Introduction to US Stock Trading

US Stock Entry | New Hand Investment Must-Reads: US Stock Market Hours, Fundamentals, Top 3 Exchanges

Step 1: What Trading Rules Do You Need to Know Before Buying a US Stock?

A LOT OF NEW IDEAS FOR START-UPS TO INVESTBuy US Stocks, but one day you suddenly find that the opening time of the US stock market has changed? Why was the launch of the market suddenly delayed by an hour?

First, let's get to know the following basic trading rules for US stocks:

US Stock Entry: US Stock Trading Hours

1. US Stock Opening Hours

U.S. stocks open at 9:00 a.m. to 4:00 p.m. on Monday through Friday. It differs from Hong Kong stocks and does not close at noon.

However, since the United States is also divided into Daylight Saving Time and Winter Time, the corresponding Hong Kong time will be different:

US Equities | U.S. Daylight Saving Time (March-11) | Mid-winter season (November - March next year) |

US Stock Market Opening Hours | 21:30 Hong Kong Time - 4:00 the next day | 22:30 Hong Kong Time - 5:00 PM the next day |

2. US Stock Pre-Market Trading Hours

Pre-market trading hours for U.S. stocks are Eastern Time (ET: 4:00 a.m. to 9:30 p.m., Monday through Friday. The corresponding Hong Kong time is:

US Equities | U.S. Daylight Saving Time (March-11) | Mid-winter season (November - March next year) |

US Stock Pre-Market Trading Hours | Hong Kong Time 16:00-21:30 | Hong Kong Time 17:00-22:30 |

3. Post-Market Trading Hours of US$

Post-market Trading Hours for US Shares are Eastern Time (ET): Monday to Friday from 16:00 to 20:00. The corresponding Hong Kong time is:

US Equities | U.S. Daylight Saving Time (March-11) | Mid-winter season (November - March next year) |

Post-Market Trading Hours of US$ | Hong Kong Time 4:00-8:00 | Hong Kong Time 5:00-9:00 |

4. US Stock Night Trading Hours

U.S. Stock Overnight Trading Hours are Eastern Time (ET): 8:00 p.m. and 4:00 p.m. on Sunday through Wednesday. The corresponding Hong Kong time is:

US Equities | U.S. Daylight Saving Time (March-11) | Mid-winter season (November - March next year) |

US Stock Overnight Trading Hours | Hong Kong Time 8:00-16:00 | Hong Kong Time 9:00-17:00 |

The Hong Kong Stock Price Divergence is the Hong Kong time period in which the United States shares are trading.

U.S. Daylight Saving Time (March-11) | ||||

Hong Kong Time | 21:30 - 4:00 the next day | Next day 4:00-8:00 | 8:00-16:00 | 16:00-21:30 |

US Stock Trading Hours | US Stock Market Opening Hours | Post-Market Trading Hours of US$ | US Stock Overnight Trading Hours | US Stock Pre-Market Trading Hours |

Mid-winter season (November - March next year) | ||||

Hong Kong Time | 22:30 - 5:00 the next day | Next day 5:00-9:00 | 9:00-17:00 | 17:00-22:30 |

US Stock Trading Hours | US Stock Market Opening Hours | Post-Market Trading Hours of US$ | US Stock Overnight Trading Hours | US Stock Pre-Market Trading Hours |

It should be noted that in general, the volatility of US stocks increases before, after market opening, and overnight trading, and the big news of many listed companies is going public at this time, and the price can generate a lot of volatility.

Futubull is the premier provider in Hong KongUSD 5×24 Hours*All-Day TradeThe platform allows trading and trading of US stocks at any time, and investors can take advantage ofFutu Night PaneCapture profit opportunities faster.

Download Futubull nowExperience 24 Hours of Uninterrupted Trade in US Stocks!

*US Stock Overnight Trading Risks and Risks. Before investing, please understand the characteristics of the USD Night Spot Trading Service and understand the risks, and consult a professional if necessary.

US Equity Entry Threshold

Unlike Hong Kong stocks, US stocks have no one-handed concept. Trading units of US shares have no restrictions and can sell 1 share at a time.

Extended Reading:Is it easier to get started with Hong Kong stocks compared to US stocks and more opportunities to make money?

US Stock Settlement Rules

Trade pattern of US shares is T+0, and US shares can be sold today.

The calculation rule for US shares is T+1. Defining the time to Sell Stock Stocks is T, then a time after T, then a trade day after T, Traders and Clearing Days, Dealers and Settlement Institutions can collect funds, and Institutions can collect funds and Stock Stocks are sold Cash received from Selling Stock Shares may be freely withdrawn after the transfer.

U.S. stocks rise and fall limits

There is no limit to upside and decline in US stocks, but when the market swings too much, it will automatically trigger a US stock meltdown mechanism.

The US Stock Divergence Mechanism: When the price of stocks fluctuates strongly, the market will stop trading for a period of time and resume trading again after a period of time.

The US equity trading mechanism is based on the S&P 500 Index, divided into three stages:

Index Declines 7%, Trade Suspended for 15 Minutes

Index falls 13%, pauses again for 15 minutes

The index fell 20% and closed directly on the day

Extended Reading:Start investing in US stocks, look out for special days!

The purpose of the US Stock Diversion Mechanism is: When the market is experiencing a dramatic surge, by forcefully pausing the US Stock Trading for a while, to allow the market to cool down for a while, to prevent the panic from lingering and leading to a fall in the US benchmark stock price.

Resuming to buy US stocks again is to be hoped that investors will keep in mind the risks and strategies associated with trading US stocks in time, avoid headwinds, reduce irrational selling, and restore market volatility.

Step 2: Why Invest in the US Stock Market

The US Stock Market has experienced long-term growth and enormous growth, becoming one of the largest and most vibrant stock markets in the world today. A new and high hand in investing in US stocks, has huge investment motivation and investment value.

FROM A HISTORICAL PERSPECTIVE, THE START OF THE US STOCK MARKET CAN BE TRACED BACK TO 1792, WHEN THE NEW YORK SECURITIES EXCHANGE (NYSE) WAS FOUNDED ON WALL STREET. Subsequently, with the growth of the US economy, the US stock market continued to grow and expand to become one of the most mature and stable stock markets in the world.

From the perspective of the market, the US Stock Market is the largest stock market in the world, and it attracts a large number of profitable companies to go public here, for example, in large numbers.USA-7 Technology Group: $Apple(AAPL.US)$ 、 $Microsoft(MSFT.US)$ 、 $Alphabet-A(GOOGL.US)$ 、$Amazon(AMZN.US)$、 $NVIDIA(NVDA.US)$、 $Meta Platforms(META.US)$、 $Tesla(TSLA.US)$ 。 In addition to this, well-known companies in other countries, such as China $Alibaba(BABA.US)$、 $Taiwan Semiconductor(TSM.US)$ And more, you can invest through US stocks.

Data Source:Investopedia

American Stock Exchange

After the company is listed on the Exchange, we need to understand the most representative and influential exchanges in the US stock market, which are the most representative and influential in the US stock market, which are:

The New York Stock Exchange (NYSE), Nasdaq (NASDAQ) and the U.S. Securities Exchange (AMEX).

1. New York Stock Exchange (NYSE)

The New York Stock Exchange, commonly known as the NYSE, is the largest and most widely used securities exchange in the history of the US stock market.

Companies listed on the NYSE are mostly historically poor, exemplary, and stable businesses. These companies are often seen as blue-chip stocks in the market, representing solid financial performance and long-term investment value. Due to other listing standards, the NYSE has attracted many internationally renowned corporate brands, making it the preferred market for investors seeking steady income.

2. Nasdaq Exchange (NASDAQ)

The Nasdaq Stock Exchange is the largest listed company on the U.S. stock market, the most traded securities exchange with the largest number of securities traded in the U.S. stock market.

Many innovative technology companies are listed on the Nasdaq Stock Market, which is why it is considered a trend sign for the global technology industry. These companies typically have high growth momentum, with high volatility and are suitable for investors looking for long-term growth opportunities. Beyond that, Nasdaq counts companies with multiple biotech, Internet, and XINXINGCHANYE industries as a hub for innovation.

3. American Stock Exchange (AMEX)

The US Securities Exchange was the third largest securities exchange in the United States, merged with the NYSE in 2008 and is now called NYSE American.

Companies listed in US Securities Trading are mostly small and medium-sized US companies. Stocks are traded less frequently and liquidity is low. If the market door is lower, it allows multi-American companies to choose to list on the US Securities Exchange and then grow back on the NYSE, hence the growth of the blue-chip stocks.

The top three U.S. stock indexes

We will get acquainted again after the completion of the Mimi Stock ExchangeThe top three U.S. stock indexes, This can help US equity entry investors better understand the overall situation and movements of the US stock market. There are three major indexes for the U.S. stock market, including the Standard PPL500 Index, the Nasdaq Composite Index, and the Dow Jones Industrial Index SSEIndustrialIndex.

The S&P 500 Index, commonly referred to as the S&P 500 Index, is commonly referred to as the most widely distributed and comprehensive indicator of the US stock market.

The S&P 500 Index is mainly composed of the 500 companies with the highest market capitalization in the US stock market, covers most sectors of the US stock market, makes up 80% of the total market capitalization of the US stock market, and has representative and leadership positions for various industries, which is why it is often recognized as the most reflective of the US stock market. Integrity index.

On the other hand, the S&P 500 has a certain market cap, because there is a market cap, large stocks in the US equity funds in the other selected stocks, and there are some high quality and strong growth stocks that cannot be tracked for a while.

Nasdaq Composite Index (NASDAQ Composite)

The Nasdaq Composite Index (NASDAQ Composite Index) is generally considered a representative index of U.S. technology and growth stocks.

The list is made up of all US stocks listed on the Nasdaq Exchange, with a share of more than 3000, mainly consisting of all US stocks listed on the High Tech and Semiconductor Emerging Markets, with a share of more than 3000, mainly US companies in the High Tech and Semiconductor New Interest Industry, are usually considered to beUS Stocks Technology StocksThe representative index.

It also means that there is a certain limitation, due toUS Stocks Technology StocksLarger footprint, often has the disadvantage of lower dispersion and greater volatility.

Dow Jones Industrial IndexSSEIndustrialIndex

The Dow Jones Industrial Index (SSEIndustrialIndex), commonly referred to simply as the channel indicator, is the longest-running index in the history of the US stock market.

The index was produced early, which includes 12 US Stocks that are the least representative of the US industrial sector. More recently, the company now includes 30 of the largest and most well-known blue-chip stocks in all US industries, largely unrelated to industry and are divided into Food, Finance, Pharmaceuticals, Technology, etc. Microsoft, Apple, Visa, JPMorgan, UnitedHealth, and many of them are the constituents of the company.

Data Source: Futubull, as an example of the top 5 companies in Market Cap, data to 2024/2/16

Compared to other indicators, the Index's Dividend Differences are based on Share Pricing Rights rather than Market Cap Authorisations, and may not fully reflect the diversity of the stock market.

All in all, the three major U.S. stock indices have various disadvantages, and we can analyze all three U.S. stock indices one by one when investing. Moreover, apart from the top three US equity indices, US equity inbound investors can follow the Semiconductor Sector Index .SOX (PHLX) for the Semiconductor Industry to follow the Semiconductor Sector Index (SOX).

How to Find the 3 Major Index Stocks in US Stocks

Futubull lists all the constituent stocks of the Big 3 indices, and simultaneously looks at the correlation between the falls and the Volume. New investors can try their hand at finding a heart diving stock!

The three major US equity indices have various disadvantages, and when investing, we can analyze all three US indices one by one. Moreover, apart from the top three US equity indices, US equity inbound investors can follow the Semiconductor Sector Index .SOX (PHLX) for the Semiconductor Industry to follow the Semiconductor Sector Index (SOX).

Step 3: How to Buy US Stocks? Where to buy US stocks?

Open a US Stock Account and Deposit Funds

Having a thorough understanding of the basics of investing in stocks, have you ever wondered what it means to invest in (buy and sell stocks)?

Before investing (buying and selling) US Stocks, it is essential to open a Securities (Stocks Account).

Monthly Supply of US Stocks

Monthly Supply of US StocksIt is not necessary to trade ordinary stocks. Trade generally requires a whole hand or a share to buy all hands or one share, but rather, as required by an individual, set a monthly supply, or as required by an individual, Set a monthly supply, Buy a different number of shares, at any time, different number of shares, at any time During this period, stocks will move up to Buy price, which will help reduce short-term risk. This method is suitable for people with limited funds or just starting out to invest, build a stable investment learning path, and by providing this method over the months, increase the deficit and achieve long-term financial goals.

Step 4: What are the types of US stocks and which US stocks are best for me to buy?

Stocks on the US Stock Market are numbered in the thousands, and each company has its own characteristics and advantages, and every Industry is different.

When it comes to investing in US stocks, it is common to choose the US Stocks that you want to invest in and create your own portfolio of US stocks that you want to invest in.

But what Global Sectors does the US Stock Market have bottomed out in, and is not possible? Let us read the following:

What Sectors Does the US Stock Market Have?

According to the Global Industry Segmentation Standard (GICS), the US stock market can be divided into 11 sectors. We are divided into Information Technology, Finance, Finance, MedicalHealth, Non-Required Consumer Goods, Industrial, Communications Services, Energy, Healthcare, Non-Required Consumer Goods, and Industrial Industry, Communication Services, Required Consumer Goods, Energy, Real Estate RealEstate, Materials and Public Sector, Materials and Public Sector Block Sector. Data Source:MSCI

Extended Reading:Want to buy a sample of US stocks? List of Top 11 Industries

1. Information Technology (Information Technology)

The US-based Technology Sector consists mainly of US technology companies in the Internet hardware and semiconductors categories.

The seven major U.S. technology majors known as Apple (AAPL), Microsoft (MSFT), Google, Amazon (AMZN), NVIDIA (NVDA), META, Tesla (TSLA) all belong to this Industry.

2. Financial

The US Equity Finance Sector consists mainly of Banks, Insurers, Securities Dealers, Real Estate Investment Trusts, and Multi-Dollar Financial Services Companies.

The top three companies in this Sector Market Cap are: the top three companies*are VisaVisa (V), Visa (V), JPMorgan (JPM), JPMorgan (JPM), Goldman MasterCard (MA), etc.

3. Medical Care (Healthcare)

Major US Healthcare Sector includes Pharmaceutical, CNI Biomedicine Index, and Health Services Companies.

In this Sector Market Cap, the top three companies*are: The top three companies*are: ElyIllyandCo (Lly), Novo (NVO), Eli Lilly and Co (LLY), Novo (NVO), United HealthUnitedHealth (UNH).

4. Consumer Discretionary

Major consumer goods include: Electronics, Hotels, Outfits, Luxury Goods, Cars, etc.

The top three companies in this Sector Market Cap are: Tesla (TSLA) and the top three companies in Market Cap are*such as Tesla (TSLA), Home Depot (HD), Home Depot (HD), and McDonald's (MCD), etc.

5. Industry

Major US Equity Industry Sectors include Aerospace & National Defense, Railroads & Construction, Freight & Logistics.

The top three companies in this Sector Market Cap are: the top three companies*are Caterpillar (CAT), Caterpillar (GE), Caterpillar (GE), General Electric (GE), United PacificUnionPacific (UNP).

6. Communication Service

The main US-based Communications Services Sector includes telecom service providers, media companies, and entertainment companies.

The top three companies in this Sector Market Cap are*such as*: Yuanga (Google, Meta, Netflix (NFLX, etc.

7. Consumer Staples

The main segments of US Share Required Expenses include: Household & Personal Products, Food & Daily Goods Retail, Beverage Companies.

For this Sector Market Cap, the top three companies*are*such as: Walmart, Walmart (WMT), Clean Procter & Gamble, Procter & Gamble (PG), Procter & Gamble (PG), and more Costco.

8. Energy

The main US Energy Sector includes Henry Hub Natural Gas & Consumable Fuels, Energy Equipment & Services Companies.

The top three companies in this Sector Market Cap are: The top three companies*are: ExxonMobil (XOM), Exxon Mobil (XOM), Chevron (CVX), Chevron (CVX), Shell (SHELL)

9. Real Estate (Real Estate)

The US Real Estate Block Sector includes major real estate developers and managers, including real estate developers and managers, including real estate developers, real estate developers, real estate real estate operators.

In this Sector Market Cap, the top three companies are: PLD, the top three companies*such as PLD, American Tower Corp (AMT), Quinnix-EquinixInc (EQIX).

10. Materials

Major US Stock Sectors include: Chemicals, Containers & Packaging Blocks, Metals & Mining, Construction Companies.

The first three companies in this Sector Market Cap are: Lind Group (LIN), the top three companies*for example: Lind Group (LIN), P&P BHPGROUPLTD Group (BHP), BHP Group (BHP), Power Riotinto Group (RIO).

11. Utilities

The U.S. Equity Public Sector consists primarily of companies that produce or distribute electricity and Henry Hub Natural Gas, as well as renewable energy producers.

In this Sector Market Cap, the top three companies*are: The top three companies*are NextEra Energy (NEE), NextSouth Power (SO), NextEra Energy (NEE), South Square Power (SO), DukeEnergy (DUKEenergy), etc.

In different economic conditions, US stocks in different sectors are different. For example, in a recession period, resistant blocks will be more resistant to new investments in US stocks that are about to enter the market. Learn more about which industries in US stocks can help to reverse market trends and find out what kind of trends in the stock market can be found at a specific time Mr. Stocks to help create the right investment portfolio for you.

Futu Investment Themes Feature Investment Opportunities

If you are bullish on an Industry trend and want to quickly choose a High Dive stock from the middle? The Futu Investment Themes feature is categorized by different investment themes. Let you discover new investment opportunities at a glance at the Industry Topic Raise and other comprehensive stock lists!

Futu U.S. stock odd lot $0 gold low cost core water U.S. stock

When investing in U.S. stocks, you'll be able to track the hottest stocks on the market. However, you may find that some US stocks are higher so that you don't invest so much money in the early days, making you very hopeful that you will be able to own the stocks of these companies. At this time, you can make use of the odd lot feature of US stocks to reduce the cost of entering the market.

Step 5: What are the days to look out for when buying US stocks?

Economic issues have a strong impact on US equities, such as CPI, non-farm payrolls, GDP growth, US savings rate policy and MMF policy, etc., will directly reflect market sentiment and investor decisions. Futubull's financial calendar and featured visitor data provide investors with an important tool for keeping up with the latest economic trends!

Just use Futubull and join the Cattle Affiliate Program to see more visitor data, help you stay on top of the market and make more impactful investment decisions!Click to learn more >>>

Extended Reading:Start investing in US stocks, watch out for special days!

Fed FOMC Meeting

The US Federal Reserve at the heart of the storm is the central bank of the United States, made up of three major components: the Governing Council, the 12-nation Federal Reserve Bank, and the Federal Open Market Committee (FOMC).

The Board of Governors and the 12 Federal Reserve Banks are jointly organized into the Federal Open Market Committee (FOMC). The FOMC holds 8 annual meetings each year, sometimes more than five meetings during times of emergency, for example, during the new vaccine period, only in March.

In general terms, the Fed's way of filling the gullies, implementing tightening monetary policy in the run-up to the heat of the economy, adopting an expanded monetary policy during the economic downturn, the oil door is running from the future to reducing market volatility, and the economy is stable now.

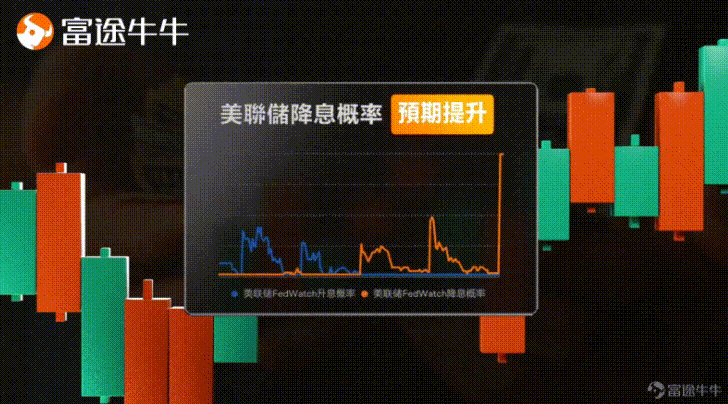

Therefore, the decision of the Fed FOMC meeting on whether to “raise” or “cut rates” will affect the direction of the entire US equity market. In general, interest rate cuts are used to stimulate the economy in times of recession or slowdown and benefit the U.S. stock market.

There is no doubt that the new hand in US equity investment is high hand, and it is necessary to pay attention to the monetary policy of the US joint reserve, for example, in order to be more attentive to the emergence of investment opportunities and avoidance of investment risks.

Extended Reading:The impact of Fed rate cuts on equity and debt markets

Results Period

U.S. STOCK PERFORMANCE TYPICALLY STARTS IN THE THIRD WEEK OF JANUARY, APRIL, JULY, AND OCTOBER EACH YEAR. U.S. STOCK COMPANIES PUBLISH PREVIOUS QUARTERLY RESULTS SUCCESSIVELY DURING THE PERFORMANCE PERIOD. WHY SHOULD INVESTMENT IN U.S. STOCKS FOCUS ON PERFORMANCE? There are mainly the following reasons:

Performance can reflect the income, profit or similar financial condition of a company over a quarter. In order to better assess the value of a company's stocks and investment risks, US equity investors can make the investment worthless by analyzing the development status and outlook of the company.

The performance is directly related to the rise in the price of stocks of companies. Stocks move lower when the company's performance is ahead of schedule, the market's confidence in the company increases, and if the company's performance does not meet the expectations, the market declines in confidence in the company, and the share price falls.

The performance of US equity capital firms, with their own stock price volatility, may reflect the direction of the entire US stock market. If the company is performing well ahead of schedule, it is possible to add fire to the whole behavior. If it does not work out and is expected, the market's heat wave may require a glass of cold water.

Day of the Three Witches

Many investors who are interested in US stocks have probably heard of a special day, “TripleWitching Day.”

Three Witches Day refers to the expiration date of the three major U.S. stock financial derivatives on the third Friday of March, June, September, and December each year.

These 3 U.S. stock finance products are: Stock Index Futures, Stock Index Options, and Individual Stock Options. You may have heard that the fourth day of the 2020 Single Stock Futures has been changed to the third day since the Single Stock Futures in the United States ceased trading in the United States.

On this day, the Financial Product Deadlines of 3 types of US stocks allowed many investors to carry out Buy and Sell Operations and Adjust Hold Positions, thus showing an increase in the Volume of the entire US Stock Market towards the moment.

As volume increases, the volatility of the market is gradually increasing. During this time, the uncertainty of the entire US equity market is high and can be a big loss at the same time as the gains of US equity investors. That is why US equity investors need to take a lot of reckless investment risk right now.

2025 U.S. Stock Market Dates List | |

1 | 2025/3/15 |

2 | 2025/6/20 |

3 | 2025/9/19 |

4 | 2025/12/19 |

Form 13F Shareholder Announcement Day

Form 13F Report (13 Filings) refers to Institutional Investors with Assets of US$0.1 billion or more that are required to be disclosed on a quarterly basis.

Institutional Investors in the United States Securities Regulated Investment Market (SEC) with assets valued at more than US$0.1 billion are required to file a Form 13F report with the Securities Depository to disclose their assets currently held and provide a reversal of the relevant funds within 45 days of the end of each quarter.

As a rule, investors from various Institutions will publish their Hold Positions and Coordinates before 15 days in February, May, August and November. Some of the biggest concerns: Buffett's Walker, Solos Funds, and Bridgewater Funds, etc.

To put it simply, the Form 13F Report will be the best source of information for US Equity Institutions investors to learn about how Smart Money moves.

For US equity investors, the Form 13F report serves as a reference point for US equity investing, providing a recommendable option strategy for incoming investors.

Getting Started with US Stocks Step 6: What do US and Hong Kong stocks have in common and different?

Extended Reading:Is it easier to get started with Hong Kong stocks compared to US stocks and more opportunities to make money?

What US and Hong Kong stocks have in common

The trading pattern is the same: US stocks and Hong Kong stocks trade on average T+0, while US stocks and Hong Kong stocks that are bought today can be sold today.

The settlement rules are the same: the settlement rules for US stocks and Hong Kong stocks are T+2, and cash from US stocks and Hong Kong stocks can only be withdrawn freely after T+2 settlement.

No rise and fall limit: There is no 10% increase drop limit

Differences between US stocks and Hong Kong stocks

1. Trade time is different

Hong Kong stocks continue trading hours are 9:30-12:00, 13:00-16:00, noon market hours are closed for one hour, and regular trading hours of American shares are 9:30-16:00, and no market open at noon.

Hong Kong Stock Trading Hours | |||

Hong Kong Time | 9:00-9:30 | 9:30-12:00,12:00-16:00 | 16:00-16:08~16:10 |

Hong Kong Stock Trading Hours | Hong Kong Stock Market Opening Hours | Hong Kong Shares Resume Trading Hours | Hong Kong Stock Market Bidding Period |

US Stock Trading Hours - Summer Time Example | ||||

Hong Kong Time | 21:30 - 4:00 the next day | Next day 4:00-8:00 | 8:00-16:00 | 16:00-21:30 |

US Stock Trading Hours | Standard Trading Hours | Post-Market Trading Hours of US$ | US Stock Overnight Trading Hours | US Stock Pre-Market Trading Hours |

2. Different entry thresholds

The Basic Trading Unit of Hong Kong shares is 1 hand, 1 hand is different from 100 shares to 5000 shares, and less than 1 hand is an odd lot.

A US stock has no 1-hand concept, and there is no limit to the minimum trading unit of a US stock that can be sold one share at a time.

3. Trade code is different

Hong Kong's Trade Code starts with a 5-digit number starting with 0, for example, 00700, and Alibaba's 09988.

Trade codes for US shares are abbreviated in English for the company, such as Apple is AAPL and Microsoft is MSFT.

4. Trade tax is different

Hong Kong shares are subject to Printing Tax, Printing Tax is calculated at 0.1%* of the transaction fee, no dividend tax.

On the other hand, income from US stocks is subject to 30% dividend tax and 30% of dividends is subject to tax.

See here, the top story of US Stock Investing. If you want to learn more advanced stock investing knowledge, please come to Futubull and create your own long-term investment system!

Note: * Data as of February 20, 2024.

In addition to investing in US stocks, you can also exploreCryptosInvestment potential! More and more people are recognizing investment products that have become popular with investors in recent yearsWhat are Cryptos。

Under strict regulation, Hong Kong investors can trade Cryptocurrencies in a safe environment at any time, enabling multiplatform investments.

* Learn moreVirtual MMF Execution FeeDetails >>