The settlement index is calculated based on the actual prices of the underlying assets of the contract at a specific time during the trading day. The final settlement price may differ from the closing price of the underlying asset.

2.4 Contract size

An option's contract size is based on the contract multiplier and the strike price. Usually, the contract size of index options is larger than that of its corresponding ETF option. For example, the contract size of an SPX index option is about 10 times that of the SPY index ETF options.

Contract size = Multiplier * Strike Price