Futu Research | ETF Investment Research

【Japan ETF】Which Japanese Stock Market ETFs are available to invest directly in the Japanese Stock Market?

Due to the outstanding performance of the market, the Japanese stock market has recently attracted the attention of investors around the world. In previous articles, we have shared someJapanese ETFs in Hong Kong stocks and US stocksFor everyone to make an investment decision.

As mentioned above, there are many advantages to trading TradeFund Funds (ETFs) using Exchange Traded Funds (ETFs):

Extremely high liquidity: Investors can trade ETFs as easily as trading stocks at any time of the trading day, enabling flexibility and timeliness of asset allocation.

Lower management fees: Significant cost savings compared to actively managed funds, which contributes to the accumulation of long-term investment returns.

Dispersion: Effectively disperse the risks associated with a single security by replicating a single indicator or Global Sectors.

Greater Transparency: Investors can understand the configuration of other underlying Assets so that it is easy to manage and monitor the performance of investment portfolios.

Therefore, ETFs are an indispensable or missing part of the construction of Xiandai Investment Combinations, regardless of whether Individual Investors are Institutional Investors, and are a thinking tool for realizing investment objectives and risk management. But Japan does not have Japanese land that can be purchased directly on the Japan ExchangeETF。 This makes it convenient to have a reserve of trading tools when holding yen in your own hands or earning yen for long-term investments. Please follow the introduction below to find out more ~

What are the Japan ETFs (which track the performance of the Japanese stock market)?

How many Japanese ETFs can directly connect investors to the Japanese stock market? In the investment chart of the Japanese stock market, investors can trade TradeFund Funds (ETFs) with this convenient tool to effectively track and monitor the performance of the Japanese stock market. Below are three market-equivalent direct-tracking ETFs, each with different market fundamentals that provide investors with a wide range of market insights and investment strategies.

1306 NEXT FUNDS TOPIX ETF

1306($NEXT FUNDS TOPIX ETF(1306.JP)$) TRACK THE PERFORMANCE OF THE TOPIX INDEX. The assets are 23.46 trillion yen, with a turnover of about 2 million in March.

THE INVESTMENT OBJECTIVE OF THIS ETF IS TO TRACK THE PERFORMANCE OF THE JAPANESE STOCK MARKET, ESPECIALLY THE TOPIX INDEX, PROVIDING INVESTORS WITH EXTENSIVE EXPOSURE TO THE JAPANESE STOCK MARKET. The ETF's portfolio consists mainly of Japanese stocks, including TOPIX index constituents. THE TOPIX INDEX IS ONE OF THE MAJOR INDICES OF THE JAPANESE STOCK MARKET, COMPRISING SHARES OF APPROXIMATELY 2000 LISTED COMPANIES IN JAPAN, COVERING VARIOUS INDUSTRIES AND SECTORS. IT IS ONE OF THE LARGEST ETFS ON THE JAPANESE MARKET. The ETF seeks long-term stable capital gains by investing in these stocks.

1321 NEXT FUNDS Nikkei 225 ETF

1321 ($NEXT FUNDS Nikkei 225 ETF(1321.JP)$) Assets measured at ¥11 trillion, with an average volume of about 0.4 million in March, showing 225 indicators on the following day. The Nikkei 225 Index is another major index of the Japanese stock market, including the shares of 225 listed companies in Japan. Relative to the assets of TOPIX, the Nikkei 225 Index Industry Index is higher, the Average Blue Index is higher, the Average Blue Index is higher, and the Average Blue Index, while the Asset Assets Standard and the Asset Model and Volume Volume are correspondingly lower.

1599 iFreeETF JPX-Nikkei400

1599($iFreeETF JPX-Nikkei400(1599.JP)$) The ETF has an asset size of about ¥459 billion, with a trading volume of about 1000 units as of March. It tracks the JPX-Nikkei 400 index, which selects 400 companies with higher management and profitability listed on Japanese exchanges. The index's component screening mechanism, in addition to considering market capitalization, emphasizes the quality of business management and financial stability of the enterprise, including but not limited to indicators such as profitability, shareholder returns, corporate transparency, and board structure.

What are Japan ETFs (tracking global markets)?

Faced with an increasingly globalized financial market, Japanese investors can also reach a wide swath of international markets through ETF products issued locally in Japan. The following three ETF products target the performance of U.S. equity markets, Chinese tech startups and global equity markets, opening the door for investors to invest across borders. ETFs issued in Japan that track global market performance:

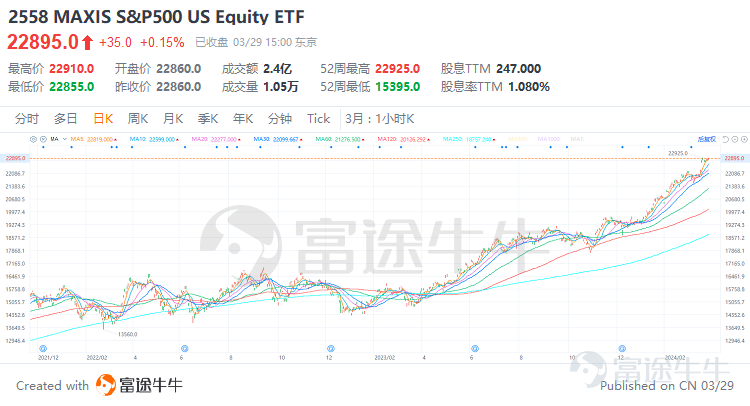

2588 MAXIS S&P500 US Equity ETF

2588($MAXIS S&P500 US Equity ETF(2558.JP)$It is an ETF that represents the management of Mitsubishi Financial Group in Japan. ETF's investment objective is to track the performance of the US Stock Market, similar to the performance of the S&P 500 Index, to provide investors with opportunities for the US stock market. ETF Assets are valued at ¥55.9 billion, with an average Volume of 0.03 million as of March, and decreased by 58% year-to-date in 2023.

2628 iFreeETF China STAR500

The China STAR50 Index selected 50 listed companies in the China Science Board. 2628 ($iFreeETF China STAR50(2628.JP)$) The ETF tracks the performance of Chinese start-ups and aims to enable investors to engage with the most innovative and growth potential technology companies in China through a single fund product. The ETF had a trading volume of 2000 units and an asset size of about ¥0.393 billion as of March, and is a small range ETF listed in Japan.

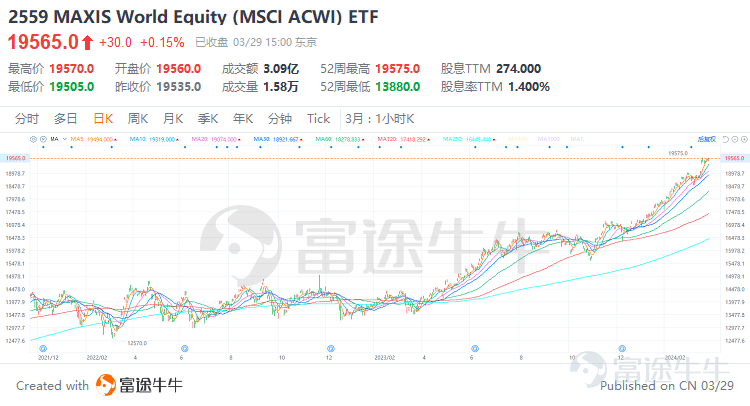

2599 MAXIS World Equity

2599($MAXIS World Equity (MSCI ACWI) ETF(2559.JP)$) is an ETF managed on behalf of Mitsubishi Financial Group in Japan. The ETF's investment objective is to track the performance of the MSCI ACWI index, providing investors with investment opportunities in global equity markets. The MSCI ACWI Index is a global stock market index compiled by MSCI Corporation, comprising 23 emerging market and 24 emerging market stocks, covering most of the market capitalization of global equity markets. The ETF's portfolio consists primarily of MSCI ACWI index constituents and aims to achieve long-term stable capital gains by investing in these stocks. The ETF had a trading volume of about 0.02 million in March and an asset size of about 45.6 billion yen, an increase of about 42% in the first 23 years to date.

Learn about the leveraged ETF for the Japanese stock market

IN FINANCIAL MARKETS, LEVERAGED ETFS SERVE AS AN INNOVATIVE FINANCIAL TOOL THAT OFFERS INVESTORS THE POSSIBILITY OF MAGNIFYING THE EFFECTS OF MARKET VOLATILITY, GIVING THEM THE OPPORTUNITY TO EARN HIGHER RETURNS WHEN PREDICTING THE MARKET DIRECTION CORRECTLY, BUT ALSO POTENTIALLY FACING THE SAME LEVEL OF LOSSES.

Leveraged ETFs issued in Japan:

1. $NEXT FUNDS Nikkei 225 Leveraged Index Exchange Traded Fund(1570.JP)$

Managed by Tokai Waseda Investment Advisors Limited, Japan, tracks a twofold daily decline of the JPY 225 index and aims to provide leverage for the JPY 225 index. The size of the assets is about 270.5 billion yen and the total volume of sales in March was about 2 million, up 148% from the beginning of the year 23.

2. $Nikkei225 Bear -2x ETF(1360.JP)$

This is a one-of-a-kind ETF managed by a company called Higashida, Japan. The ETF investment portfolio is mainly composed of the Nikkei 225 Index, but the investment strategy is to follow the decline of the day by two points, the current day's Nikkei 225 Index is down 1% and the ETF's net value is down 2%. It is listed on Securities Trading in Japan and investors can buy through securities brokers or online trading platforms. ETF has a management fee of 0.65%, and the cost is high. Assets measured at ¥47.4 billion, with an average volume of about 30 million in March, down 64.76% from the beginning of 23 years.

On the other hand, ETFs are ETFs that use financial life tools (such as Futures and Exchange Agreements) to measure the daily returns of major underlying indices. However, these products typically offer daily returns of 2x or 3x, but they are not suitable for long term Hold Positions.

Overall, an ETF is like a key to opening the door to diversified investment, capturing both the potential for returns on the market as a whole and diversifying the risks of individual securities to a certain extent. However, like all investment instruments, ETFs are not risk-free, and market volatility, liquidity risks, tracking errors, and industry-specific upturns all have a direct impact on investor returns.

As such, while embracing the return opportunities offered by ETFs, wise investors also need an in-depth understanding of potential risks and prudent coping strategies.

After all, it is only with a clear understanding of the delicate balance between risk and return that you can be more stable on the investment path and achieve long-term appreciation and preservation of assets.

How to Trade Japan ETFs?

Before investing in a Japan ETF, you first need to open a securities account. Just like depositing money in a bank, you need to open a bank account first.