自研發了一套體系化的評分模型。

經綜合評分達到合格且靠前的產品,才可以成為平台的基金。

環球頂尖基金

精選世界頂級優質資產

立即開戶

已與全球超過50家

頂尖基金公司建立深度合作

頂尖基金公司建立深度合作

50家

近一個月為33萬+

客戶獲得2.1億港元*

客戶獲得2.1億港元*

2.1億港元

富途集團财富管理规模

突破400億港元*

突破400億港元*

400億港元

*數據截止至2023年6月8日

開戶最高可得 HK$1200 新客奖赏!

立即領取 >富途大象財富

自研基金公司選品法

自研基金公司選品法

從業績表現、投資理念、投資組合、管理團隊、管理公司、投資流程六方面,對基金做一個全面的分析。

Process

投資流程

People

團隊管理

Parent

基金公司

Portfolio

投資組合

Philosophy

投資理念

Performance

業績表現

參照6P原則

多維度挑選好基金

根據大數據條件展示各基金排行榜

睇睇大家都買什麼!

睇睇大家都買什麼!

熱門認購榜

展示近1月平台淨認購金額

排行前的基金榜單

排行前的基金榜單

*數據截止日期:2023-07-05

展示近1月平台淨認購金額

排行前的基金榜單

排行前的基金榜單

下載APP查看更多榜單 >

1

富蘭克林入息基金MDis

HKD

+20.96%

2022年回报

-7.33%

2021年回报

+13.88%

2020年回报

+1.26%

2019年回报

+13.90%

2018年回报

-7.31%

近三年回報

2w+

人均認購金額

2

匯添富中港策略基金

HKD

+13.95%

2022年回报

-9.85%

2021年回报

-11.21%

2020年回报

+79.91%

2019年回报

+26.48%

2018年回报

-14.55%

近三年回報

4w+

人均認購金額

3

大成中國靈活配置基金MDis

HKD

+12.08%

2022年回报

-20.51%

2021年回报

+5.48%

2020年回报

+40.39%

2019年回报

+23.88%

2018年回报

-19.77%

近三年回報

3w+

人均認購金額

持倉金額榜

展示近1月平台持倉金額

排行前的基金榜單

排行前的基金榜單

*數據截止日期:2023-07-05

展示近1月平台持倉金額

排行前的基金榜單

排行前的基金榜單

下載APP查看更多榜單 >

1

貝萊德世界科技基金

USD

+23.20%

2022年回报

-43.06%

2021年回报

+8.01%

2020年回报

+85.50%

2019年回报

+43.48%

2018年回报

-0.34%

近三年回報

4w+

人均認購金額

2

安聯收益及增長基金MDis

HKD

+20.37%

2022年回报

-19.65%

2021年回报

+12.37%

2020年回报

+21.37%

2019年回报

+18.91%

2018年回报

-4.69%

近三年回報

8w+

人均認購金額

3

富蘭克林科技基金

HKD

+30.90%

2022年回报

-44.34%

2021年回报

+23.87%

2020年回报

+60.44%

2019年回报

+37.30%

2018年回报

+1.64%

近三年回報

2w+

人均認購金額

銀行熱銷榜

香港本地銀行近1個月

熱銷基金

熱銷基金

*數據截止日期:2023-06-14

香港本地銀行近1個月

熱銷基金

熱銷基金

下載APP查看更多榜單 >

1

富蘭克林入息基金MDis

HKD

+13.95%

2022年回报

-7.33%

2021年回报

+13.88%

2020年回报

+1.26%

2019年回报

+13.90%

2018年回报

-7.31%

近三年回報

282.41億

基金规模

2

安聯收益及成長基金MDis

HKD

+20.37%

2022年回报

-19.65%

2021年回报

+12.37%

2020年回报

+21.37%

2019年回报

+18.91%

2018年回报

-4.69%

近三年回報

3185億

基金规模

3

富蘭克林科技基金

HKD

+30.90%

2022年回报

-44.34%

2021年回报

+23.87%

2020年回报

+60.44%

2019年回报

+37.30%

2018年回报

-1.64%

近三年回報

702億

基金规模

*上述展示的基金規模數據為基金最新披露的數據,基於最新的匯率換算為港元金額進行呈現,數據來源於晨星

歷史數據並不預示未來收益,僅供參考

下載APP查看更多榜單 >歷史數據並不預示未來收益,僅供參考

現金寶

優質的現金管理工具

優質的現金管理工具

富途為投資者提供現金寶産品

兼具較穩定、

風險係數交易以及交易便捷等特點

兼具較穩定、

風險係數交易以及交易便捷等特點

買入現金寶一年的收益

持有額度 HK$100,000

立即開戶

持有額度 HK$100,000

*現金寶過去一年收益率最高達5%

數據參考自富途平台上最高收益的美元貨幣基金,

取自近1年歷史收益率, 截至2024年3月20日

歷史收益僅供參考,基金的過往表現不能預示日後的表現。即使錄得正分派收益,亦非意味可取得正回報。

立即開戶

數據參考自富途平台上最高收益的美元貨幣基金,

取自近1年歷史收益率, 截至2024年3月20日

歷史收益僅供參考,基金的過往表現不能預示日後的表現。即使錄得正分派收益,亦非意味可取得正回報。

*數據參考自富途平台上最高收益的美元貨幣基金, 取自近1年歷史收益率, 截至2024年3月20日

增值財富

現金寶最高年化累計收益率達5%

現金寶持倉10萬一年即可獲得最高HK$5000收益

開通自動申贖後,現金寶持倉同樣計入購買力

現金寶持倉10萬一年即可獲得最高HK$5000收益

開通自動申贖後,現金寶持倉同樣計入購買力

閒錢自動享收益

開通自動申贖功能後,賬戶閒置資金自動買入現金寶賺取收益

現金寶內的資產可直接用於交易股票、抽新股

使用融資時,自動還融資/欠款;跨市場交易時,直接兌換貨幣進行交易

現金寶內的資產可直接用於交易股票、抽新股

使用融資時,自動還融資/欠款;跨市場交易時,直接兌換貨幣進行交易

每月派息基金,為“閒錢”

創造被動收入月回報收益率高達 8%

創造被動收入月回報收益率高達 8%

什麼是派息基金?

可獲得穩定派息的基金稱為派息基金

派息基金的優勢?

· 投資時間越長,越能降低本金虧損風險

· 定期獲得穩定的現金流

*數據更新日期:2023-07-05

*近1年派息率是基于基金披露的近1年的月派息率计算,數據来源于晨星

*以上仅统计列出富途平台已上线并且正在募集中的非货公募基金产品的信息;派息率没有保证,过往派息金额及派息率并

不保证将来基金的表现,仅供参考

*近1年派息率是基于基金披露的近1年的月派息率计算,數據来源于晨星

*以上仅统计列出富途平台已上线并且正在募集中的非货公募基金产品的信息;派息率没有保证,过往派息金额及派息率并

不保证将来基金的表现,仅供参考

貝萊德系統分析環球股票高息基金

+8.29%

2022年回报

-14.86%

2021年回报

+17.01%

2020年回报

+8.86%

2019年回报

+17.27%

2018年回报

-9.47%

近1年派息率

98%

抗風險能力超同類

大成中國靈活配置基金MDis

+8.78%

2022年回报

-20.51%

2021年回报

+5.48%

2020年回报

+40.39%

2019年回报

+23.88%

2018年回报

-19.77%

近1年派息率

97%

抗風險能力超同類

安聯收益及增長基金MDis

+9.54%

2022年回报

-19.65%

2021年回报

+12.37%

2020年回报

+21.37%

2019年回报

+18.91%

2018年回报

-4.69%

近1年派息率

97%

抗風險能力超同類

*派息率并不保证,股息可从股本中分派

派息只代表基金分派收益的频次及派息率高低,不能视为保本的承诺。选择派息基金,除了匹配自身风险偏好及现金流目标,还需了解基金派息政策和过往派息情况,筛选适合的产品。

歷史收益僅供參考,基金的過往表現不能預示日後的表現。即使錄得正分派收益,亦非意味可取得正回報。

派息只代表基金分派收益的频次及派息率高低,不能视为保本的承诺。选择派息基金,除了匹配自身风险偏好及现金流目标,还需了解基金派息政策和过往派息情况,筛选适合的产品。

歷史收益僅供參考,基金的過往表現不能預示日後的表現。即使錄得正分派收益,亦非意味可取得正回報。

低費率助您

輕鬆開啟基金投資之旅

輕鬆開啟基金投資之旅

在富途每申購1筆$10,000的基金

可節省$730

立即開戶

可節省$730

*基金相關收費數據統計來自2023年3月31日市場上主要提供基金

服務的銀行及

券商平台的平均值, 數據未不完全統計,僅供參考。

服務的銀行及

券商平台的平均值, 數據未不完全統計,僅供參考。

0佣金 申購

贖回基金無需任何費用

0平台 費用

平台不收取任何額外費用

0.01 起購

最低0.01港元/美元

即可開始基金投資

即可開始基金投資

專業1對1基金投資顧問

在單資產投資和研究上經過嚴格訓練,深入研究底層資產

長期追踪了解主要公募、私募基金策略與風格,熟悉基金長期歷史業績表現,幫您專業

歸因與復盤。

長期追踪了解主要公募、私募基金策略與風格,熟悉基金長期歷史業績表現,幫您專業

歸因與復盤。

如何開始投資

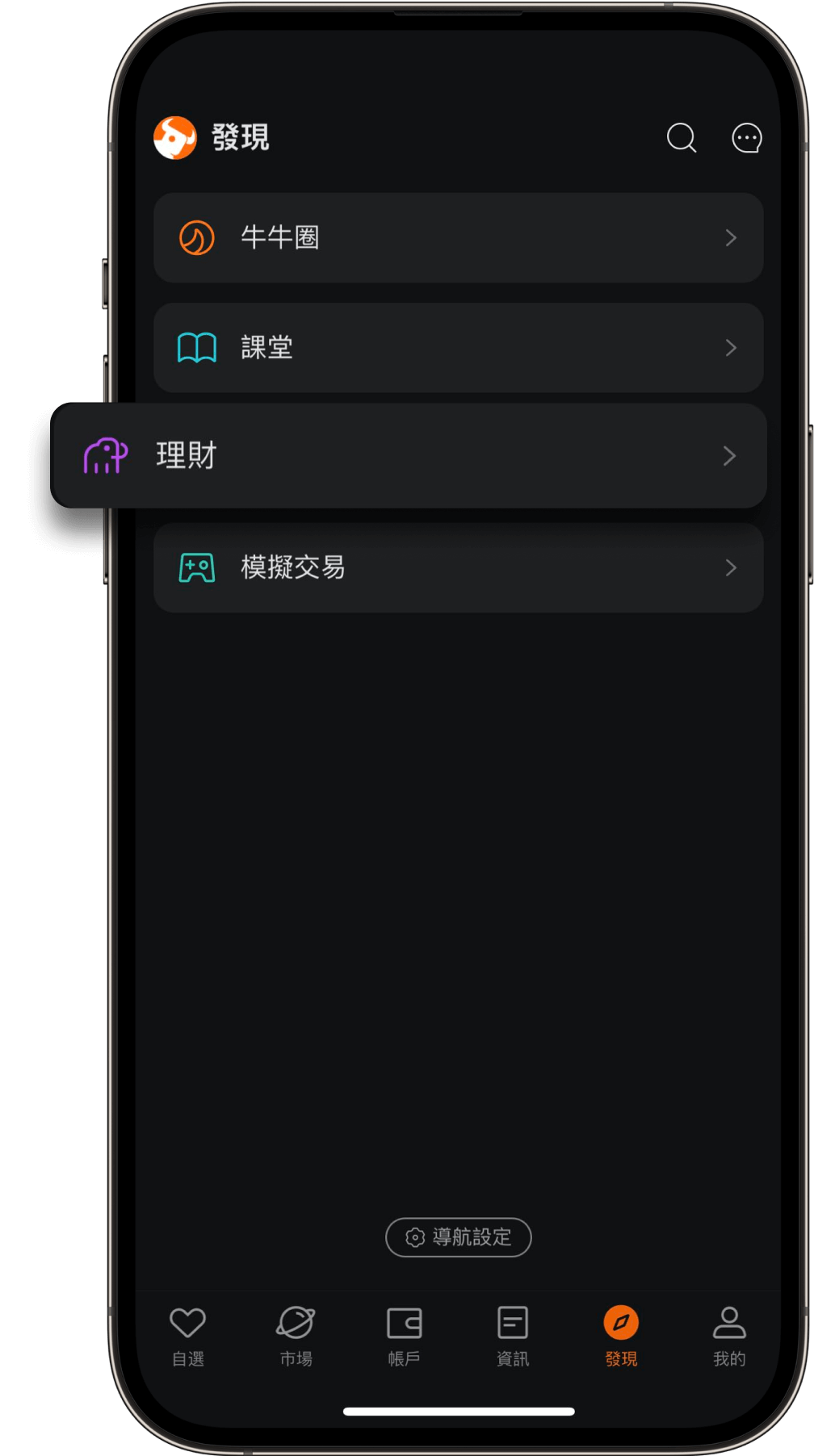

1.

進入APP,選擇【發現】頻道,

點擊【理財】頻道

點擊【理財】頻道

您可以看到基金、債券、私募、組合等多樣化的理財產品

2.

點擊【基金排行】查看所有基金

您可以選擇心儀的基金

3.

點擊基金詳情頁左下角【買入】

輸入交易密碼

輸入交易密碼

您可以選擇可用的理財現金券(開戶可得HK$1200),即可完成購買

4.

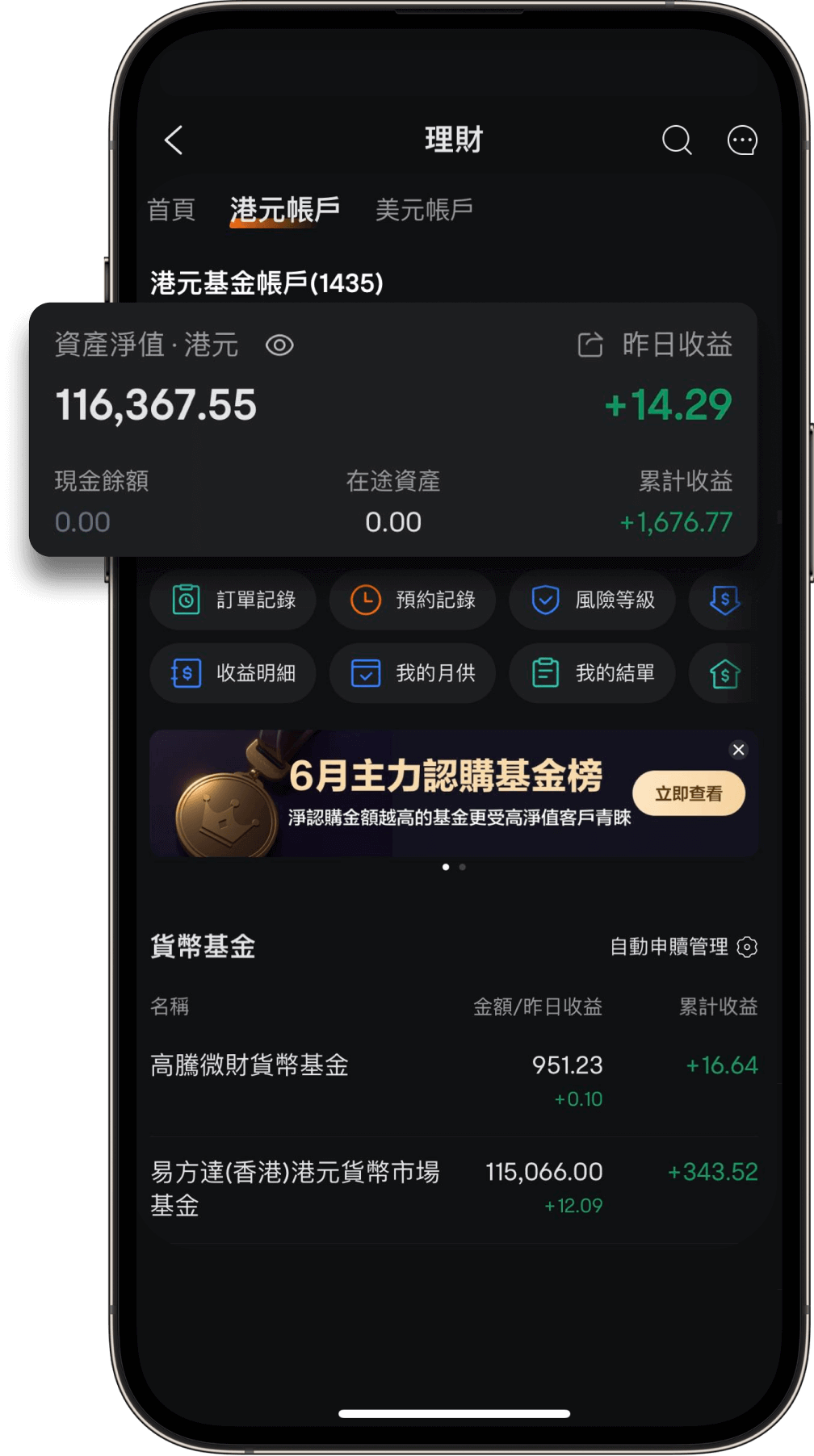

每天都可以看到你的基金收益

買入完成後再對應賬戶頁,可以查看基金的收益情況

免責聲明及風險披露

本免责聲明及風險披露由富途證券編制及授權發佈,本站點內容並未經證券及期貨事務監察委員會審閱,本文件只應作為非商業用途及參考之用途,會因經濟、市場及其他情況而隨時更改而毋須另行通知。任何媒體、網站或個人未經授權不得轉載、連接、聽帖或以其他文本複製發表本文件及任何內容。在若干國家,傳開及分派本文件的方式可能受法律或規例所限制,獲取本文件的人士須知悉及遵守該等限制,本文件並非及不應被視為邀約、招攬、邀請、建議買賣任何投資產品或投資決策之依據,亦不應被詮釋為專業意見。閲覽本文件的人士或在作出任何投資決策前,應完全了解其風險以及有關法律、賦稅及會計的特點及後果,並根據個人的情況決月供資是否切合個人的財政狀況及投資目標,以及能否承受有關風險,必要時應尋求適當的專業意見.投資涉及風險,投資者應仔細閱讀基金信息及相關文件(包括其風險因素)。敬請投資者注意,基金産品的價格可升亦可跌,可能在短時間内大幅變動,投資者或無法取回其投資於基金的金額,基金過往的表現不能預示日後的表現。本文件中如有類似前瞻性陳述之内容,此等内容或陳述不得視為對任何將來表現之保證,且應注意實際情況或發展可能與該等陳述有重大落差。

有關於基金的信息及相關文件,除非另行明確註明為其他來源,均由基金管理人提供。我們並未對該等信息及相關文件進行獨立核證。在法律允許的範圍内,我們對基金管理人及信息提供者提供的信息及相關文件的準確性、可靠性、完整性、充分性,以及該等信息及相關文件的更新狀況概不作出任何保證或認可;我們就此所提供的信息及相關文件內容本身的任何錯誤、遺漏、不準確、不充分或數據供應商及基金管理人未及時向我們提供基金信息及相關文件導致的未及時更新情況不承擔任何責任。

投資貨幣市場基金會面臨的風險包括:利率突然發生大幅變化、多家公司的信用評等邁下調、公司違約,市場因恐慌發生大量贖回。市場利率(如聯邦基金利率)低於基金的费用率,可能會產生損失。

有關於基金的信息及相關文件,除非另行明確註明為其他來源,均由基金管理人提供。我們並未對該等信息及相關文件進行獨立核證。在法律允許的範圍内,我們對基金管理人及信息提供者提供的信息及相關文件的準確性、可靠性、完整性、充分性,以及該等信息及相關文件的更新狀況概不作出任何保證或認可;我們就此所提供的信息及相關文件內容本身的任何錯誤、遺漏、不準確、不充分或數據供應商及基金管理人未及時向我們提供基金信息及相關文件導致的未及時更新情況不承擔任何責任。

投資貨幣市場基金會面臨的風險包括:利率突然發生大幅變化、多家公司的信用評等邁下調、公司違約,市場因恐慌發生大量贖回。市場利率(如聯邦基金利率)低於基金的费用率,可能會產生損失。