Futu Research | ETF Investment Research

【High Yield ETF】5 US Equity High Yield ETFs to choose from

Since the start of the year, as the rate hike cycle draws to a close, the market is expecting a drop in the US dollar rate more strongly. As a result, the US market has been on a wave of high dividends in recent months, with more and more people choosing to invest in some high-yield products to resist the risk of falling stock prices.

While there are some high-dividend companies in every segment of the market that are happy to return to shareholders, there is a more stable and secure way to invest in stocks — high dividends for investors who are less likely to opt for stocks.ETF。 The High Yield ETF (Dividend ETF), primarily known as the Cash Dividend Dividend Dividend Form, determines the ETF's constituent stock options and determines the shareholding rights. Even in the face of the double weight of the recent political economy and the decline in stocks, high-yield ETF investments can receive quality returns over a period of time. Stocks Asset Assets that track products can spread risks, which are not suitable for investors who want to follow a certain hedge..

How to Choose a High Dividend ETF

In general, to choose the best ETF for you from a wide range of products, you can start from the three aspects of Indices, Remuneration Performance, and ETF Mechanism.

1.Indicator: Know which Assets you are buying

High-Dividend ETFs typically track specific dividend indices, such as the Hang Seng High Dividend Index, S&P High Dividend Aristocrats, etc. These indices are generally composed of company stocks that pay stable dividends in the market and have relatively high returns, but there are differences in the composition of specific holdings. As wise investors, we should have a basic understanding of the logic of ETF holdings and choosing stocks to avoid “a rat's ?$#@$ spoils a pot of soup”.

2. Remuneration Performance: Understand How Yield and Dividend Rates

Everyone's buying a high-dividend ETF is to expect a stable and higher yield. Therefore, when choosing a product, it is necessary to compare the current yield and dividend rates of different high-dividend ETFs, and combine the growth trend of dividends, to select products with strong dividend paying capacity and expect continued growth.

3.ETF Mechanism: Reduce the Amplitude of “Broker Earning Spreads”

A series of Stocks products ETFs offered by Institutions are available for direct purchase by major investors, requiring a management fee report. As investors, we compare costs for different products, ETFs management and operating performance are directly related to net returns, while lower cost ratios increase investors' net returns. MOREOVER, SINCE THIS IS A SPECIAL TYPE OF HIGH-YIELD ETF, INVESTORS NEED TO PAY ATTENTION TO THE FREQUENCY OF THE FEAST — AS ETF ALLOWS SHARES TO BE REINVESTED, MORE FREQUENT BETS CAN ALLOW INVESTORS TO MOVE THROUGH THE NUMBER OF DIVIDENDS FASTER, AS INVESTORS DO NOT NEED IMMEDIATE CASH INFLOWS, EVEN IF THE AMOUNT IS EQUAL TO THREE TIMES THE TOTAL Large parties may result in lower Trade Costs and Tax Charges rather than advantages.

High Dividend ETF (US Stock) Recommendation

Below, we will recommend several high-dividend ETFs on the US stock market, which you can choose according to your investment preferences:

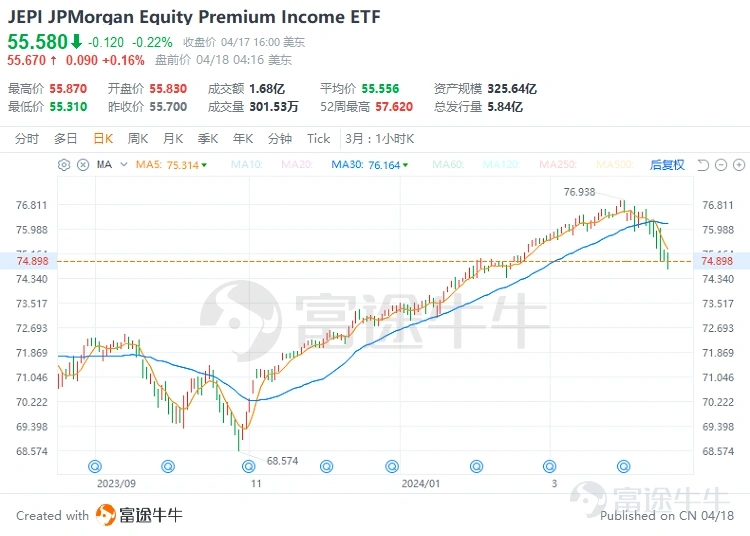

JEPI

$JPMorgan Equity Premium Income ETF(JEPI.US)$It is one ofCovered Call ETF issued by JPMorganThis is followed by companies in the P500, which simultaneously provide additional income by charging investors with Sell Long Call options and provide Distributable Inbound and Stock Market Exchanges during smaller volatile months. According to data provided by JPMorgan, there are three main advantages to this ETF:

Offers a highly attractive 12-month rolling dividend yield of 8.50% and a 30-day total return of 7.04%;

yield in the top third of products in the same category;

Compared to peers, the price is more competitive with a management rate of only 0.35%.

Currently, Hong Kong users are required to pay 30% dividend tax when purchasing this ETF, and 10% dividend tax for Mainland Chinese personal users, usually deducted directly from dividends. The following four ETFs are the same in terms of taxation.

RYLD

$Global X Russell 2000 Covered Call ETF(RYLD.US)$The ETF tracks the e-mini Russell 2000 Index, which represents the performance of 2000 companies with a smaller market capitalization and is often considered a benchmark for the small stock market. By Selling 50% upside options in the investment portfolio, the product is able to capture upside momentum towards the top half of the Assets Index. As of now, ETF Assets are estimated at US$1.4 billion, management fees are 0.35%, dividend yield is 12.56%, and average one-year Fund NAVs have grown by 12.74%.

KBWD

$Invesco KBW High Dividend Yield Financial ETF(KBWD.US)$,This ETFEstablished in December 2010, the KBW Nasdaq Financial Dividend Ratio Index, which mainly invests in American Realty Investors Trust Funds and financial industry holders, has less than 41 shares. Major shareholders include Dynex Capital, Ellington Financial Inc, Western Union, etc.

This ETF has a high yield of more than 10%.

To date, the ETF has an asset size of about $0.359 billion, a management rate of 0.35%, a dividend yield of about 12.3%, an SEC 30-day yield of 11.9%, with monthly dividends.

QYLD

$Global X Nasdaq 100 Covered Call ETF(QYLD.US)$The ETF is based on investments in US technology growth stocks such as AI, semiconductors, and technology giants such as Semiconductor, Microsoft, Apple and Fiida as its constituent stocks. It generates additional income through CoveredCall, that is, buying stocks in the Nasdaq 100 index and selling the corresponding Long Call of the same index to earn option fees, then distributing dividends to holders. This way generates a higher rate of return in volatile times.

At the end of the day,The ETFAssets are estimated at US$8.1 billion, management fees are 0.61%, dividend yield is 11.70%, 12-month revenue is 12.32%, according to monthly reports.

IDV

If you are interested in other overseas markets besides the United States, you can choose $iShares International Select Dividend ETF(IDV.US)$ This ETF is a high-dividend investment. It focuses on large markets outside the United States, including the UK, Australia, South Korea, Japan, Spain, such as London mining giant Lito Group (RIO) and Japanese shipping giant Japan Postage (NPNYY), which also has a high dividend yield of about 7%.

As of now, the ETF has an asset size of approximately $4.1 billion, a management fee of 0.51%, a dividend yield of 6.79%, and a 5-year yield of 10.75% with quarterly dividends.

It is worth mentioning that ETFs are taxed also depends on the assets they hold, and since US Treasuries are tax-free at the state and local level, so if an ETF that holds US Treasury bonds, such as TLT, their dividend payments are also exempt from state and local income taxes.

Since Dividends are the reason for this type of ETF, it is necessary for large companies to understand the prepayment and refund rules when buying on the platform before buying. The tool can be referenced in the Futu article:ETF Tax Refund Guide: Know Your Investment Returns

summed

With the dual objective of pursuing stable returns and potential capital gains, the US Equity High Dividend ETF provides investors with an ideal tool to effectively spread risk and obtain passive income, making it a good choice for investors who are willing to moderately sacrifice some upside potential in pursuit of income while moderately sacrificing some upside potential.

How to Trade US Equity High Yield ETFs?

Before investing in a Japan ETF, you first need to open a securities account. Just like depositing money in a bank, you need to open a bank account first.